Alarum Technologies Ltd. (TLV:ALAR) Stock Catapults 56% Though Its Price And Business Still Lag The Industry

Those holding Alarum Technologies Ltd. (TLV:ALAR) shares would be relieved that the share price has rebounded 56% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 60% share price drop in the last twelve months.

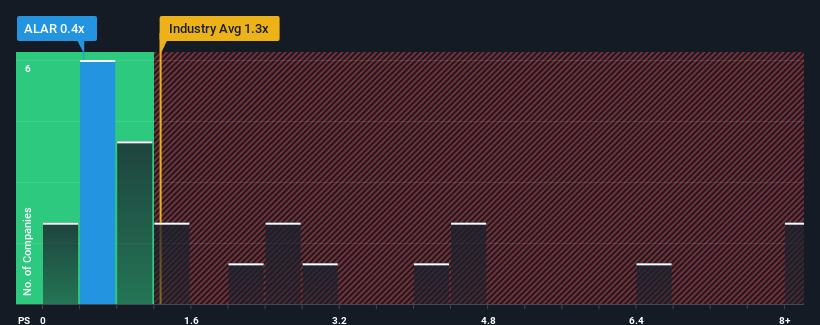

In spite of the firm bounce in price, Alarum Technologies may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Software industry in Israel have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Alarum Technologies

How Has Alarum Technologies Performed Recently?

Alarum Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Alarum Technologies' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Alarum Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 83%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 25% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 29%, which is noticeably more attractive.

With this information, we can see why Alarum Technologies is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Alarum Technologies' P/S Mean For Investors?

Despite Alarum Technologies' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Alarum Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Alarum Technologies is showing 6 warning signs in our investment analysis, and 4 of those are potentially serious.

If you're unsure about the strength of Alarum Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ALAR

Alarum Technologies

Provides web data collection solutions in North, South, and Central America, Europe, Southeast Asia, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives