- Israel

- /

- Semiconductors

- /

- TASE:QLTU

Qualitau Ltd's (TLV:QLTU) Shares Climb 28% But Its Business Is Yet to Catch Up

Qualitau Ltd (TLV:QLTU) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last month tops off a massive increase of 149% in the last year.

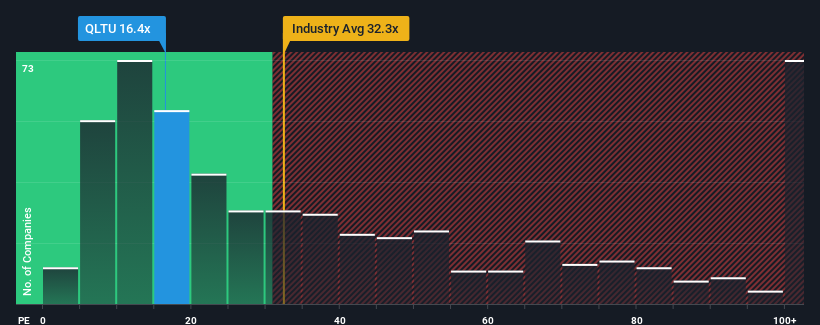

Following the firm bounce in price, Qualitau may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.4x, since almost half of all companies in Israel have P/E ratios under 13x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Earnings have risen firmly for Qualitau recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Qualitau

How Is Qualitau's Growth Trending?

Qualitau's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow EPS by 91% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 26% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Qualitau's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

The Key Takeaway

The large bounce in Qualitau's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Qualitau revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Qualitau (1 is a bit concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Qualitau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:QLTU

Qualitau

Engages in the development, manufacture, and sale of test equipment and services for use in the semiconductor industry for European and Far-Eastern markets.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026