- Japan

- /

- Trade Distributors

- /

- TSE:8066

Undiscovered Gems None's Promising Stocks for February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating indices and economic uncertainties, investors are keenly observing the impact of AI competition and policy decisions on stock performance. Amidst this backdrop, small-cap stocks often present unique opportunities for growth, particularly when they demonstrate resilience against broader market volatility or capitalize on emerging trends. Identifying promising stocks in such an environment involves looking for companies with strong fundamentals that can thrive despite external pressures like tariff risks or shifts in monetary policies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Castro Model (TASE:CAST)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, fashion accessories, and cosmetics and care products, with a market capitalization of ₪889.09 million.

Operations: The company's revenue primarily comes from apparel fashions, generating ₪1.36 billion, and fashion accessories in Israel, contributing ₪505.50 million. Care and cosmetics add another ₪75.03 million to the revenue stream.

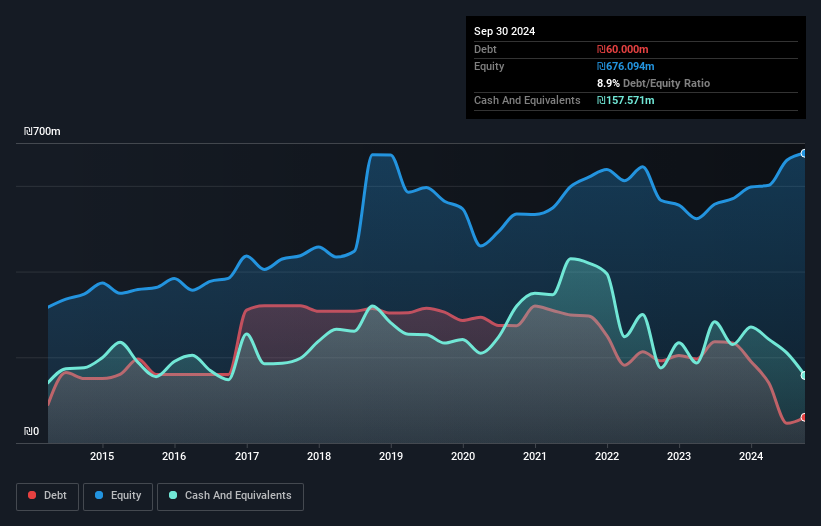

With a debt-to-equity ratio dropping from 54.1% to 8.9% over five years, Castro Model shows significant financial improvement. The company's earnings soared by an impressive 2960%, outpacing the Specialty Retail industry's -22.2%. Trading at nearly 80% below its estimated fair value, it seems undervalued in the market. Despite having more cash than total debt, its interest payments aren't fully covered by EBIT, with a coverage ratio of just 2.4x. Recent results highlight growth with sales hitting ILS 507 million in Q3 and net income reaching ILS 77 million for nine months, showcasing strong operational performance.

- Take a closer look at Castro Model's potential here in our health report.

Understand Castro Model's track record by examining our Past report.

NJS (TSE:2325)

Simply Wall St Value Rating: ★★★★★★

Overview: NJS Co., Ltd., with a market cap of ¥38.39 billion, operates in water and environmental consulting, digital transformation, and customer services both domestically in Japan and internationally through its subsidiaries.

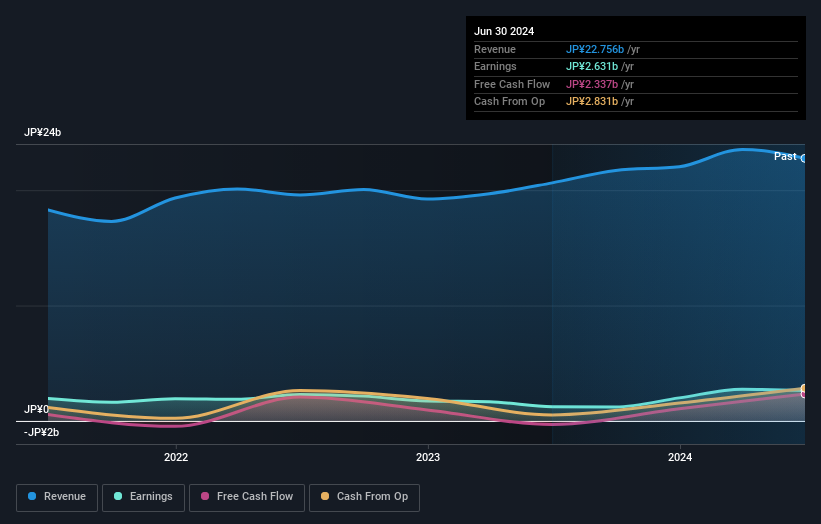

Operations: NJS generates revenue primarily from its domestic operations, which account for ¥19.53 billion, and overseas operations contributing ¥2.64 billion. The company's financial performance is also influenced by segment adjustments amounting to ¥30.51 million.

NJS, a small cap player, stands out with its impressive earnings growth of 112% over the past year, significantly outpacing the Commercial Services industry's 8%. This growth is partly influenced by a notable one-off gain of ¥1.2 billion impacting recent financial results. The company operates debt-free now, contrasting its position five years ago when it had a debt-to-equity ratio of 0.05%. Trading at 23.5% below estimated fair value suggests potential undervaluation in the market. Despite these positives, investors should be mindful of its highly volatile share price in recent months.

Mitani (TSE:8066)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitani Corporation operates in the information system, construction, and energy sectors both in Japan and internationally, with a market capitalization of ¥171.59 billion.

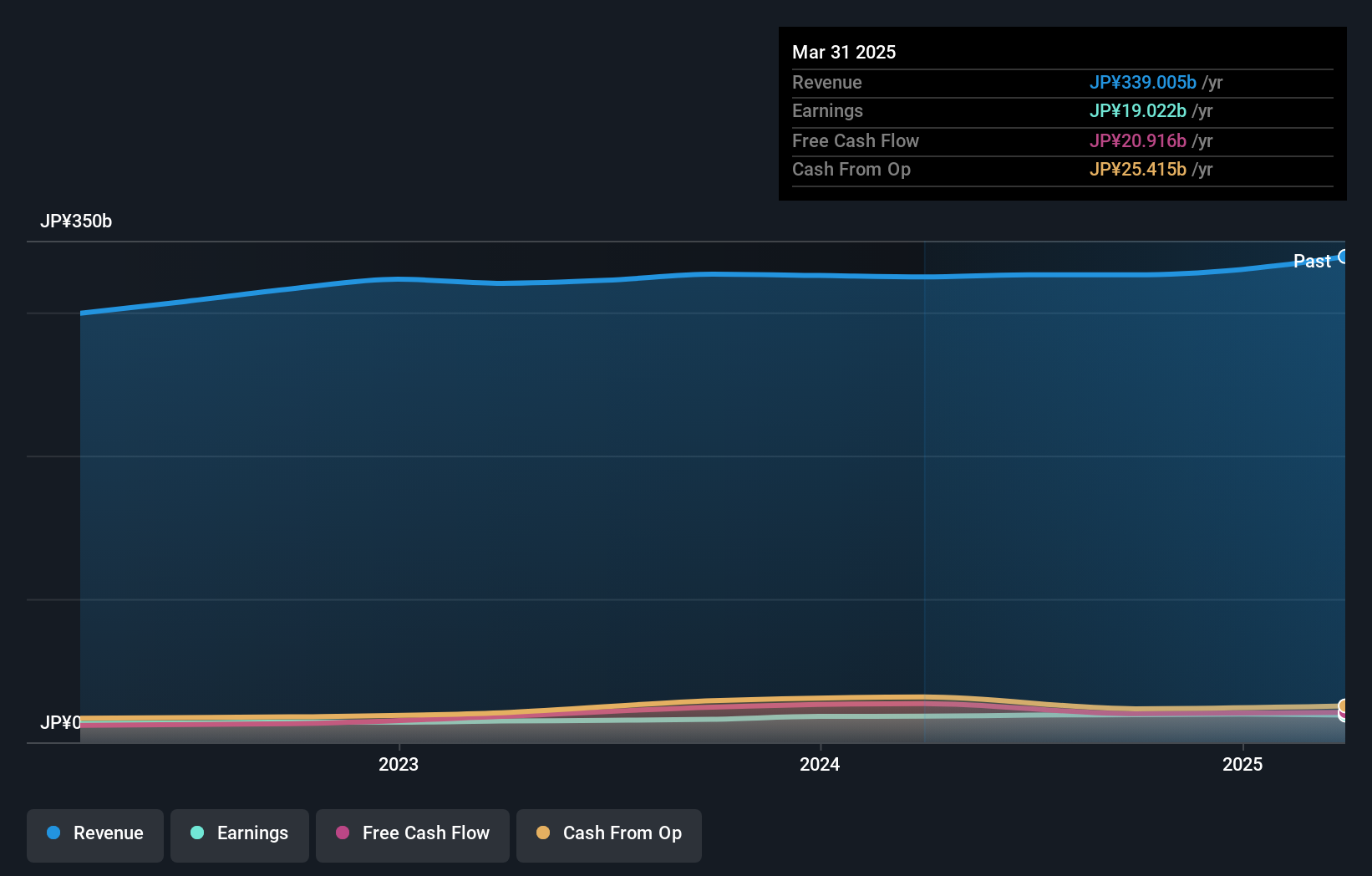

Operations: Mitani Corporation generates revenue primarily from its Corporate Supply Related Business, which accounts for ¥234.23 billion, followed by the Lifestyle/Local Service Related Business at ¥147.62 billion, and the Information System Related Business at ¥30.64 billion.

Mitani, a relatively smaller player in its industry, has shown promising performance with earnings growth of 20.2% over the past year, outpacing the Trade Distributors sector's 1%. The company trades at 21.2% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. Over five years, Mitani's debt-to-equity ratio improved from 7.3 to 5%, indicating better financial health and reduced leverage risk. Recently, it repurchased 922,000 shares for ¥1.73 billion as part of a buyback strategy aimed at enhancing shareholder value and adjusting capital structure amidst shareholders' selling intentions.

- Delve into the full analysis health report here for a deeper understanding of Mitani.

Evaluate Mitani's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4685 more companies for you to explore.Click here to unveil our expertly curated list of 4688 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8066

Mitani

Engages in the information system, construction, energy, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives