- Israel

- /

- Specialty Stores

- /

- TASE:CAST

Undiscovered Gems in Middle East for July 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains driven by positive corporate earnings, with Dubai's main index reaching a 17.5-year high, the Middle East presents intriguing opportunities despite Saudi Arabia's continued losses. In this dynamic environment, identifying promising stocks involves looking for companies that can capitalize on regional growth trends and demonstrate resilience amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY13.81 billion.

Operations: Lila Kagit's revenue is primarily derived from its Paper & Paper Products segment, generating TRY11.94 billion.

Lila Kagit Sanayi Ve Ticaret, a small player in the household products sector, has shown mixed financial performance recently. Despite trading at 31.8% below its estimated fair value and boasting high-quality earnings, the past year saw a dramatic earnings growth of 195.8%, outpacing industry averages by far. However, first-quarter results for 2025 revealed sales dipping to TRY 3 billion from TRY 3.59 billion last year and a net loss of TRY 0.92 million compared to previous profits of TRY 167 million. The company remains free cash flow positive with levered free cash flow reaching approximately US$2 billion in late 2024.

Castro Model (TASE:CAST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, fashion accessories, and cosmetics and care products with a market capitalization of ₪1.21 billion.

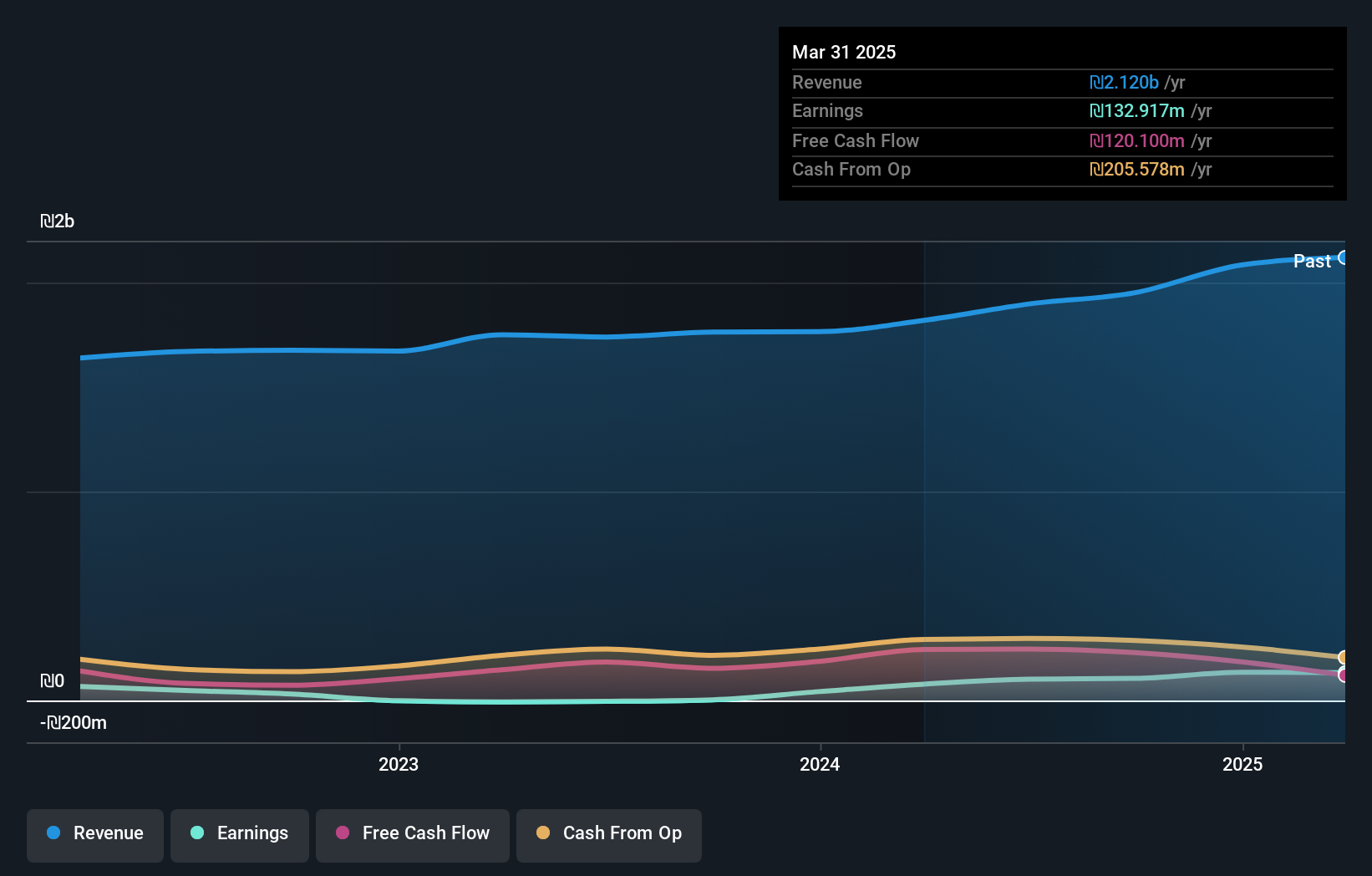

Operations: Castro Model Ltd. generates revenue primarily from apparel fashions (₪1.47 billion), fashion accessories in Israel (₪551.33 million), and care and cosmetics (₪81.42 million).

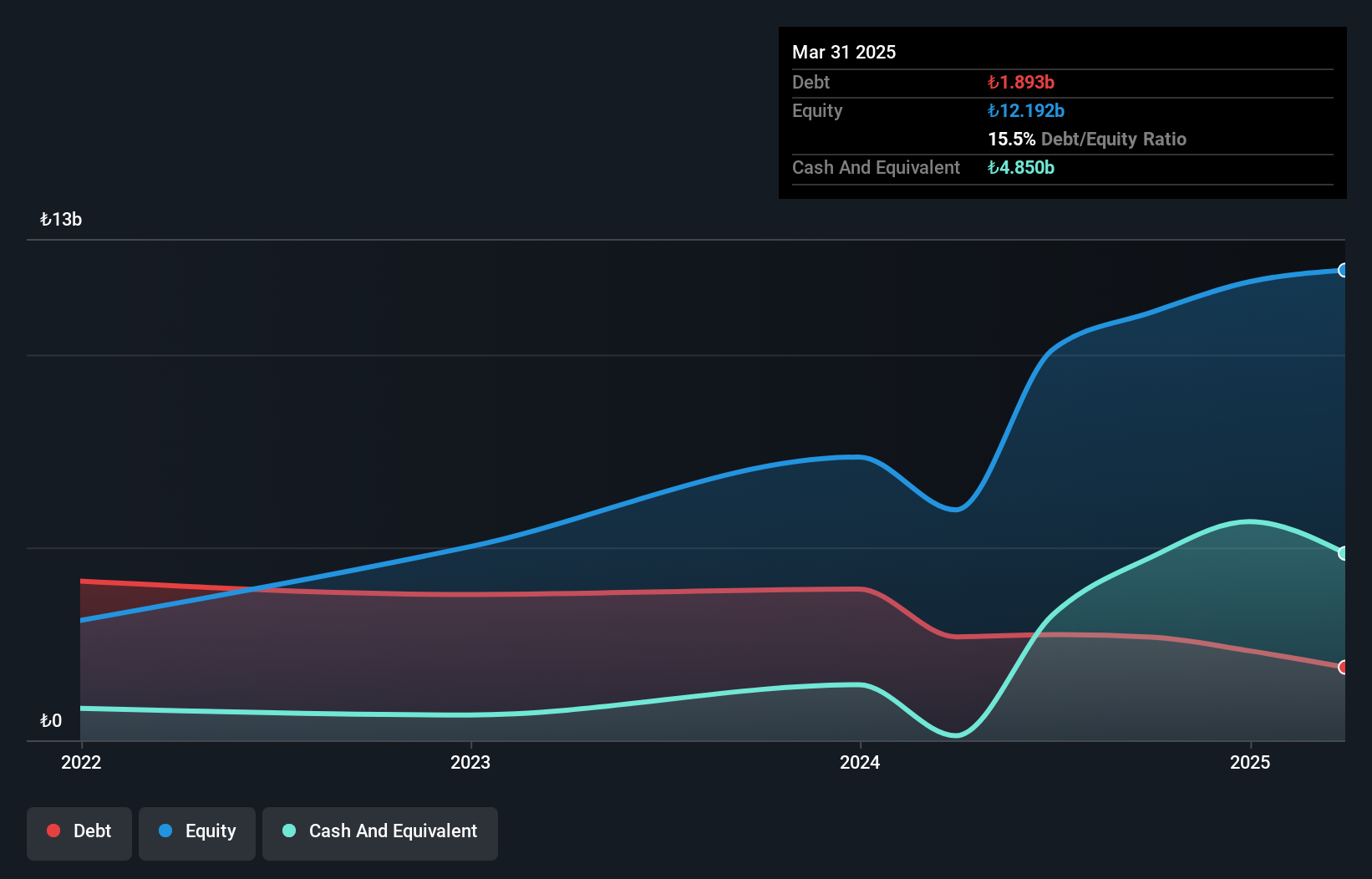

Castro Model's earnings have surged by 69.7% in the past year, outpacing the Specialty Retail industry’s 61% growth. The company boasts a debt-to-equity ratio that has decreased significantly from 63.9% to just 8.2% over five years, indicating effective financial management. With a price-to-earnings ratio of 9.1x, it appears undervalued compared to the IL market average of 16.3x, suggesting potential for value investors seeking opportunities in this region. Despite recent sales growth to ILS 470.57 million from ILS 434.63 million last year, net income dropped to ILS 1.42 million from ILS 3.91 million, hinting at challenges in maintaining profitability amidst expanding operations.

- Click here to discover the nuances of Castro Model with our detailed analytical health report.

Explore historical data to track Castro Model's performance over time in our Past section.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.39 billion.

Operations: Diplomat Holdings generates revenue primarily through its sales and distribution activities in the fast-moving consumer goods sector. The company has a market cap of ₪1.39 billion.

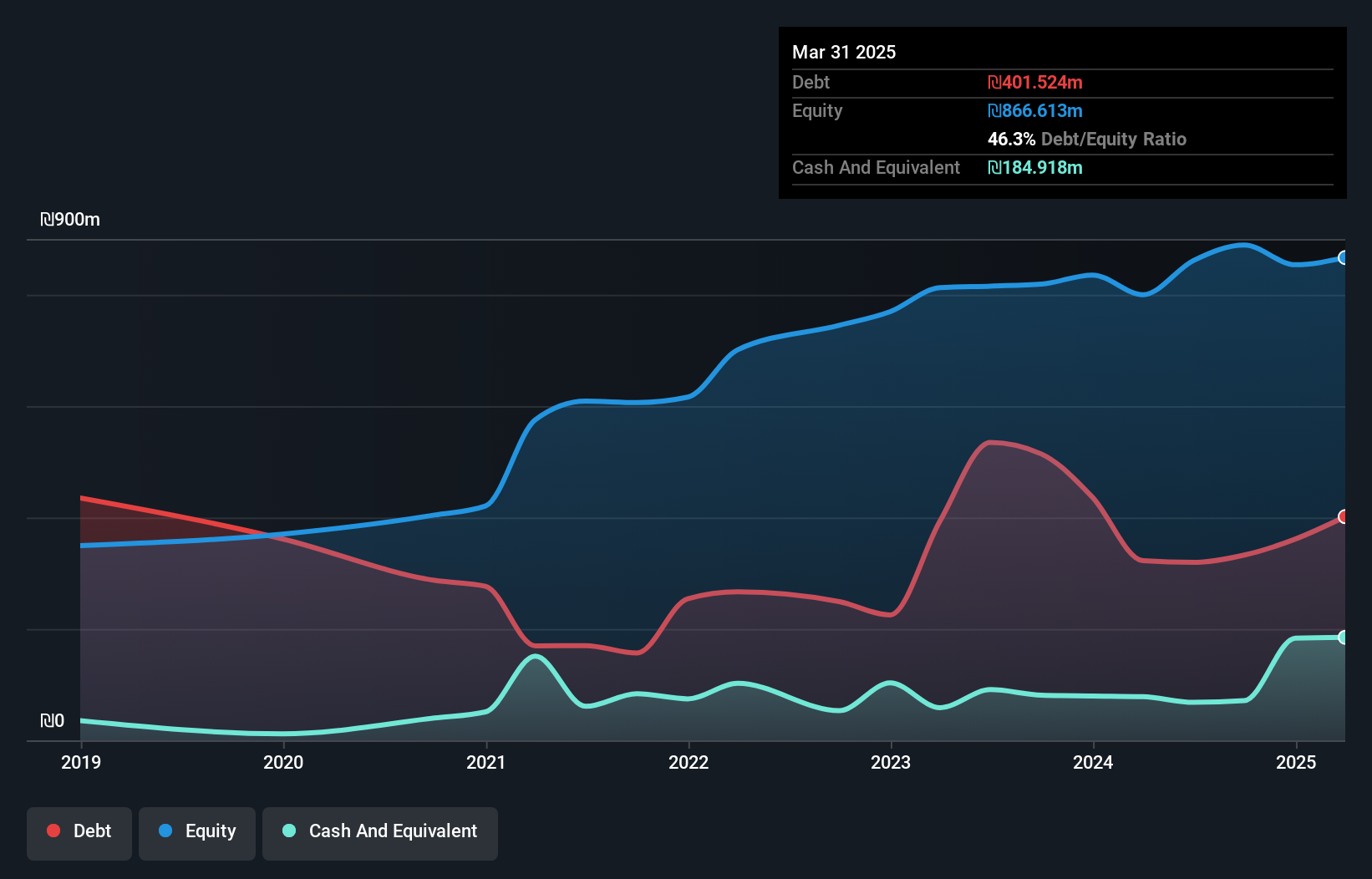

Diplomat Holdings, a nimble player in the consumer retailing sector, has shown impressive earnings growth of 110% over the past year, outpacing the industry's 45%. A notable one-off gain of ₪34.9M has impacted recent financial results. The company boasts a debt to equity ratio that improved significantly from 88% to 46% over five years, indicating stronger financial health. With an EBIT covering interest payments by more than ten times and a price-to-earnings ratio of 11x below market average, Diplomat seems to offer value potential despite its modest size in the market landscape.

- Unlock comprehensive insights into our analysis of Diplomat Holdings stock in this health report.

Examine Diplomat Holdings' past performance report to understand how it has performed in the past.

Summing It All Up

- Get an in-depth perspective on all 221 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives