As the Middle Eastern markets navigate fluctuating oil prices and geopolitical developments, Abu Dhabi's index has shown resilience with gains driven by a surge in oil, while Dubai faces profit-taking pressures. In this dynamic environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option to consider amidst the current market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.52% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.08% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.45% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.42% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.73% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.64% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.27% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 5.73% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.22% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.97% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Al Maather Reit Fund (SASE:4334)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Maather Reit Fund is a real estate investment fund with a market cap of SAR561.54 million.

Operations: Al Maather Reit Fund generates revenue from several segments, including Offices (SAR18.45 million), Hotel Suites (SAR12.61 million), Galleries (SAR11.02 million), Hospitals (SAR8.16 million), Schools (SAR6.24 million), and Warehouses (SAR6.13 million).

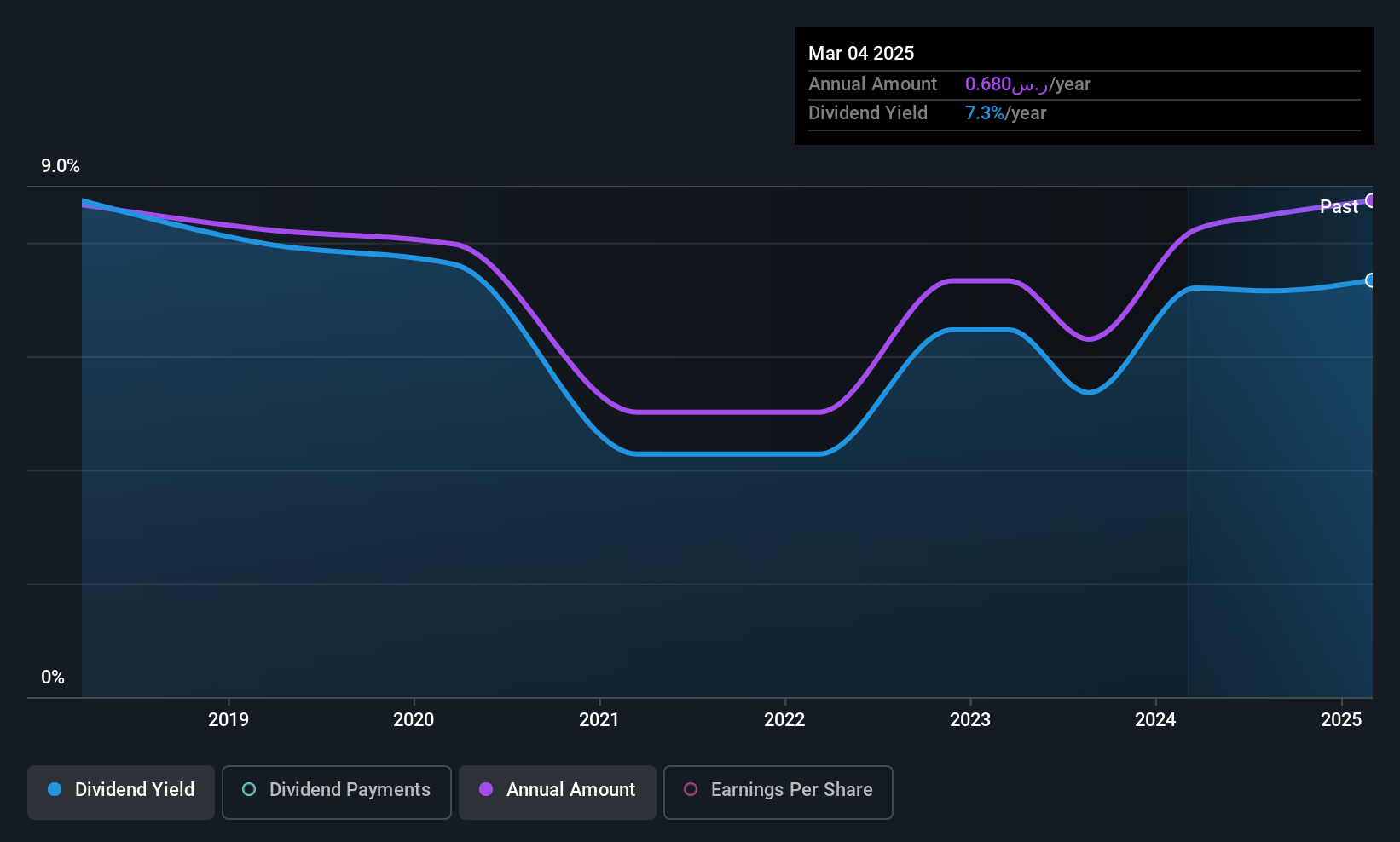

Dividend Yield: 7.3%

Al Maather Reit Fund offers a compelling dividend yield of 7.3%, placing it among the top 25% of dividend payers in the Saudi Arabian market. Despite being undervalued at 59.5% below its estimated fair value, its dividends are well-covered by earnings and cash flows, with payout ratios of 70.8% and 73.1%, respectively. However, investors should note the fund's unstable dividend history over seven years, marked by volatility and large one-off financial impacts.

- Get an in-depth perspective on Al Maather Reit Fund's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Al Maather Reit Fund's share price might be too pessimistic.

Arad (TASE:ARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arad Ltd. designs, develops, manufactures, and sells water systems in Israel and internationally, with a market cap of ₪1.28 billion.

Operations: Arad Ltd. generates revenue from its Electronic Test & Measurement Instruments segment, which amounts to $399.46 million.

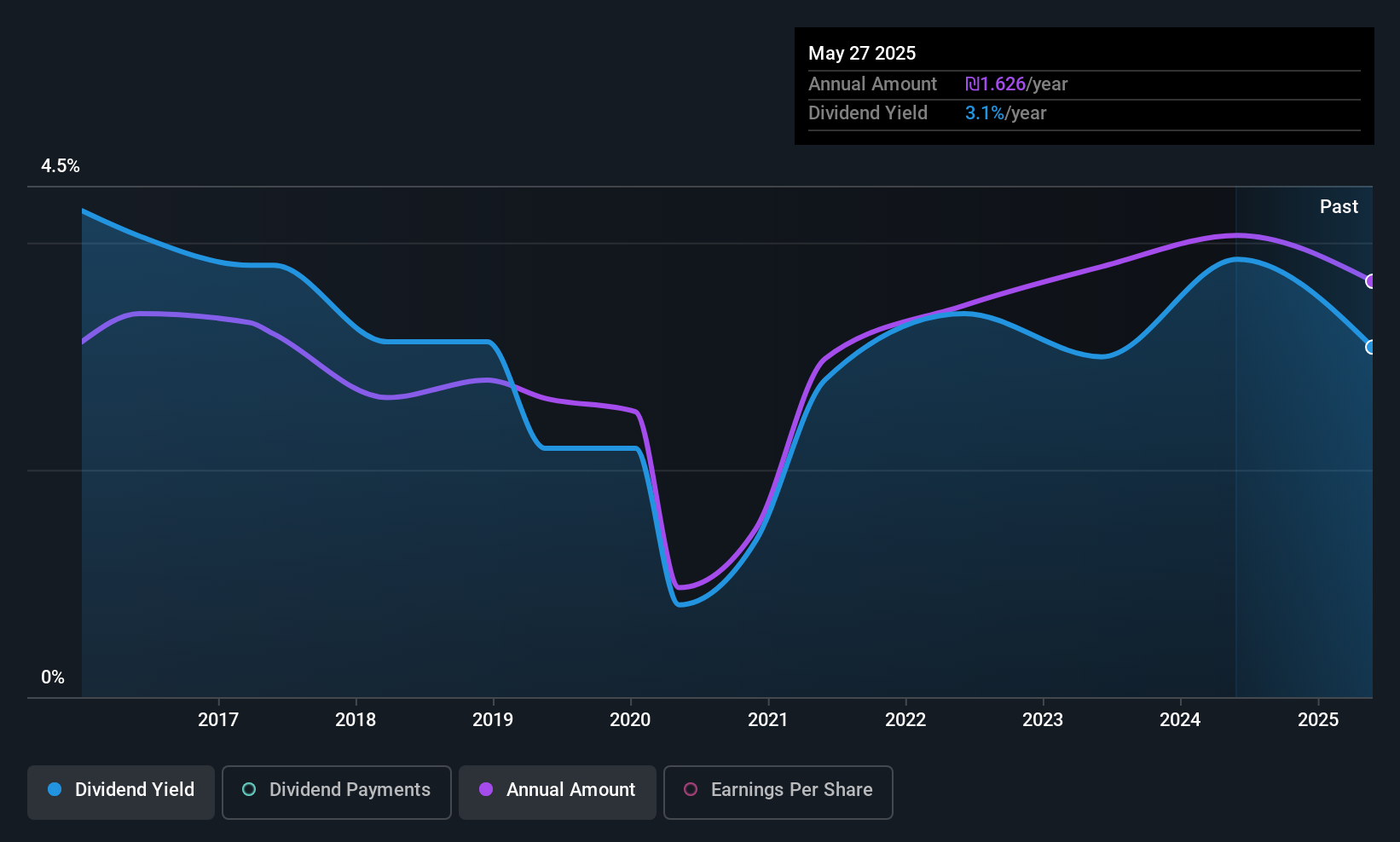

Dividend Yield: 3%

Arad Ltd. has shown volatility in its dividend payments over the past decade, despite a recent increase. The dividends are well-supported by earnings and cash flows, with payout ratios of 46.6% and 31.3%, respectively, but remain low compared to top-tier payers in the IL market. Recent earnings for Q1 2025 showed modest growth in sales and net income, possibly indicating financial stability ahead of its upcoming dividend payment of $0.465 per share on May 27, 2025.

- Click here to discover the nuances of Arad with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Arad shares in the market.

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories and cosmetics, with a market cap of ₪12 billion.

Operations: Castro Model Ltd. generates revenue from its segments in Israel as follows: Apparel Fashions at ₪1.47 billion, Fashion Accessories at ₪551.33 million, and Care and Cosmetics at ₪81.42 million.

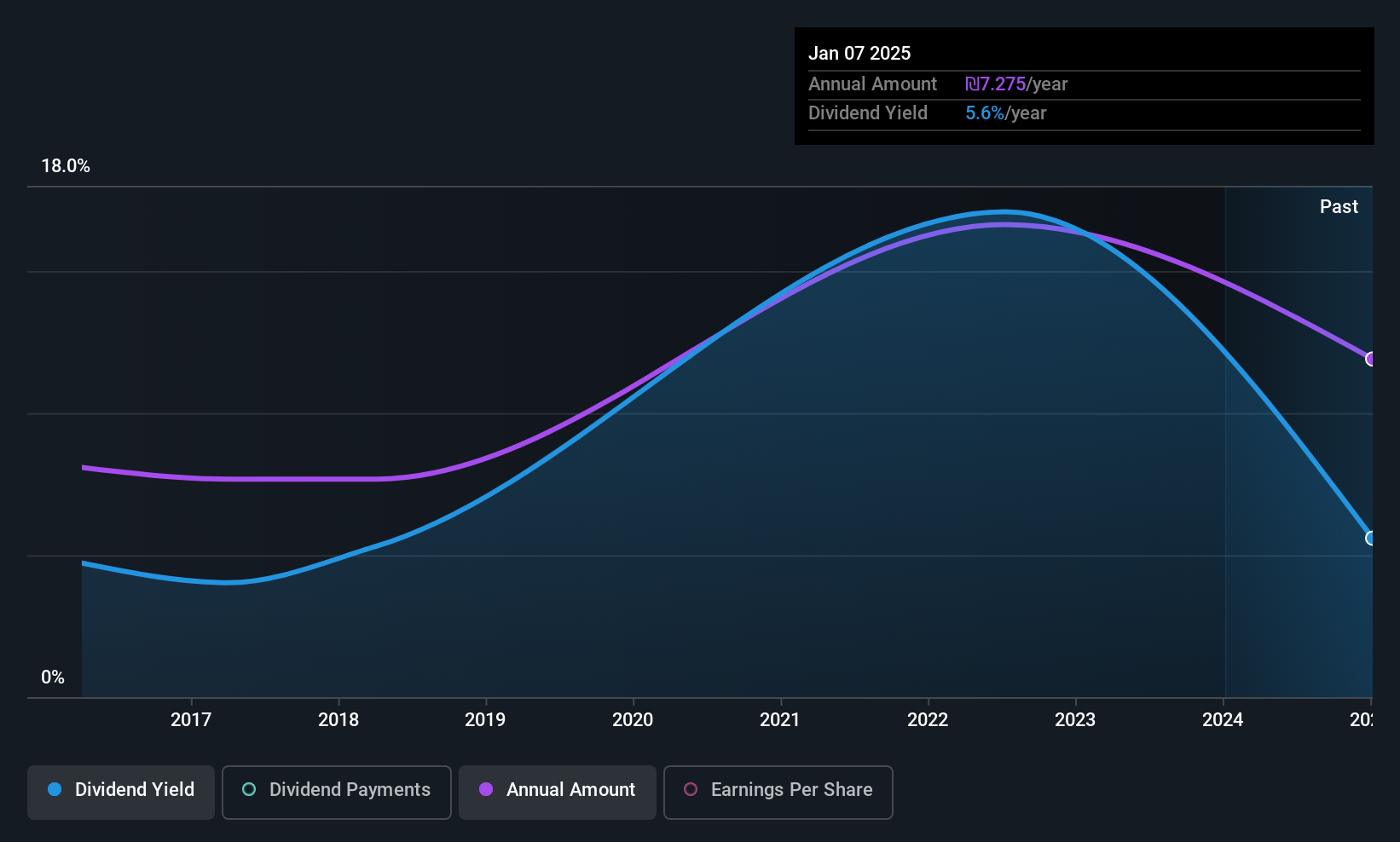

Dividend Yield: 5%

Castro Model's dividend payments, though increasing over the past decade, have been unreliable and volatile. With a payout ratio of 44.2% and cash payout ratio of 50%, dividends are well-covered by earnings and cash flows. However, its 5% yield is below the top-tier IL market payers. Recent Q1 2025 earnings showed sales growth to ILS 470.57 million but a decline in net income to ILS 1.42 million, reflecting potential financial challenges impacting dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Castro Model.

- Insights from our recent valuation report point to the potential overvaluation of Castro Model shares in the market.

Next Steps

- Investigate our full lineup of 75 Top Middle Eastern Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ARD

Arad

Designs, develops, manufactures, and sells water systems in Israel and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives