- Israel

- /

- Specialty Stores

- /

- TASE:CAST

Middle Eastern Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As geopolitical tensions between Israel and Iran continue to affect the Middle Eastern markets, most Gulf indices have experienced declines, with Dubai's main share index losing 0.7% and Abu Dhabi's falling by 0.8%. In this fluctuating environment, dividend stocks can offer a measure of stability and income potential for investors looking to navigate the current market uncertainties.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.91% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.86% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.42% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.77% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.42% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.74% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 8.16% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.97% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.35% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 8.19% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

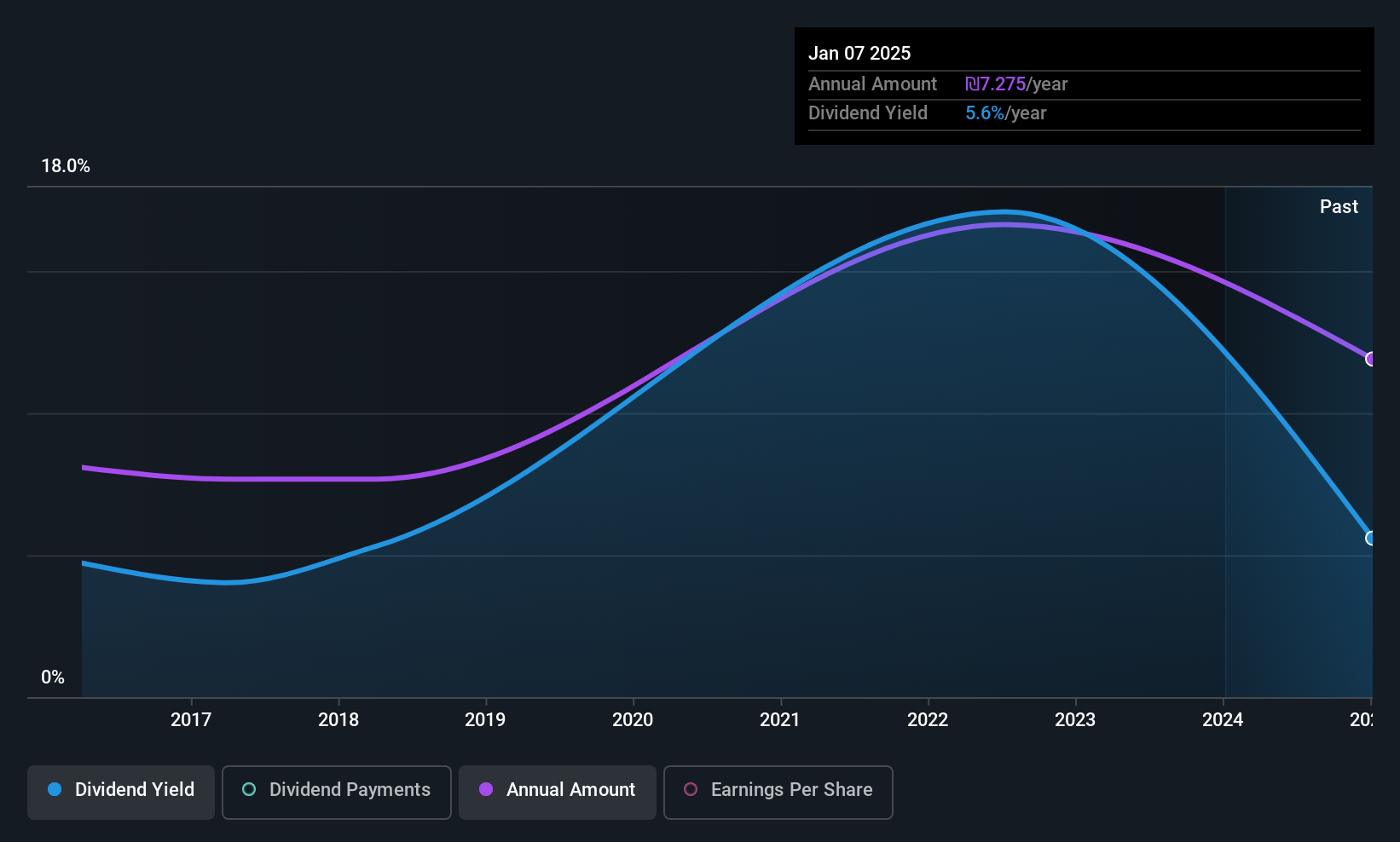

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector and has a market capitalization of TRY19.56 billion.

Operations: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. does not have specific revenue segments listed in the provided text.

Dividend Yield: 3.8%

Yeni Gimat Gayrimenkul Yatirim Ortakligi maintains a solid dividend profile with its dividends well covered by both earnings and cash flows, reflected in payout ratios of 29.1% and 46.1%, respectively. Despite having paid dividends for less than a decade, the company has shown stability with growing payments and offers a competitive yield among Turkish stocks. However, recent earnings showed a decline in net income to TRY 66.8 million from TRY 223.57 million year-over-year, which may impact future payouts if the trend continues.

- Click here to discover the nuances of Yeni Gimat Gayrimenkul Yatirim Ortakligi with our detailed analytical dividend report.

- Our expertly prepared valuation report Yeni Gimat Gayrimenkul Yatirim Ortakligi implies its share price may be too high.

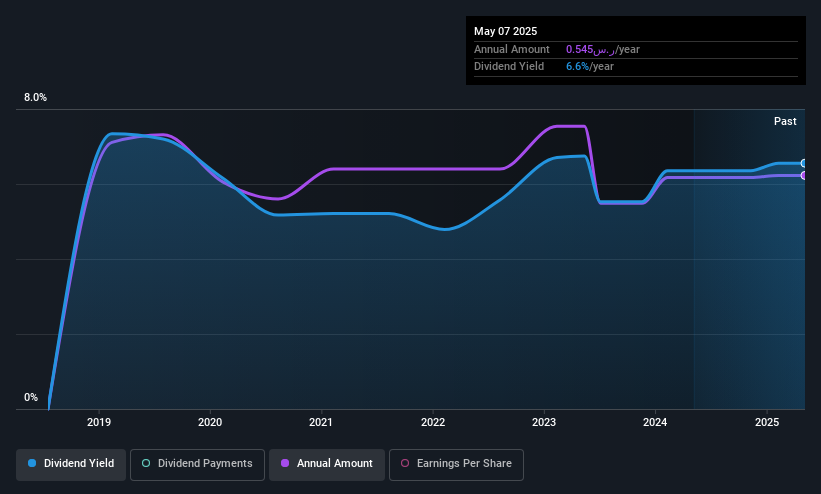

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund is a Sharia-compliant fund listed on Tadawul, focused on generating periodic income through investments in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.26 billion.

Operations: The Al Rajhi REIT Fund generates revenue primarily from its commercial real estate investments, amounting to SAR260.26 million.

Dividend Yield: 6.6%

Al Rajhi REIT Fund's dividend profile shows volatility, with payments decreasing over its six-year history. Despite a high dividend yield of 6.56%, the fund's payout ratios of 96.8% for earnings and 98.3% for cash flows indicate limited sustainability, as nearly all profits and cash flows are distributed to shareholders. Recent financials reported significant earnings growth to SAR 1.42 billion, but this was influenced by large one-off items, questioning the consistency of future payouts.

- Take a closer look at Al Rajhi REIT Fund's potential here in our dividend report.

- The valuation report we've compiled suggests that Al Rajhi REIT Fund's current price could be quite moderate.

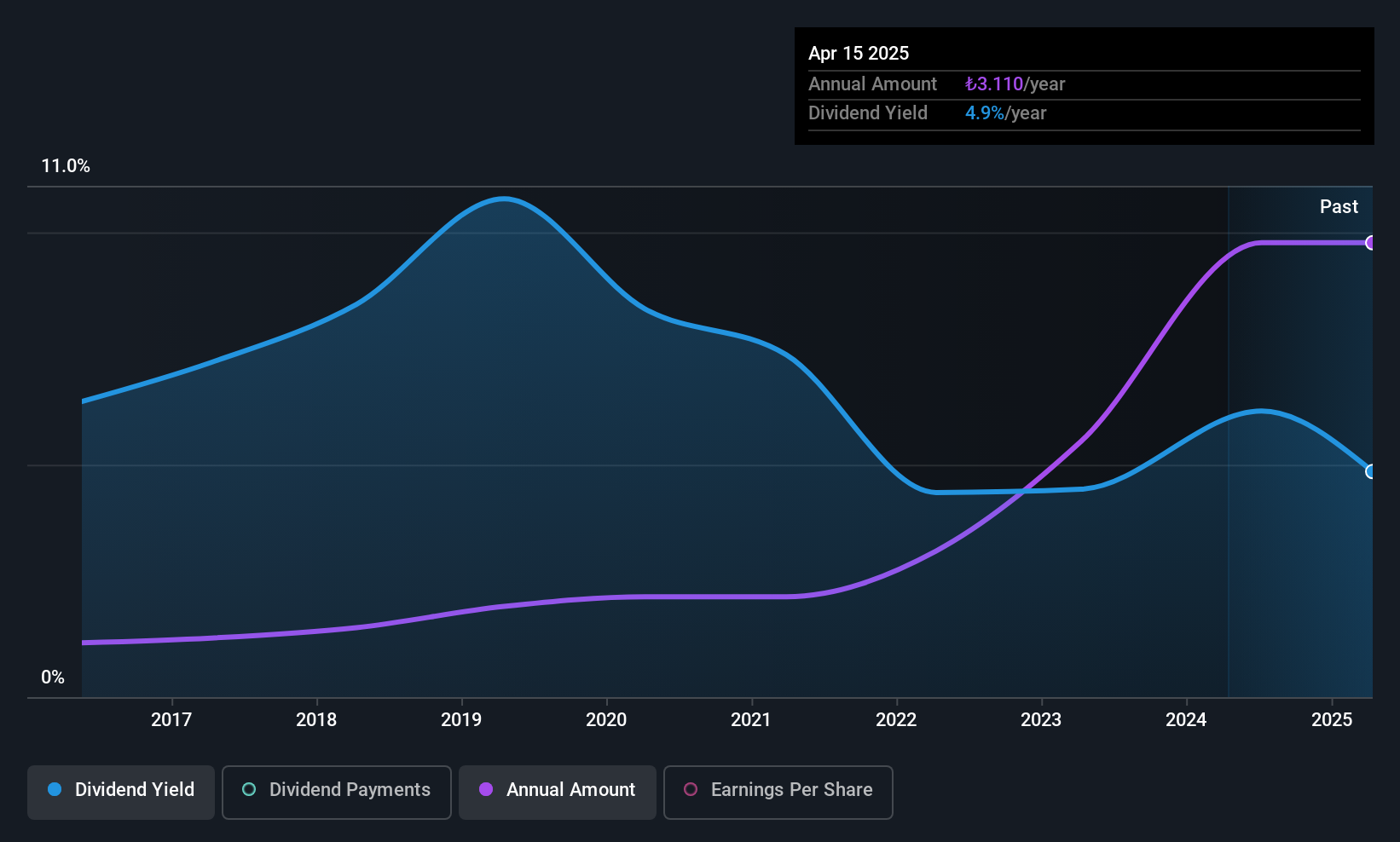

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories, and cosmetics with a market cap of ₪1.18 billion.

Operations: Castro Model Ltd. generates revenue from several segments, including Apparel Fashions at ₪1.47 billion, Fashion Accessories in Israel at ₪551.33 million, and Care and Cosmetics at ₪81.42 million.

Dividend Yield: 5.1%

Castro Model's dividend payments are well-covered by both earnings (44.2% payout ratio) and cash flows (50% cash payout ratio), indicating sustainability. However, the dividend yield of 5.08% is below the top tier in the IL market. Despite a history of volatility in dividends, there has been growth over the past decade. Recent financials show increased sales to ILS 470.57 million but a decline in net income to ILS 1.42 million, affecting future payout reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Castro Model.

- According our valuation report, there's an indication that Castro Model's share price might be on the expensive side.

Key Takeaways

- Investigate our full lineup of 75 Top Middle Eastern Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives