- Israel

- /

- Specialty Stores

- /

- TASE:CAST

Castro Model Ltd. (TLV:CAST) Looks Just Right With A 25% Price Jump

The Castro Model Ltd. (TLV:CAST) share price has done very well over the last month, posting an excellent gain of 25%. Looking back a bit further, it's encouraging to see the stock is up 69% in the last year.

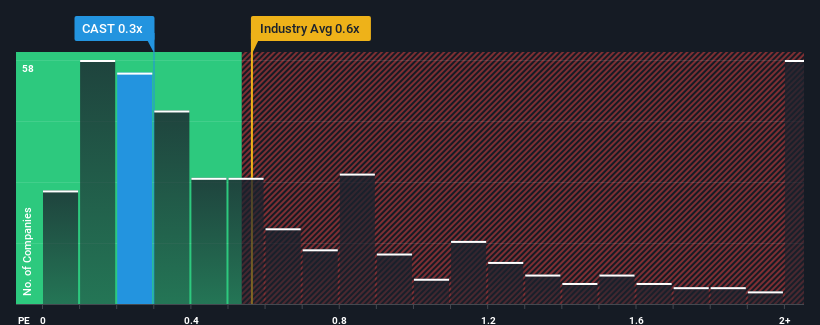

In spite of the firm bounce in price, it's still not a stretch to say that Castro Model's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in Israel, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Castro Model

How Has Castro Model Performed Recently?

The recent revenue growth at Castro Model would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Castro Model's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Castro Model's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we can see why Castro Model is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From Castro Model's P/S?

Its shares have lifted substantially and now Castro Model's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Castro Model maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Castro Model with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives