- Israel

- /

- Real Estate

- /

- TASE:SRFT

A Look At Zvi Sarfati & Sons Investments & Constructions' (TLV:SRFT) CEO Remuneration

Rafi Sarfati has been the CEO of Zvi Sarfati & Sons Investments & Constructions Ltd. (TLV:SRFT) since 1993, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Zvi Sarfati & Sons Investments & Constructions pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Zvi Sarfati & Sons Investments & Constructions

How Does Total Compensation For Rafi Sarfati Compare With Other Companies In The Industry?

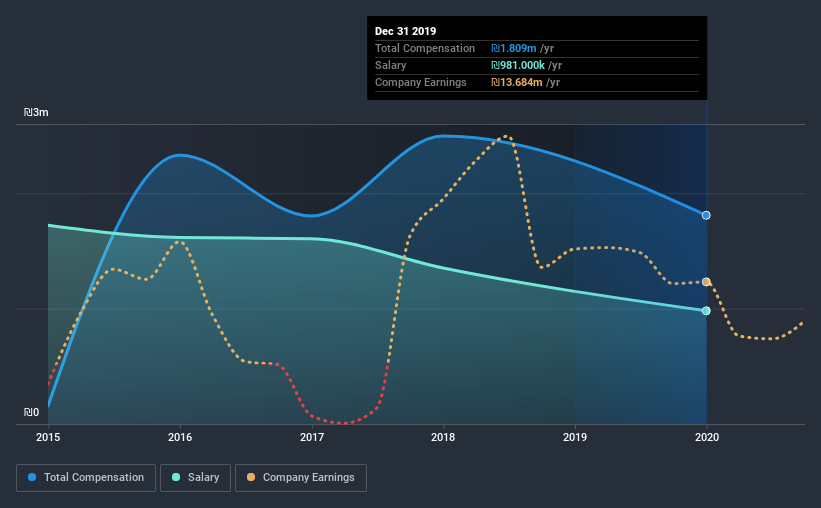

Our data indicates that Zvi Sarfati & Sons Investments & Constructions Ltd. has a market capitalization of ₪312m, and total annual CEO compensation was reported as ₪1.8m for the year to December 2019. That's a notable decrease of 27% on last year. Notably, the salary which is ₪981.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below ₪646m, reported a median total CEO compensation of ₪1.4m. From this we gather that Rafi Sarfati is paid around the median for CEOs in the industry. Furthermore, Rafi Sarfati directly owns ₪26m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2017 | Proportion (2019) |

| Salary | ₪981k | ₪1.4m | 54% |

| Other | ₪828k | ₪1.1m | 46% |

| Total Compensation | ₪1.8m | ₪2.5m | 100% |

Speaking on an industry level, nearly 55% of total compensation represents salary, while the remainder of 45% is other remuneration. Zvi Sarfati & Sons Investments & Constructions is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Zvi Sarfati & Sons Investments & Constructions Ltd.'s Growth

Over the last three years, Zvi Sarfati & Sons Investments & Constructions Ltd. has shrunk its earnings per share by 39% per year. It achieved revenue growth of 24% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Zvi Sarfati & Sons Investments & Constructions Ltd. Been A Good Investment?

Boasting a total shareholder return of 61% over three years, Zvi Sarfati & Sons Investments & Constructions Ltd. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As previously discussed, Rafi is compensated close to the median for companies of its size, and which belong to the same industry. Investors will be happy that Zvi Sarfati & Sons Investments & Constructions has produced strong shareholder returns for the past three years. Meanwhile, revenues have been increasing recently On a sour note, EPS growth has been negative. Considering overall performance, it's fair to say Rafi is paid reasonably.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which makes us a bit uncomfortable) in Zvi Sarfati & Sons Investments & Constructions we think you should know about.

Switching gears from Zvi Sarfati & Sons Investments & Constructions, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Zvi Sarfati & Sons Investments & Constructions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zvi Sarfati & Sons Investments & Constructions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:SRFT

Zvi Sarfati & Sons Investments & Constructions

Through its subsidiaries, constructs and sells residential projects, apartments, and commercial spaces and offices in Israel.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026