Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Norstar Holdings Inc. (TLV:NSTR) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Norstar Holdings

What Is Norstar Holdings's Debt?

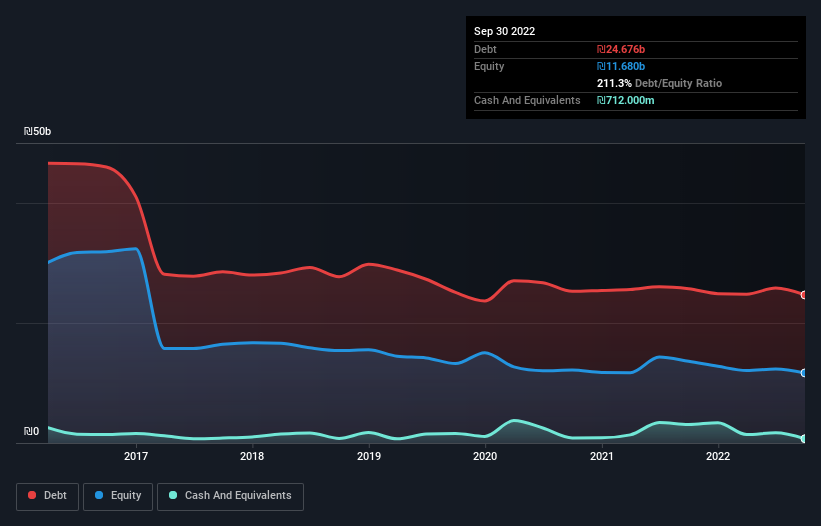

As you can see below, Norstar Holdings had ₪24.7b of debt at September 2022, down from ₪25.7b a year prior. However, it also had ₪712.0m in cash, and so its net debt is ₪24.0b.

A Look At Norstar Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Norstar Holdings had liabilities of ₪3.71b due within 12 months and liabilities of ₪24.0b due beyond that. Offsetting this, it had ₪712.0m in cash and ₪673.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪26.3b.

This deficit casts a shadow over the ₪644.4m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Norstar Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.57 times and a disturbingly high net debt to EBITDA ratio of 19.4 hit our confidence in Norstar Holdings like a one-two punch to the gut. The debt burden here is substantial. The good news is that Norstar Holdings improved its EBIT by 2.5% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Norstar Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Norstar Holdings's free cash flow amounted to 29% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Norstar Holdings's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. Taking into account all the aforementioned factors, it looks like Norstar Holdings has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Norstar Holdings you should be aware of, and 2 of them don't sit too well with us.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Norstar Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NSTR

Norstar Holdings

Develops, rents, and manages real estate properties in Northern Europe, Central and Eastern Europe, Israel, Brazil, and the United States.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.