- Israel

- /

- Real Estate

- /

- TASE:ALRPR

With EPS Growth And More, Alrov Properties and Lodgings (TLV:ALRPR) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Alrov Properties and Lodgings (TLV:ALRPR), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Alrov Properties and Lodgings

How Fast Is Alrov Properties and Lodgings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Alrov Properties and Lodgings has grown EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

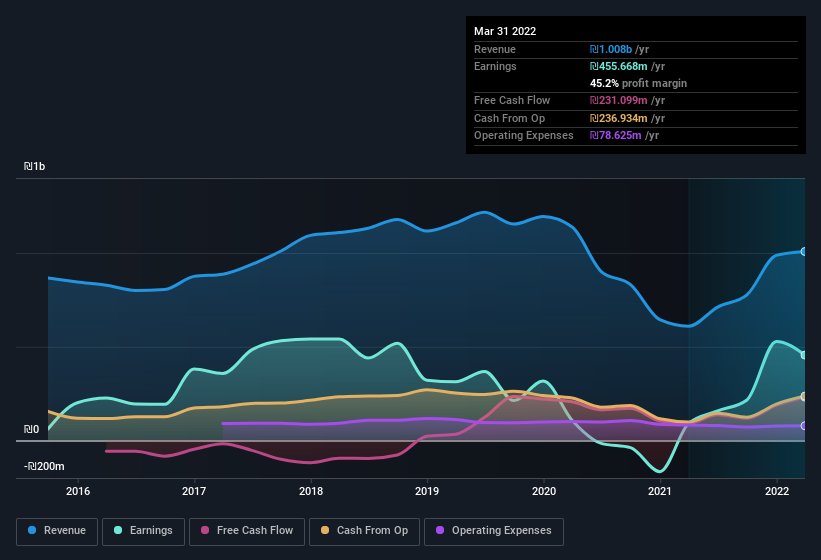

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Alrov Properties and Lodgings' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Alrov Properties and Lodgings shareholders is that EBIT margins have grown from 25% to 40% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Alrov Properties and Lodgings Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Alrov Properties and Lodgings insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 79%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. That means they have plenty of their own capital riding on the performance of the business!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Alrov Properties and Lodgings, with market caps between ₪3.4b and ₪11b, is around ₪5.2m.

The CEO of Alrov Properties and Lodgings only received ₪1.1m in total compensation for the year ending December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Alrov Properties and Lodgings Deserve A Spot On Your Watchlist?

As previously touched on, Alrov Properties and Lodgings is a growing business, which is encouraging. Earnings growth might be the main attraction for Alrov Properties and Lodgings, but the fun does not stop there. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. What about risks? Every company has them, and we've spotted 3 warning signs for Alrov Properties and Lodgings (of which 2 are significant!) you should know about.

Although Alrov Properties and Lodgings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ALRPR

Alrov Properties and Lodgings

A real estate company, develops, invests in, and operates real estate projects in Israel, the United Kingdom, France, Switzerland, and the Netherlands.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives