- Israel

- /

- Real Estate

- /

- TASE:ALRPR

A Closer Look At Alrov Properties and Lodgings Ltd.'s (TLV:ALRPR) Uninspiring ROE

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). By way of learning-by-doing, we'll look at ROE to gain a better understanding of Alrov Properties and Lodgings Ltd. (TLV:ALRPR).

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Alrov Properties and Lodgings

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Alrov Properties and Lodgings is:

5.2% = ₪257m ÷ ₪5.0b (Based on the trailing twelve months to September 2021).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every ₪1 worth of equity, the company was able to earn ₪0.05 in profit.

Does Alrov Properties and Lodgings Have A Good Return On Equity?

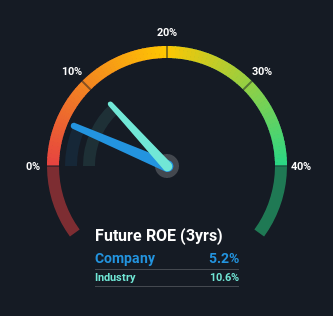

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. If you look at the image below, you can see Alrov Properties and Lodgings has a lower ROE than the average (11%) in the Real Estate industry classification.

Unfortunately, that's sub-optimal. Although, we think that a lower ROE could still mean that a company has the opportunity to better its returns with the use of leverage, provided its existing debt levels are low. When a company has low ROE but high debt levels, we would be cautious as the risk involved is too high. You can see the 3 risks we have identified for Alrov Properties and Lodgings by visiting our risks dashboard for free on our platform here.

The Importance Of Debt To Return On Equity

Virtually all companies need money to invest in the business, to grow profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Combining Alrov Properties and Lodgings' Debt And Its 5.2% Return On Equity

It's worth noting the high use of debt by Alrov Properties and Lodgings, leading to its debt to equity ratio of 1.59. With a fairly low ROE, and significant use of debt, it's hard to get excited about this business at the moment. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

Summary

Return on equity is one way we can compare its business quality of different companies. A company that can achieve a high return on equity without debt could be considered a high quality business. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Alrov Properties and Lodgings by looking at this visualization of past earnings, revenue and cash flow.

But note: Alrov Properties and Lodgings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ALRPR

Alrov Properties and Lodgings

A real estate company, develops, invests in, and operates real estate projects in Israel, the United Kingdom, France, Switzerland, and the Netherlands.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026