- Israel

- /

- Specialty Stores

- /

- TASE:DLTI

Unveiling 3 Undiscovered Gems In Middle East Markets

Reviewed by Simply Wall St

As Middle Eastern markets experience mixed outcomes amid corporate earnings reports and the anticipation of U.S.-China trade talks, investors are keeping a close eye on economic indicators that could impact small-cap companies in the region. In this dynamic environment, identifying strong stocks often involves looking for firms with robust fundamentals and growth potential that can weather broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

Overview: Albaraka Türk Katilim Bankasi A.S. is a Turkish bank offering a range of banking products and services, with a market capitalization of TRY16.03 billion.

Operations: Albaraka Türk generates revenue primarily from its Commercial and Corporate segment, contributing TRY30.79 billion, followed by the Treasury segment at TRY20.12 billion. The Individual segment adds TRY5.98 billion to the revenue stream.

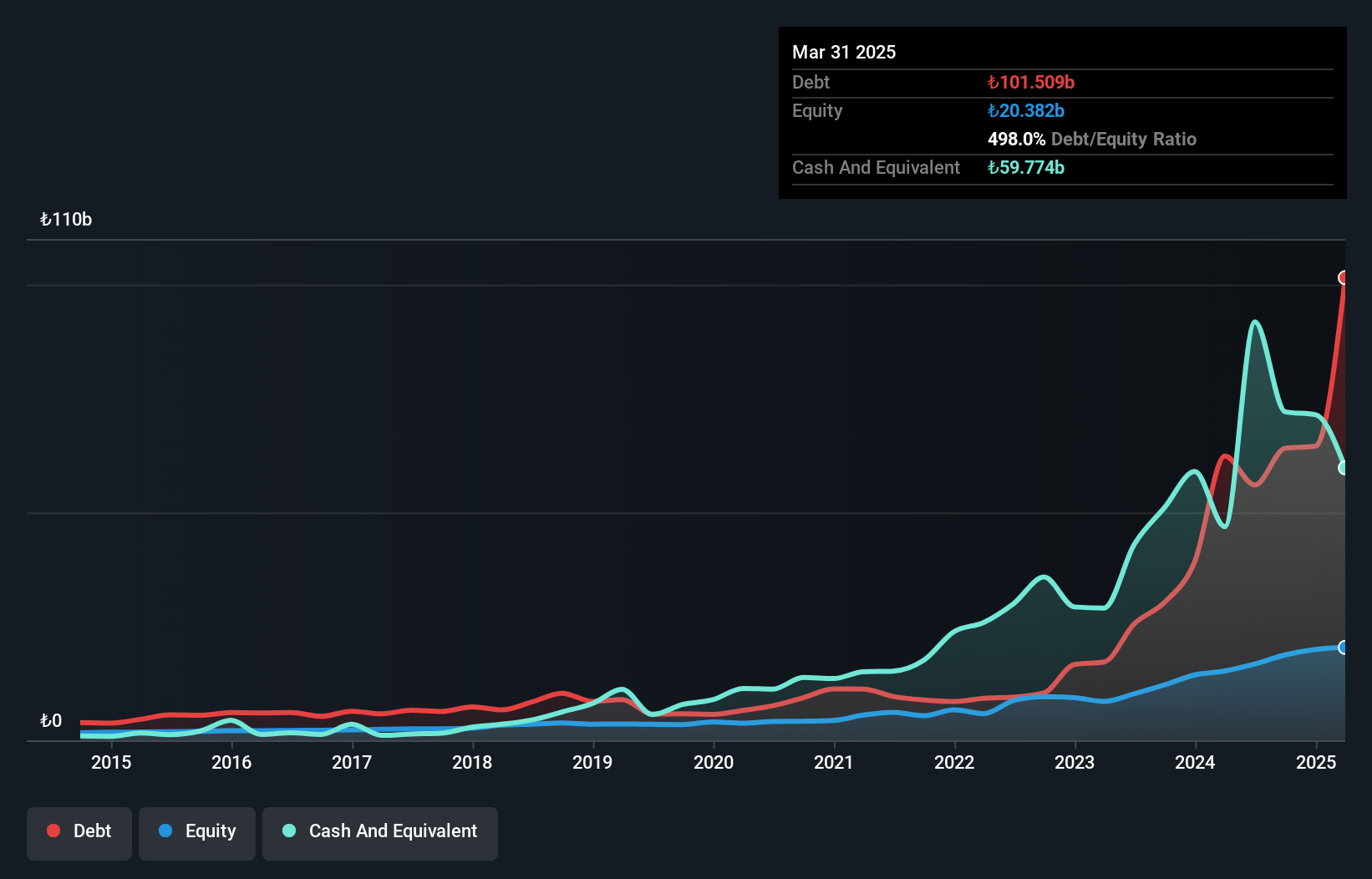

Albaraka Türk Katilim Bankasi, a notable player in the Middle Eastern financial landscape, showcases robust fundamentals with total assets of TRY311.9 billion and equity standing at TRY19.9 billion. The bank's allowance for bad loans is more than adequate at 163%, reflecting prudent risk management alongside a low non-performing loan ratio of 1.4%. Its earnings growth outpaces the industry average, rising by 30% over the past year, supported by high-quality earnings and a favorable price-to-earnings ratio of 3.1x compared to the market's 17.5x. Despite challenges in free cash flow positivity, its funding structure remains largely low-risk with customer deposits forming a significant base.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

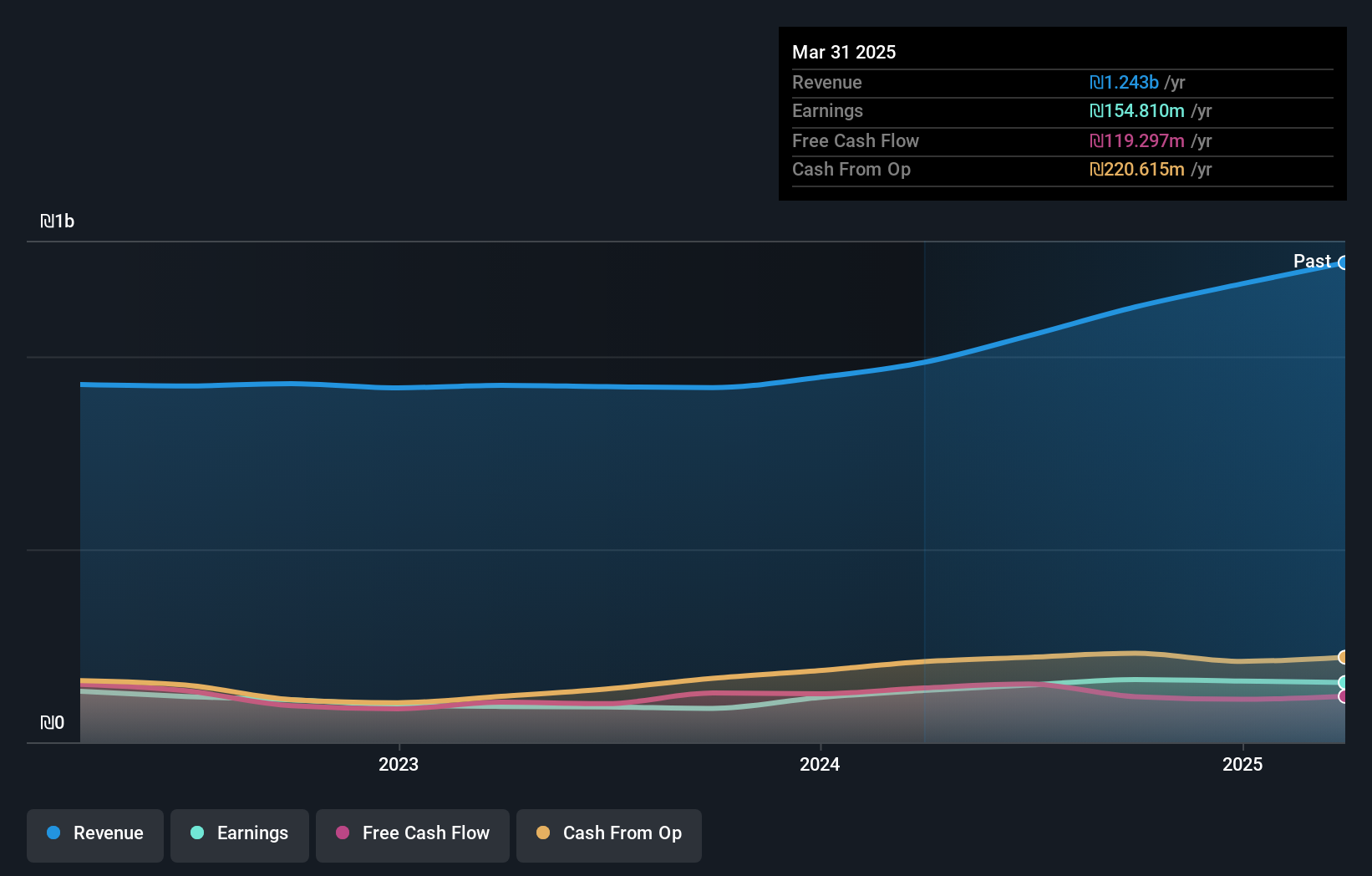

Overview: Delta Israel Brands Ltd. designs, develops, markets, and sells various clothing products in Israel with a market cap of ₪2.16 billion.

Operations: Delta Israel Brands generates revenue primarily from its owned brands, contributing ₪1.08 billion, and franchise brands, adding ₪108.47 million.

Delta Israel Brands, a nimble player in the market, showcases impressive financial health with no debt and high-quality earnings. Over the past year, its earnings surged by 36.8%, outpacing the Specialty Retail industry. The company reported sales of ILS 1.19 billion for 2024, a jump from ILS 945.88 million in the previous year, while net income rose to ILS 158.73 million from ILS 116.05 million. Basic earnings per share climbed to ILS 6.35 from ILS 4.64 last year, reflecting robust performance likely driven by strategic initiatives and market demand within its sector.

- Delve into the full analysis health report here for a deeper understanding of Delta Israel Brands.

Examine Delta Israel Brands' past performance report to understand how it has performed in the past.

Villar International (TASE:VILR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Villar International Ltd., with a market cap of ₪3.14 billion, operates in the development and construction of properties both within Israel and internationally through its subsidiaries.

Operations: Villar International generates revenue primarily through its property development and construction activities. The company focuses on projects both within Israel and internationally, contributing to its financial performance.

Villar International's recent financial performance shines with a 43.8% earnings growth over the past year, outpacing the Real Estate industry's 34.6%. The company benefits from a satisfactory net debt to equity ratio of 14.3%, down from 30.7% five years ago, indicating prudent financial management. Its price-to-earnings ratio stands at an attractive 8.8x compared to the IL market's 14.2x, suggesting potential value for investors. A notable one-off gain of ₪239M has impacted its past year's results, while interest payments are well covered by EBIT at a multiple of 6.7x, underscoring strong operational efficiency and fiscal health.

- Click to explore a detailed breakdown of our findings in Villar International's health report.

Understand Villar International's track record by examining our Past report.

Next Steps

- Discover the full array of 242 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Delta Israel Brands, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLTI

Delta Israel Brands

Designs, develops, markets, and sells various clothing products in Israel.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives