- Israel

- /

- Real Estate

- /

- TASE:SRFT

We Think Zvi Sarfati & Sons Investments & Constructions (TLV:SRFT) Is Taking Some Risk With Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Zvi Sarfati & Sons Investments & Constructions Ltd. (TLV:SRFT) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Zvi Sarfati & Sons Investments & Constructions

What Is Zvi Sarfati & Sons Investments & Constructions's Net Debt?

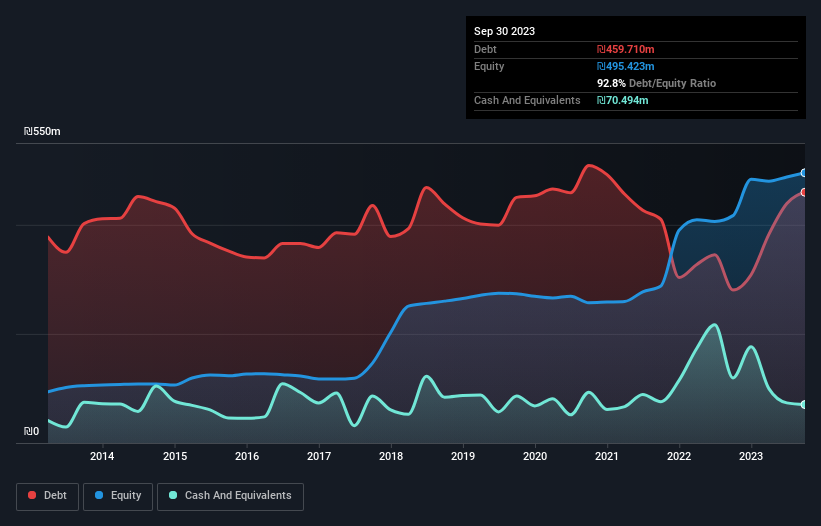

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Zvi Sarfati & Sons Investments & Constructions had ₪459.7m of debt, an increase on ₪280.7m, over one year. However, because it has a cash reserve of ₪70.5m, its net debt is less, at about ₪389.2m.

A Look At Zvi Sarfati & Sons Investments & Constructions' Liabilities

We can see from the most recent balance sheet that Zvi Sarfati & Sons Investments & Constructions had liabilities of ₪582.9m falling due within a year, and liabilities of ₪224.1m due beyond that. Offsetting these obligations, it had cash of ₪70.5m as well as receivables valued at ₪119.9m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪616.6m.

Given this deficit is actually higher than the company's market capitalization of ₪545.3m, we think shareholders really should watch Zvi Sarfati & Sons Investments & Constructions's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Zvi Sarfati & Sons Investments & Constructions has net debt to EBITDA of 2.7 suggesting it uses a fair bit of leverage to boost returns. But the high interest coverage of 7.5 suggests it can easily service that debt. Shareholders should be aware that Zvi Sarfati & Sons Investments & Constructions's EBIT was down 33% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Zvi Sarfati & Sons Investments & Constructions's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Zvi Sarfati & Sons Investments & Constructions recorded free cash flow of 45% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say Zvi Sarfati & Sons Investments & Constructions's EBIT growth rate was disappointing. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Zvi Sarfati & Sons Investments & Constructions to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Zvi Sarfati & Sons Investments & Constructions that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Zvi Sarfati & Sons Investments & Constructions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SRFT

Zvi Sarfati & Sons Investments & Constructions

Through its subsidiaries, constructs and sells residential projects, apartments, and commercial spaces and offices in Israel.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives