- Israel

- /

- Real Estate

- /

- TASE:LAHAV

Lahav LR Real Estate (TASE:LAHAV) Net Margin Hits 41.6%, Surpassing Community Profitability Expectations

Reviewed by Simply Wall St

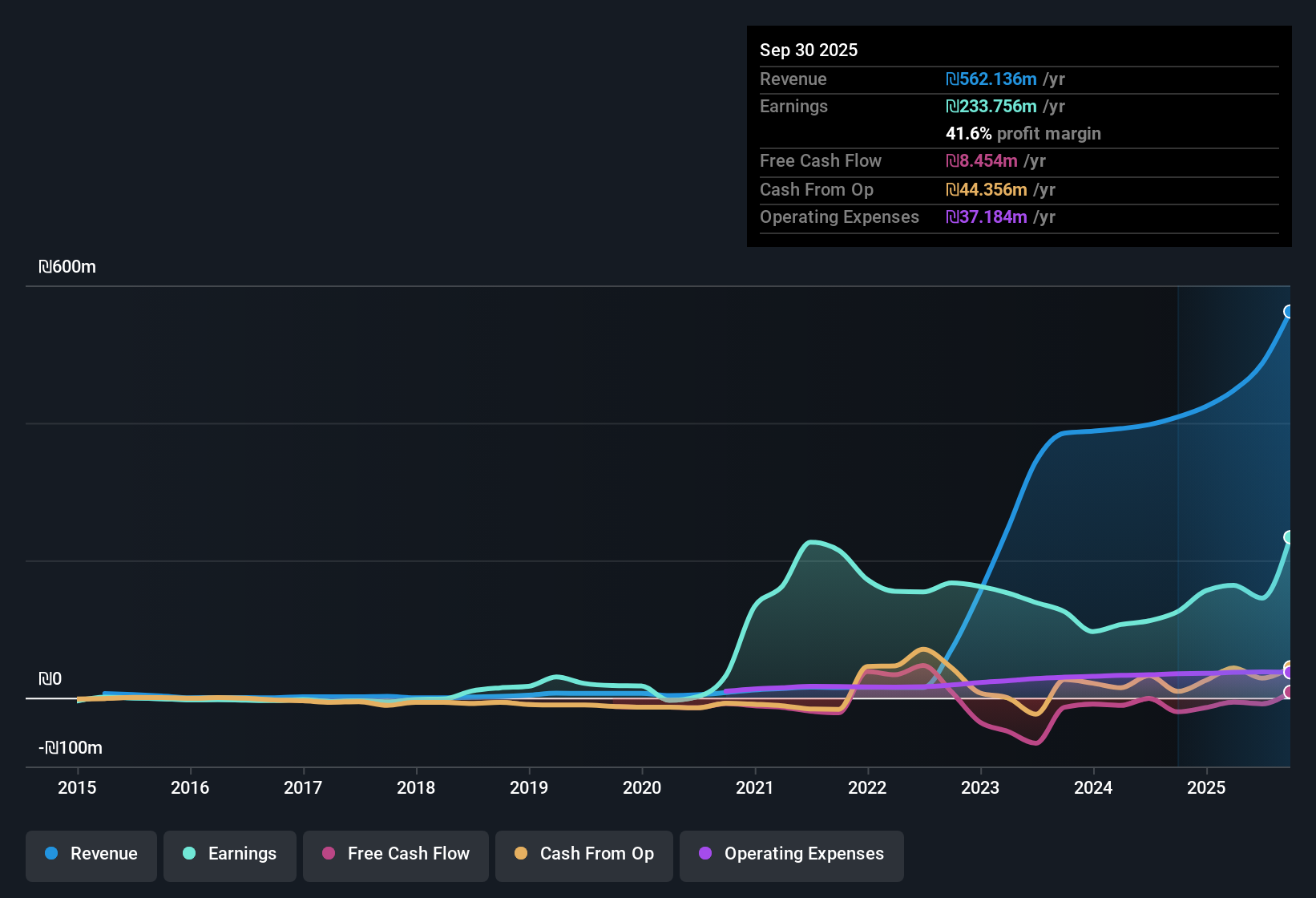

Lahav LR Real Estate (TASE:LAHAV) just released its Q3 2025 results, reporting total revenue of 266.9 million ILS and basic EPS of 0.44 ILS for the quarter. Over the past year, the company has seen revenue increase from 397.4 million ILS to 562.1 million ILS, while trailing twelve-month EPS moved from 0.45 ILS to 0.88 ILS. This reflects a sizable jump in both top- and bottom-line results. Profit margins stood out this quarter, highlighting clear margin expansion.

See our full analysis for Lahav LR Real Estate.Next, we will review how these results compare to broader market narratives and examine what the numbers might indicate for Lahav going forward.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Reach 41.6% on Trailing Basis

- Net profit margin for the trailing twelve months improved to 41.6%, up from 30.7% in the prior year, showcasing clear profitability gains as the company scaled revenues to 562.1 million ILS.

- What stands out is that this margin improvement strongly supports the core narrative that Lahav’s business mix of Israeli and German real estate, combined with renewable energy assets, is now delivering higher-quality earnings.

- Profit margin expansion well above last year is a rare achievement for a diversified real estate operator and suggests the model is working even as sector headwinds persist.

- This durability supports the market view that steady income streams and sustainability drivers are starting to pay off tangibly, not just thematically.

P/E at 8x Flags Deep Value

- The company trades at a price-to-earnings ratio of 8x, well below both the segment average (13.7x) and peers (17.7x), marking a significant valuation gap.

- Consensus narrative notes that while a low P/E appears appealing, it may reflect not just undervaluation but also the market’s mixed view on Lahav’s ability to consistently cover its financial obligations.

- Peer discount status could indicate opportunity, but only if margin expansion continues and debt coverage improves.

- This below-average P/E, set alongside robust recent profit growth, creates tension about whether markets are undervaluing Lahav’s upside or factoring in future risk.

Interest Expense Still a Watchpoint

- The company’s interest payments remain not fully covered by earnings, with related risks flagged in the past twelve months despite record net income of 233.8 million ILS.

- Critics highlight that strong headline profits have not translated into easy debt servicing, raising questions about how sustainable the current dividend yield of 2.68% is if cash generation stalls.

- While profitability metrics look favorable, the mismatch with interest coverage may keep pressure on management to improve cash flow or reconsider dividend policy.

- This risk is a concern for investors who seek more than just margin growth, as they also want assurance that the business remains financially resilient under different scenarios.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Lahav LR Real Estate's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Lahav LR Real Estate’s robust profitability is tempered by persistent concerns about its ability to comfortably service debt and maintain dividend stability if cash generation slows.

If you want to prioritize companies with healthier finances, check out solid balance sheet and fundamentals stocks screener (1931 results) to spot those built for resilience even when markets get tough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:LAHAV

Lahav LR Real Estate

Engages in the real estate and renewable green energy business in Israel and Germany.

Solid track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success