- Israel

- /

- Real Estate

- /

- TASE:ASGR

Aspen Group (TASE:ASGR) Returns to Profit, Challenging Narratives on Earnings Volatility

Reviewed by Simply Wall St

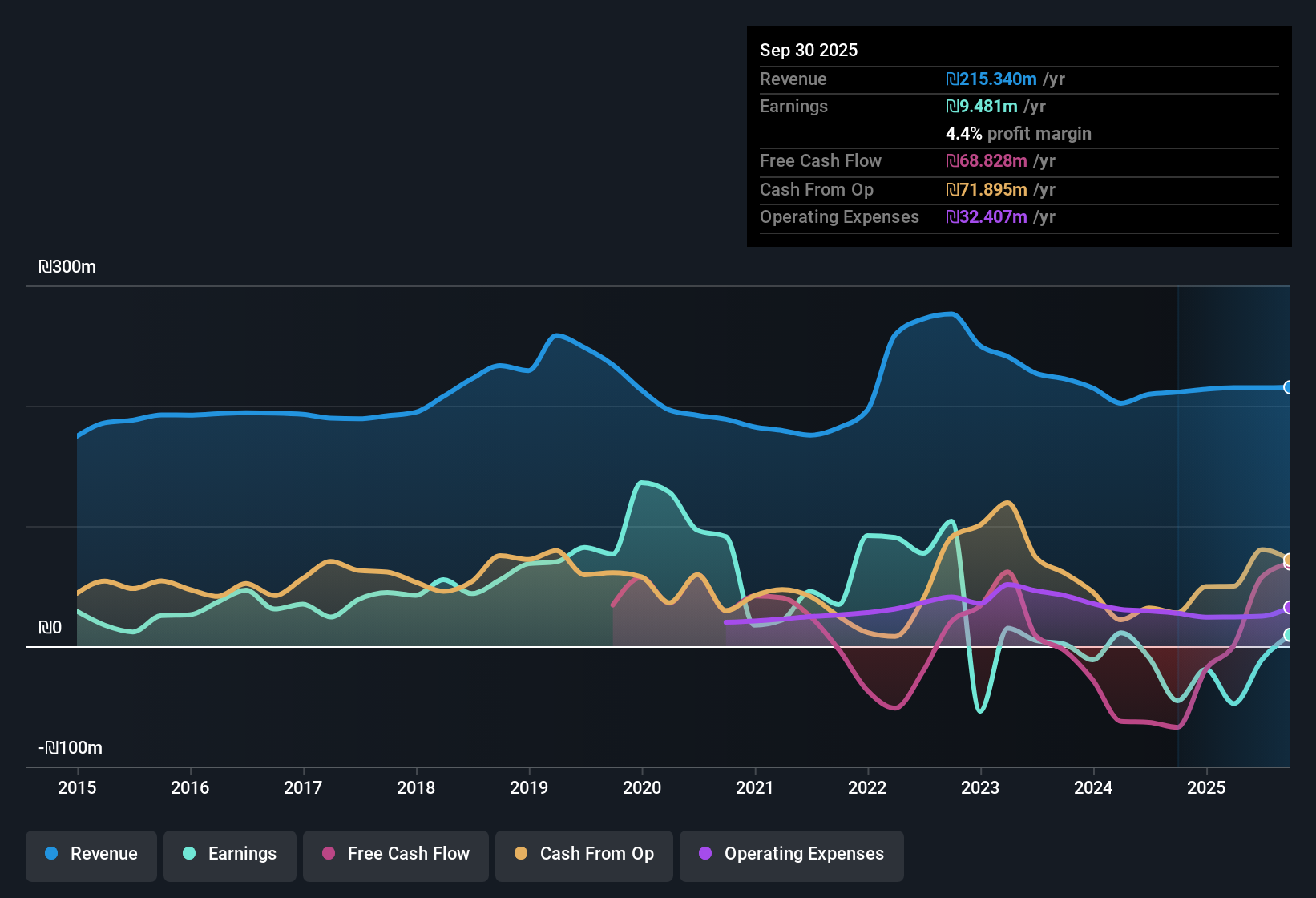

Aspen Group (TASE:ASGR) just released its Q3 2025 results, reporting total revenue of 53.201 million ILS and basic EPS of 0.182456 ILS. Over prior quarters, revenue hovered in a tight range from 51.9 million ILS to 54.902 million ILS. Basic EPS moved between -0.395787 and 0.182456 ILS. Margins remain under the microscope as investors look for signs of stabilization in the company’s bottom line amid a stretch of uneven profitability.

See our full analysis for Aspen Group.Next, we will size up the latest results against the prevailing narratives to see what aligns with expectations and what might prompt a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Income Swings from Deep Losses to Profit

- Net income (excluding extra items) rebounded to 11.5 million ILS this period, compared to a loss of 19.8 million ILS in the previous quarter and deeper losses across the past year.

- Consensus narrative highlights how rapid swings into and out of profitability reinforce Aspen Group’s defensive, diversified profile. However, operating volatility remains a hurdle for long-term investor confidence.

- The trailing twelve months remain in the red at -11.2 million ILS, despite short-term improvements.

- Consistency in rental income streams supports the defensive case. At the same time, extreme quarter-to-quarter profit changes could overshadow perceived stability and keep investors cautious.

Dividend Payouts Not Supported by Earnings

- The company’s dividend yield stands at 5.91%. Recent results show that earnings fail to cover these payouts, raising flags about long-term dividend sustainability.

- Market commentary points out that income-seeking investors may view Aspen Group’s high yield as appealing. However, uncovered dividends and weak earnings coverage create risk.

- This tension challenges the idea that the stock offers “defensive income” because ratios and trend data indicate the payouts outpace profitability.

- Interest payments and dividend obligations both remain above recent earnings power, emphasizing ongoing financial strain.

Low Price-to-Sales Ratio Signals Possible Value Opportunity

- Aspen Group trades at a 2x price-to-sales ratio, considerably below the peer average of 6.7x and industry average of 3.8x. This suggests that shares may be undervalued based on revenue multiples.

- General market opinion holds that value-focused investors may find the multiple attractive. However, declining earnings and ongoing losses caution against relying solely on the P/S ratio for investment decisions.

- Persistent unprofitability over the last year, with losses climbing at a 55.1% annual rate for five years, weighs down any enthusiasm from the lower valuation.

- Stronger sector players with higher profitability could justify higher ratios. Aspen’s discount may reflect risk rather than a hidden bargain.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aspen Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Aspen Group’s high dividend yield may catch attention, uncovered payouts and weak earnings highlight the risks to income-focused investors.

If you want robust yield backed by sustainable profits and stronger coverage, check out these 1920 dividend stocks with yields > 3% to discover income stocks with healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ASGR

Aspen Group

Engages in the purchase, initiation, improvement, management, and rental of real estate properties in Israel and the Netherlands.

Average dividend payer with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.