Is Tikun Olam - Cannbit Pharmaceuticals (TLV:TKUN) Using Debt Sensibly?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Tikun Olam - Cannbit Pharmaceuticals Ltd (TLV:TKUN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Tikun Olam - Cannbit Pharmaceuticals

What Is Tikun Olam - Cannbit Pharmaceuticals's Debt?

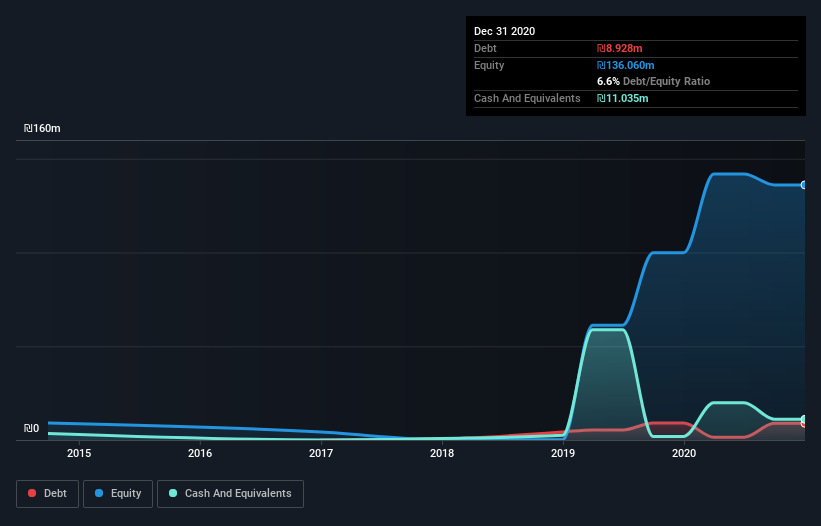

The chart below, which you can click on for greater detail, shows that Tikun Olam - Cannbit Pharmaceuticals had ₪8.93m in debt in December 2020; about the same as the year before. But it also has ₪11.0m in cash to offset that, meaning it has ₪2.11m net cash.

How Strong Is Tikun Olam - Cannbit Pharmaceuticals' Balance Sheet?

We can see from the most recent balance sheet that Tikun Olam - Cannbit Pharmaceuticals had liabilities of ₪26.4m falling due within a year, and liabilities of ₪32.3m due beyond that. On the other hand, it had cash of ₪11.0m and ₪7.66m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪40.1m.

Given Tikun Olam - Cannbit Pharmaceuticals has a market capitalization of ₪226.0m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Tikun Olam - Cannbit Pharmaceuticals also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Tikun Olam - Cannbit Pharmaceuticals's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

While it hasn't made a profit, at least Tikun Olam - Cannbit Pharmaceuticals booked its first revenue as a publicly listed company, in the last twelve months.

So How Risky Is Tikun Olam - Cannbit Pharmaceuticals?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Tikun Olam - Cannbit Pharmaceuticals had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of ₪51m and booked a ₪33m accounting loss. With only ₪2.11m on the balance sheet, it would appear that its going to need to raise capital again soon. Importantly, Tikun Olam - Cannbit Pharmaceuticals's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Tikun Olam - Cannbit Pharmaceuticals has 5 warning signs (and 2 which are a bit unpleasant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tikun Olam-Cannbit Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:TKUN

Tikun Olam-Cannbit Pharmaceuticals

Engages in the cultivation, production, marketing, storage, distribution, export and import, and sale of cannabis-based products in Israel.

Moderate and slightly overvalued.

Market Insights

Community Narratives