The Middle Eastern markets have recently experienced a boost, with UAE indices climbing on optimism surrounding potential rate cuts by the Federal Reserve. This positive sentiment has created an intriguing backdrop for investors exploring various opportunities in the region. Despite its somewhat antiquated name, the concept of penny stocks remains pertinent as these smaller or newer companies can present unique value and growth prospects when supported by robust financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.59 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.659 | ₪333.98M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.10 | AED2.2B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED333.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.29 | AED13.99B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.812 | AED3.47B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.831 | AED510.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.726 | ₪213.99M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Union Insurance Company P.J.S.C (ADX:UNION)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Insurance Company P.J.S.C. underwrites insurance products in the United Arab Emirates, Gulf Cooperation Council, and internationally with a market cap of AED264.50 million.

Operations: The company's revenue is derived from two main segments: Life Insurance, contributing AED17.34 million, and General Insurance, generating AED264.05 million.

Market Cap: AED264.5M

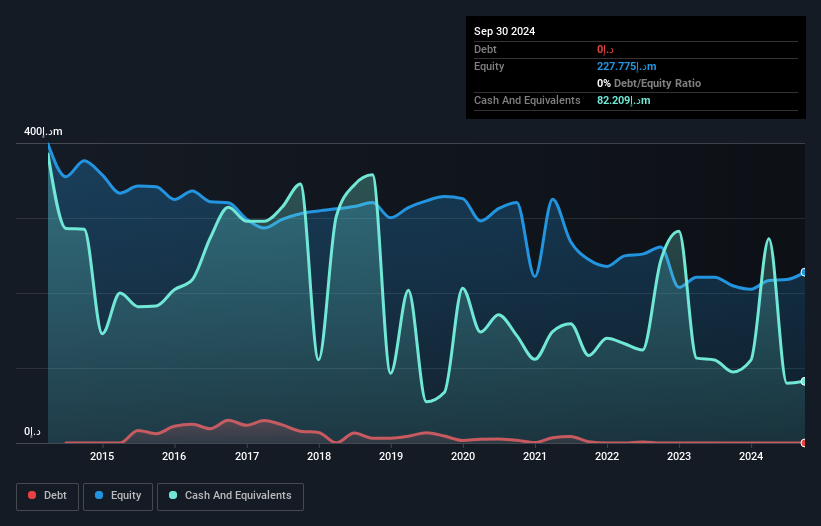

Union Insurance Company P.J.S.C. has shown significant financial improvement, becoming profitable over the past year with net income for the second quarter reaching AED 9.7 million, a substantial increase from AED 1.15 million a year ago. Despite its low Return on Equity of 18.1%, the company benefits from being debt-free and having short-term assets of AED688.9M that cover its short-term liabilities of AED6.6M, although they fall short against long-term liabilities of AED1.2 billion. The Price-To-Earnings ratio at 5.5x suggests it may be undervalued relative to the AE market average of 12.6x.

- Take a closer look at Union Insurance Company P.J.S.C's potential here in our financial health report.

- Evaluate Union Insurance Company P.J.S.C's historical performance by accessing our past performance report.

Inter Industries Plus (TASE:ININ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inter Industries Plus Ltd., with a market cap of ₪101.94 million, operates in Israel's energy and infrastructure sectors through its subsidiaries.

Operations: The company generates revenue through two primary segments: Projects, contributing ₪363.88 million, and Trade and Services, accounting for ₪328.11 million.

Market Cap: ₪101.94M

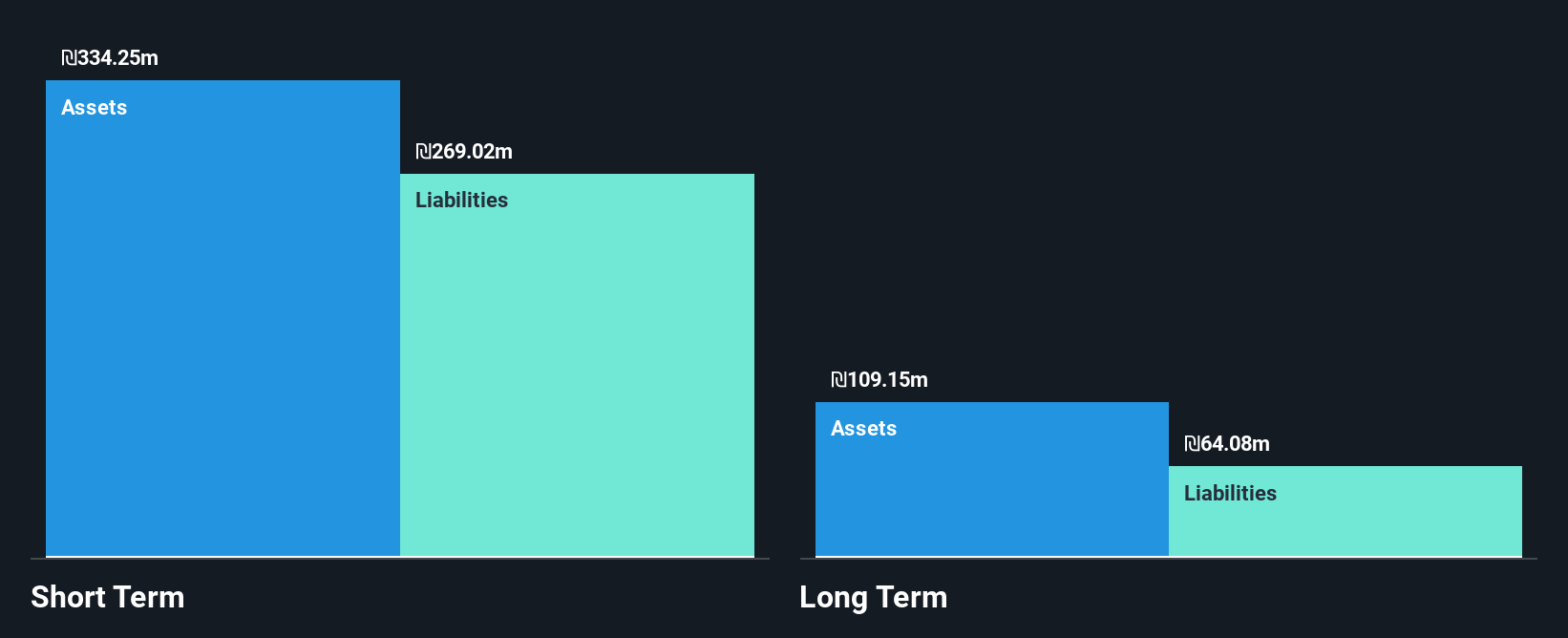

Inter Industries Plus Ltd. operates with a market cap of ₪101.94 million, focusing on energy and infrastructure in Israel. Despite being unprofitable, it maintains a satisfactory net debt to equity ratio of 8.3% and has not significantly diluted shareholders recently. The company reported a net loss of ₪6.58 million for Q2 2025, slightly higher than the previous year, with sales declining to ₪173.85 million from ₪184 million year-on-year. While its board and management team are relatively new, Inter Industries Plus benefits from sufficient cash runway exceeding three years if current free cash flow levels persist despite their decline by 34.1% annually.

- Get an in-depth perspective on Inter Industries Plus' performance by reading our balance sheet health report here.

- Understand Inter Industries Plus' track record by examining our performance history report.

PlantArc Bio (TASE:PLNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PlantArc Bio Ltd. is an Ag-Bio company focused on crop protection and yield enhancement, with a market cap of ₪6.70 million.

Operations: The company generates revenue from its Agricultural Biotech segment, amounting to ₪3.07 million.

Market Cap: ₪6.7M

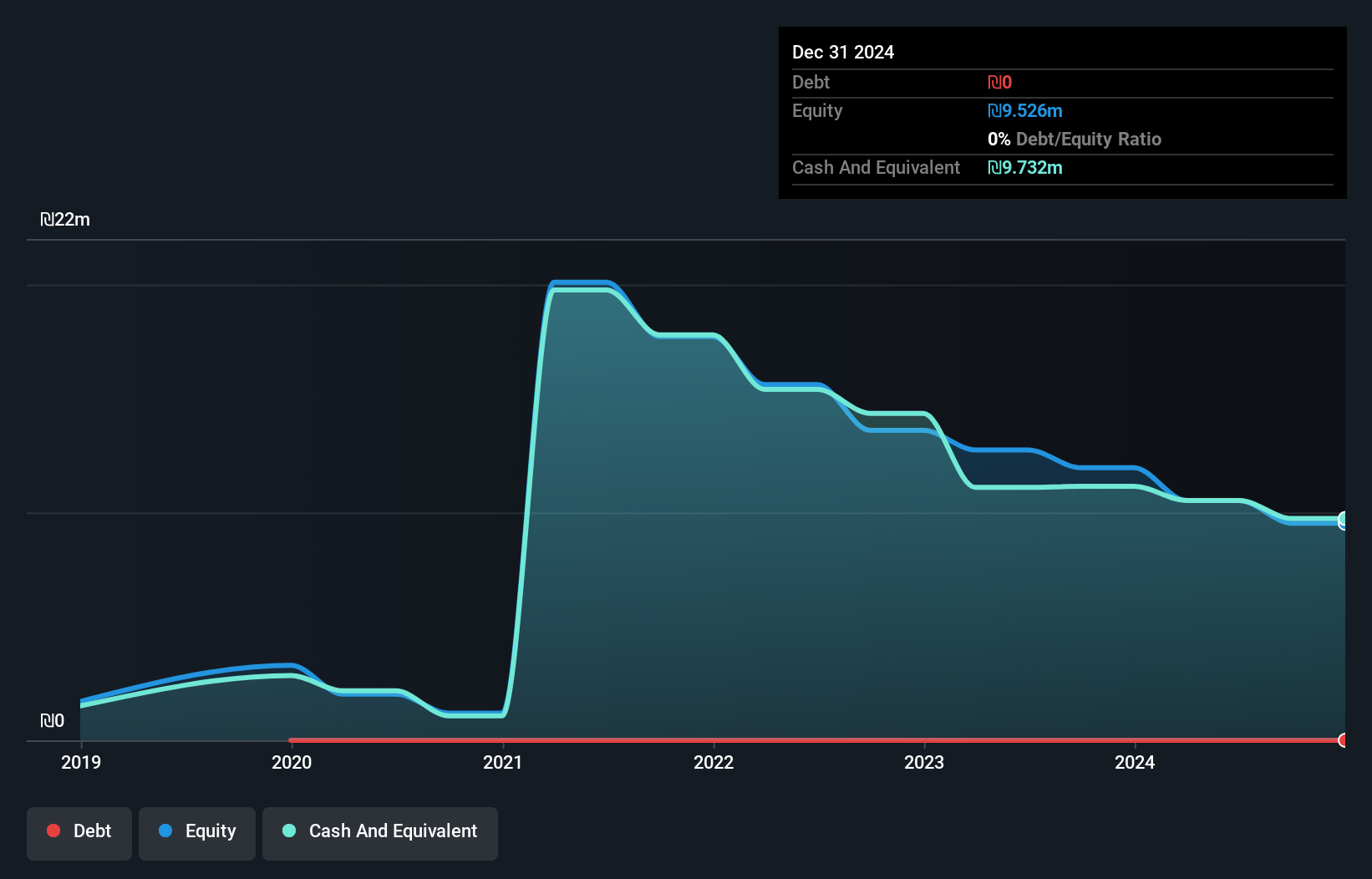

PlantArc Bio Ltd., with a market cap of ₪6.70 million, operates in the agricultural biotech sector but remains pre-revenue, generating less than US$1 million. Despite being unprofitable, the company has reduced losses over five years and maintains a debt-free status with sufficient cash runway for over three years. Recent patents for its DIPPER™ platform in the U.S. and South Korea bolster its intellectual property portfolio, enhancing gene-editing processes for crops like corn and wheat. However, recent earnings show declining sales to ₪0.81 million and increased net loss to ₪1.93 million compared to last year.

- Navigate through the intricacies of PlantArc Bio with our comprehensive balance sheet health report here.

- Learn about PlantArc Bio's historical performance here.

Summing It All Up

- Discover the full array of 76 Middle Eastern Penny Stocks right here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLNT

PlantArc Bio

Operates as an Ag-Bio company for the crop protection and yield enhancement.

Flawless balance sheet with low risk.

Market Insights

Community Narratives