- Turkey

- /

- Hotel and Resort REITs

- /

- IBSE:AKFGY

Middle Eastern Penny Stocks To Consider In April 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently faced challenges, with UAE indices experiencing declines due to ex-dividend trading and broader global economic pressures. Despite these hurdles, investors continue to seek opportunities in diverse market segments. Penny stocks, while often overlooked, can present unique investment prospects when supported by robust financials and growth potential. In this article, we explore three such stocks that may offer compelling opportunities for those looking beyond the usual market leaders.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.65B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.40 | SAR528M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.303 | ₪159.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.90 | ₪2.8B | ✅ 1 ⚠️ 2 View Analysis > |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.686 | ₪17.89M | ✅ 0 ⚠️ 6 View Analysis > |

| Tarya Israel (TASE:TRA) | ₪0.60 | ₪178.12M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.22 | ₪165.04M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.755 | AED473.22M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.83 | AED442.37M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.38 | AED10.08B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 93 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Cement and Industrial Development Co. (ADX:SCIDC) operates in the production and sale of cement and other related industrial products, with a market cap of AED473.22 million.

Operations: The company generates revenue from its manufacturing segment, amounting to AED680.15 million.

Market Cap: AED473.22M

Sharjah Cement and Industrial Development Co. has shown a robust financial performance with earnings growth of 762.2% over the past year, significantly outpacing the Basic Materials industry. The company's net profit margins have improved to 4.7%, and its debt levels are satisfactory, with a net debt to equity ratio of 21.7%. However, its return on equity remains low at 2.4%. Despite high share price volatility, SCIDC trades well below its fair value estimate and maintains strong coverage of interest payments by EBIT at 4.1x. Recent announcements include an annual dividend of AED 0.0500 per share.

- Jump into the full analysis health report here for a deeper understanding of Sharjah Cement and Industrial Development (PJSC).

- Examine Sharjah Cement and Industrial Development (PJSC)'s past performance report to understand how it has performed in prior years.

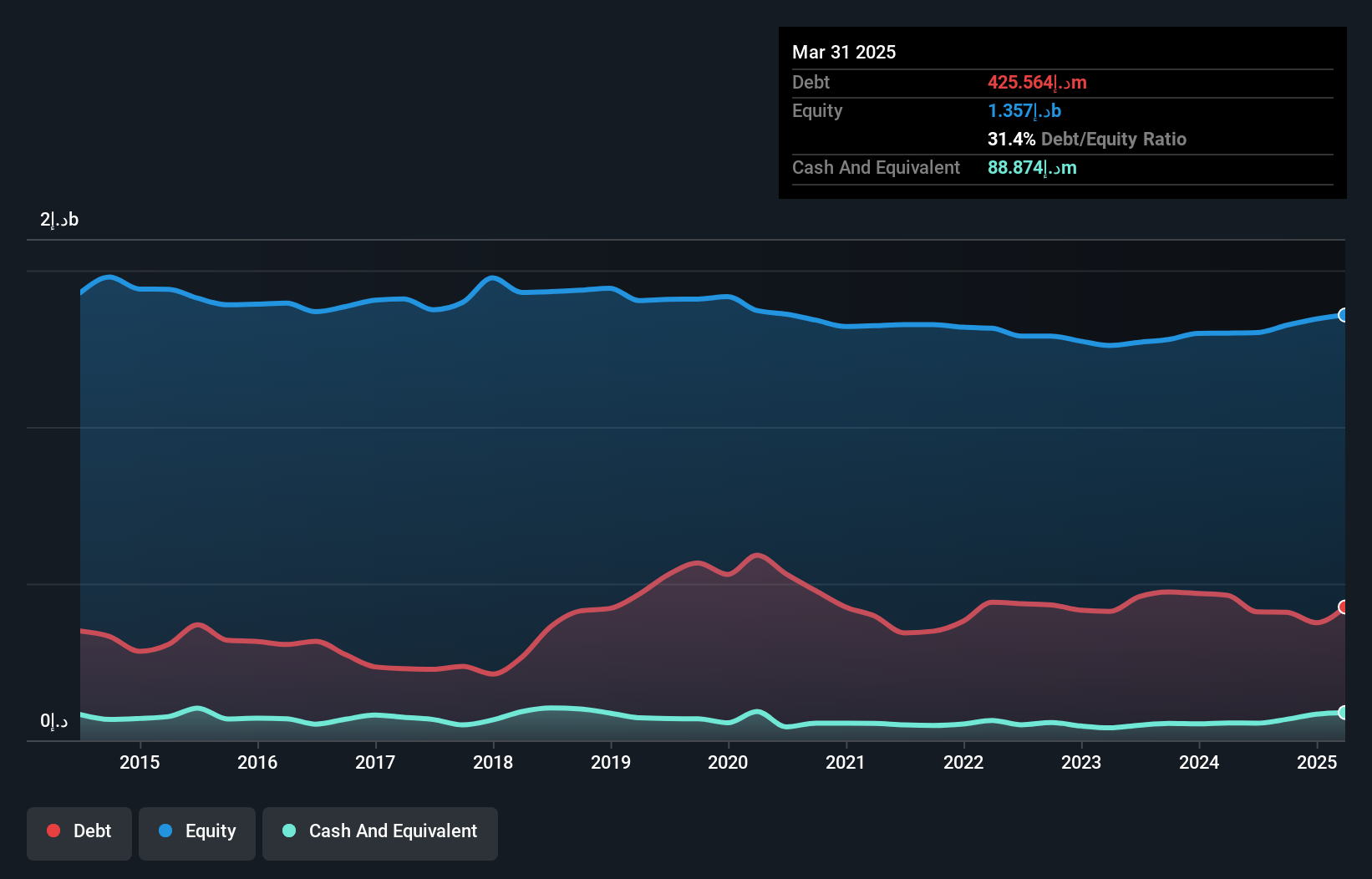

Akfen Gayrimenkul Yatirim Ortakligi (IBSE:AKFGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Akfen Gayrimenkul Yatirim Ortakligi, established in 2006 from Aksel Tourism Investments and Management Inc., operates as a real estate investment trust with a market capitalization of TRY7.64 billion.

Operations: The company's revenue is primarily derived from its real estate investments, totaling TRY1.21 billion.

Market Cap: TRY7.64B

Akfen Gayrimenkul Yatirim Ortakligi has demonstrated strong earnings growth of 37.8% over the past year, surpassing industry averages, although its revenue decreased to TRY1.21 billion from TRY1.58 billion the previous year. The company benefits from reduced debt levels, with a net debt to equity ratio now at 7.3%, and its short-term assets comfortably cover short-term liabilities but not long-term ones. Despite a low return on equity of 6.2%, Akfen's price-to-earnings ratio of 5.3x indicates potential undervaluation compared to the broader market, though negative operating cash flow remains a concern for debt coverage stability.

- Click here to discover the nuances of Akfen Gayrimenkul Yatirim Ortakligi with our detailed analytical financial health report.

- Learn about Akfen Gayrimenkul Yatirim Ortakligi's historical performance here.

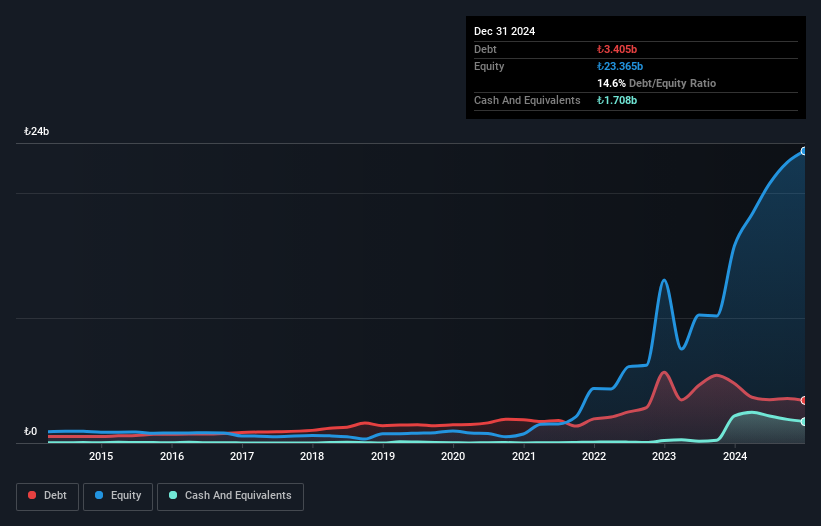

PlantArc Bio (TASE:PLNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PlantArc Bio Ltd. is an Ag-Bio company focused on crop protection and yield enhancement, with a market cap of ₪7.72 million.

Operations: PlantArc Bio Ltd. currently does not report any revenue segments.

Market Cap: ₪7.72M

PlantArc Bio Ltd., an Ag-Bio company with a market cap of ₪7.72 million, is pre-revenue and unprofitable, reporting a net loss of ₪2.57 million for 2024. Despite this, the company maintains financial stability with short-term assets covering both short and long-term liabilities and no debt over the past five years. The management team and board are experienced, with average tenures exceeding industry norms. While its share price has been highly volatile recently, PlantArc Bio's cash runway extends beyond three years under current conditions without significant shareholder dilution in the past year.

- Dive into the specifics of PlantArc Bio here with our thorough balance sheet health report.

- Understand PlantArc Bio's track record by examining our performance history report.

Seize The Opportunity

- Take a closer look at our Middle Eastern Penny Stocks list of 93 companies by clicking here.

- Ready For A Different Approach? AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKFGY

Akfen Gayrimenkul Yatirim Ortakligi

Akfen Gayrimenkul Yatirim Ortakligi A.S. (“the Company” or “Akfen GYO”) was restructured as a real estate investment trust by transforming Aksel Turizm Yatirimlari ve Isletmecilik AS (“Aksel”).

Excellent balance sheet with proven track record.

Market Insights

Community Narratives