- Israel

- /

- Oil and Gas

- /

- TASE:RTPT

Discovering Opportunities: Duran Dogan Basim ve Ambalaj Sanayi And 2 Other Middle Eastern Penny Stocks

Reviewed by Simply Wall St

As most Gulf markets rise, with Dubai's main index reaching a 17-year high, the Middle East continues to capture investor attention with its robust economic indicators and steady oil prices. Though the term 'penny stocks' might feel like a relic of past market eras, the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Terminal X Online (TASE:TRX) | ₪4.37 | ₪555.01M | ✅ 2 ⚠️ 0 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.02 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.811 | ₪197.21M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.14 | AED2.26B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.79 | TRY1.93B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.13 | AED361.51M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.41 | AED10.25B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.726 | AED441.59M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.335 | ₪173.59M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 94 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Duran Dogan Basim ve Ambalaj Sanayi (IBSE:DURDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duran Dogan Basim ve Ambalaj Sanayi A.S., along with its subsidiaries, offers packaging products across Turkey and various international markets including Europe, the United States, the Middle East, Africa, and the Asia Pacific; it has a market cap of TRY1.59 billion.

Operations: The company's revenue is primarily generated from its Packaging & Containers segment, amounting to TRY1.90 billion.

Market Cap: TRY1.58B

Duran Dogan Basim ve Ambalaj Sanayi A.S. has shown a reduction in debt levels, with its debt to equity ratio decreasing significantly over the past five years. Despite being unprofitable, the company has managed to reduce its losses annually by 13.4%. Its short-term assets comfortably cover both short and long-term liabilities, indicating a strong liquidity position. However, high net debt to equity remains a concern. Recent earnings reports highlight declining sales and continued net losses, although these losses have narrowed slightly compared to previous periods. The company's dividend is not well covered by earnings, suggesting potential sustainability issues.

- Dive into the specifics of Duran Dogan Basim ve Ambalaj Sanayi here with our thorough balance sheet health report.

- Explore historical data to track Duran Dogan Basim ve Ambalaj Sanayi's performance over time in our past results report.

Matricelf (TASE:MTLF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Matricelf Ltd is a biotechnology company focused on developing a platform for autologous tissue engineering to address various medical conditions, with a market cap of ₪44.55 million.

Operations: Matricelf Ltd does not currently report any revenue segments.

Market Cap: ₪44.55M

Matricelf Ltd, a pre-revenue biotechnology company with a market cap of ₪44.55 million, recently announced a collaboration with Cellino to advance personalized spinal cord injury treatments. This partnership leverages Cellino's Nebula™ technology and Matricelf's regenerative approach to create scalable therapies. Despite being debt-free and having short-term assets exceeding liabilities, Matricelf faces challenges due to its unprofitability and limited cash runway of less than a year. The management team is experienced, but the board is relatively new. An IND application is planned for next year, aiming to initiate clinical trials for their innovative therapy.

- Navigate through the intricacies of Matricelf with our comprehensive balance sheet health report here.

- Gain insights into Matricelf's past trends and performance with our report on the company's historical track record.

Ratio Petroleum Energy - Limited Partnership (TASE:RTPT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ratio Petroleum Energy - Limited Partnership is involved in the exploration, development, and production of oil and gas, with a market cap of ₪62.95 million.

Operations: Ratio Petroleum Energy - Limited Partnership has not reported any revenue segments.

Market Cap: ₪62.95M

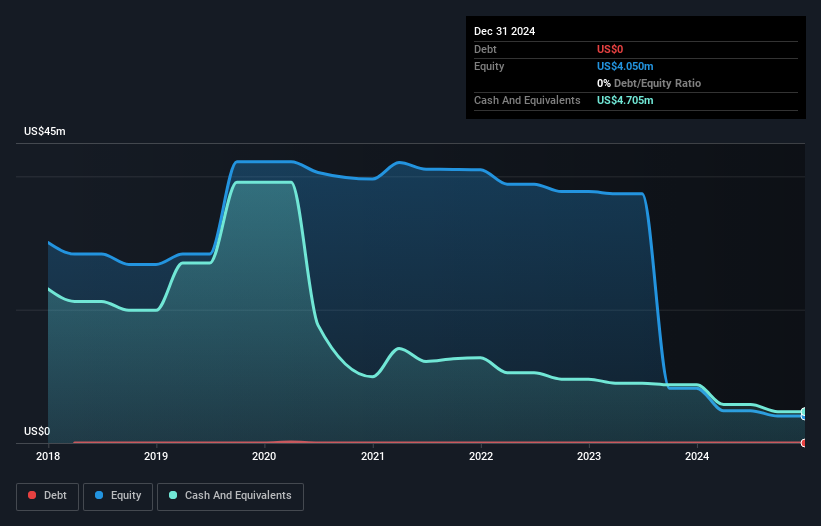

Ratio Petroleum Energy - Limited Partnership, with a market cap of ₪62.95 million, is pre-revenue and faces challenges due to its unprofitability and negative return on equity. The company reported a net loss of US$4.18 million for 2024, an improvement from the previous year's larger losses. Despite having no debt and short-term assets exceeding liabilities, its cash runway is limited to less than a year if growth continues at historical rates. The board's average tenure suggests experience; however, the management's experience remains unclear. Share price volatility has decreased but remains high compared to other Israeli stocks.

- Click here to discover the nuances of Ratio Petroleum Energy - Limited Partnership with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Ratio Petroleum Energy - Limited Partnership's track record.

Make It Happen

- Embark on your investment journey to our 94 Middle Eastern Penny Stocks selection here.

- Searching for a Fresh Perspective? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RTPT

Ratio Petroleum Energy - Limited Partnership

Engages in the exploration, development, and production of oil and gas.

Excellent balance sheet moderate.

Similar Companies

Market Insights

Community Narratives