High Growth Tech Stocks Including LINK Mobility Group Holding And 2 More

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant volatility, with U.S. stocks rebounding after a sharp sell-off and dovish signals from the Federal Reserve suggesting further monetary policy easing. This backdrop of fluctuating market sentiment and economic indicators highlights the importance of identifying high-growth tech stocks that can navigate such uncertainties; companies like LINK Mobility Group Holding are often characterized by their innovative capabilities and potential to capitalize on emerging trends in technology sectors.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 35.21% | 46.95% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.54% | 74.03% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.45% | 39.73% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Growth Rating: ★★★★☆☆

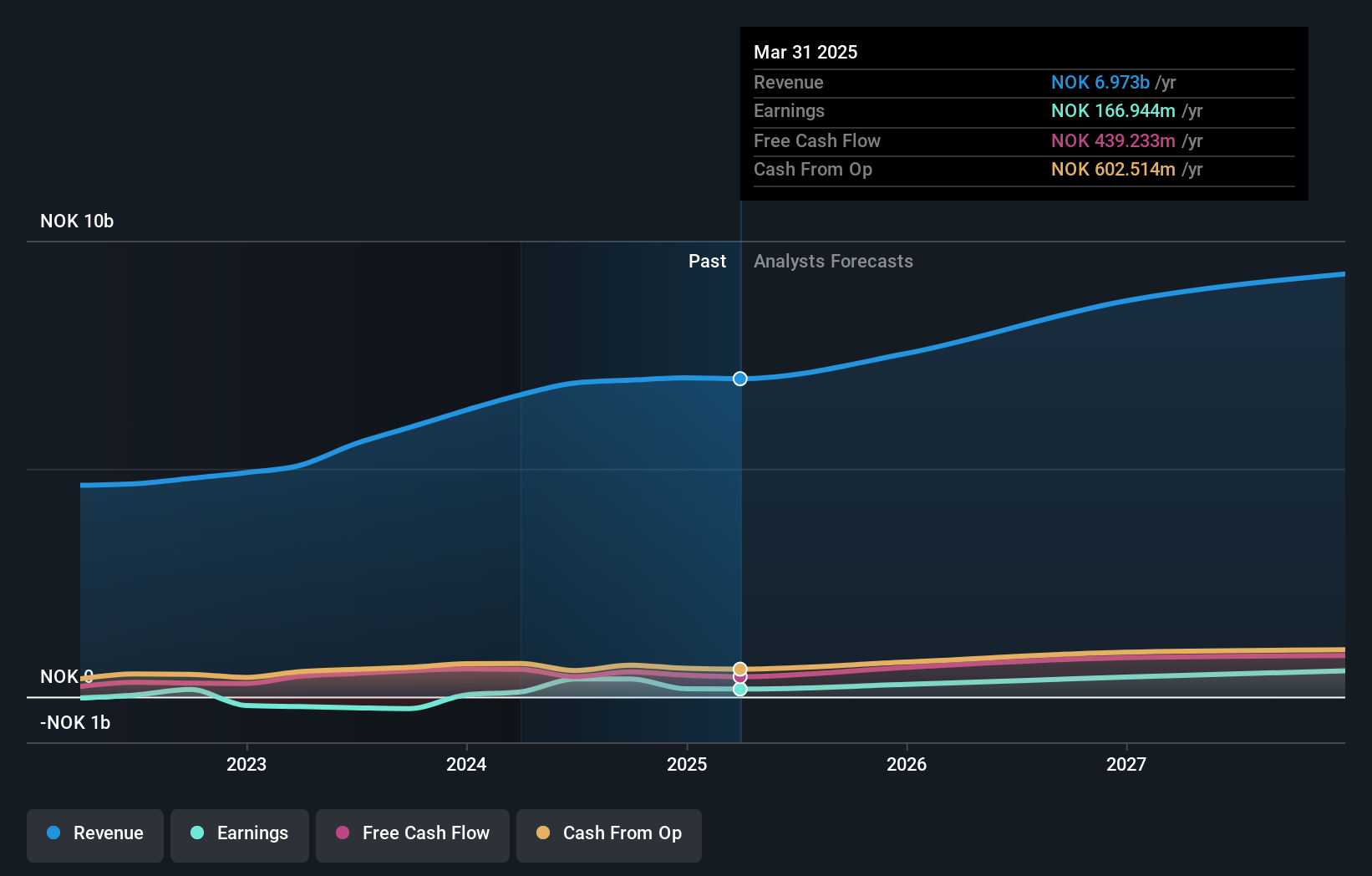

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK8.08 billion.

Operations: LINK Mobility's revenue streams are primarily derived from its operations in Central Europe (NOK1.68 billion), Western Europe (NOK2.25 billion), Northern Europe (NOK1.56 billion), and Global Messaging (NOK1.43 billion).

LINK Mobility Group Holding ASA, with its aggressive M&A strategy, recently saw a notable stake acquisition by an undisclosed buyer for approximately NOK 520 million. This move underscores LINK's ongoing efforts to expand and integrate technologies like SMSPortal into its operations, enhancing efficiency and market position in Europe. Despite a challenging quarter with sales dropping to NOK 1,758.3 million from NOK 1,816.07 million the previous year and swinging to a net loss of NOK 2.55 million from a net income of NOK 61.96 million, the company's strategic acquisitions are poised to bolster future growth prospects. With annual earnings expected to surge by 61%, significantly outpacing the Norwegian market's growth rate of 13.8%, LINK is actively pursuing value creation through both organic growth and strategic M&As.

- Navigate through the intricacies of LINK Mobility Group Holding with our comprehensive health report here.

Gain insights into LINK Mobility Group Holding's past trends and performance with our Past report.

Kamada (TASE:KMDA)

Simply Wall St Growth Rating: ★★★★☆☆

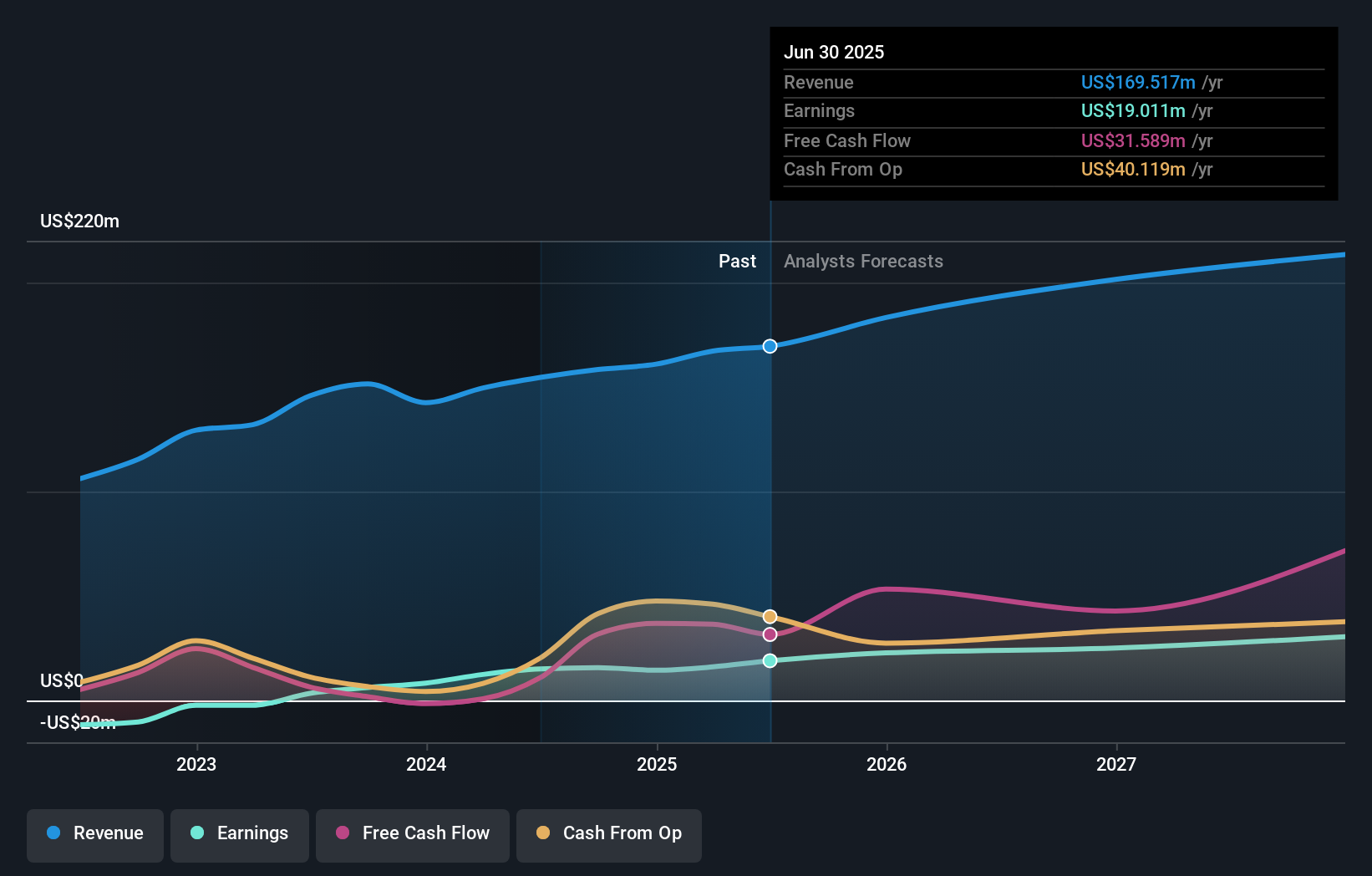

Overview: Kamada Ltd. is engaged in the manufacturing and sale of plasma-derived protein therapeutics, with a market capitalization of ₪1.34 billion.

Operations: The company generates revenue primarily through two segments: Proprietary Products, contributing $146.99 million, and Distribution, accounting for $22.52 million.

Kamada Ltd. showcases a robust growth trajectory, with revenue and earnings expanding by 11.1% and 20.9% annually, outpacing the IL market's growth rates of 7.5% and 15.8%, respectively. This performance is underpinned by strategic expansions such as the FDA-approved plasma collection facility in Houston, expected to significantly enhance its specialty plasma operations—one of Kamada's key revenue streams. Additionally, recent presentations at major healthcare conferences underscore the company’s proactive approach in engaging the broader medical community and investors about its innovative product pipeline and strategic initiatives aimed at long-term growth.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

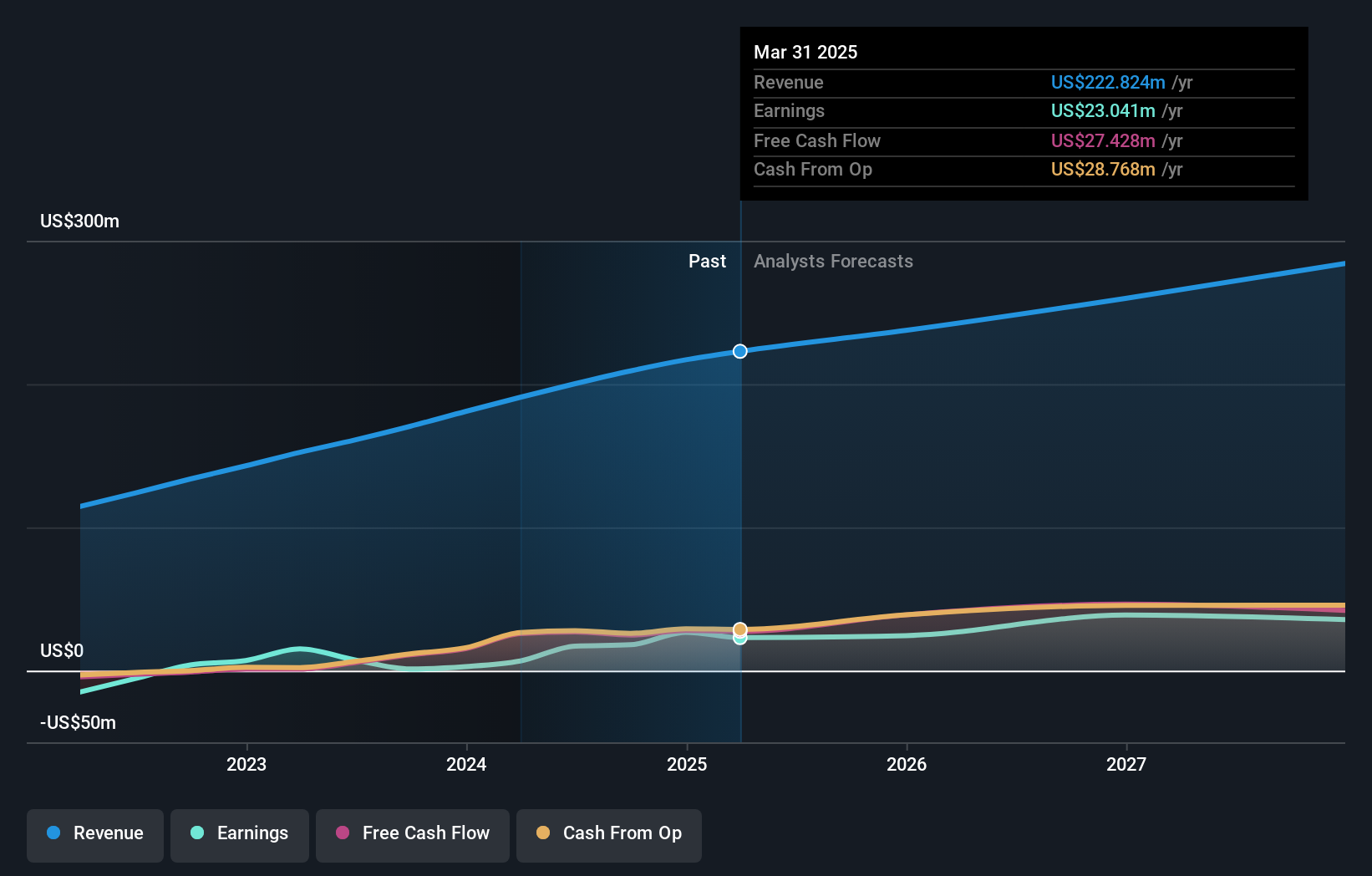

Overview: Docebo Inc. develops and provides a learning management platform for training in North America and internationally, with a market capitalization of approximately CA$1.09 billion.

Operations: The company's primary revenue stream is derived from its educational software segment, generating CA$230.50 million.

Docebo stands out in the tech landscape with its robust earnings growth, which at 33.4% annually, surpasses the Canadian market's average of 12.1%. This performance is bolstered by a significant commitment to innovation, as evidenced by R&D expenses that are strategically aligned to foster advancements in learning technologies. Recent share repurchases underscore confidence in this strategy, with over 1.7 million shares bought back for CAD 71.82 million, reflecting a proactive approach to shareholder value enhancement. Additionally, Docebo's participation in key technology conferences highlights its role as an influential player within the tech sector, poised for continued expansion fueled by strategic investments and market-leading innovations.

- Take a closer look at Docebo's potential here in our health report.

Understand Docebo's track record by examining our Past report.

Key Takeaways

- Embark on your investment journey to our 247 Global High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kamada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KMDA

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives