- Israel

- /

- Interactive Media and Services

- /

- TASE:TGTR

Together Pharma (TLV:TGTR) Is Achieving High Returns On Its Capital

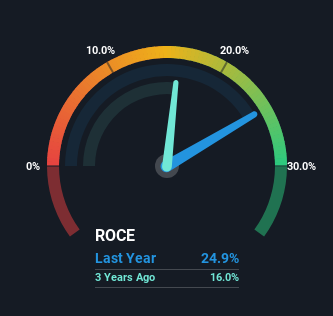

There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Together Pharma (TLV:TGTR) looks great, so lets see what the trend can tell us.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Together Pharma:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.25 = ₪22m ÷ (₪139m - ₪50m) (Based on the trailing twelve months to December 2023).

So, Together Pharma has an ROCE of 25%. In absolute terms that's a great return and it's even better than the Interactive Media and Services industry average of 12%.

View our latest analysis for Together Pharma

Historical performance is a great place to start when researching a stock so above you can see the gauge for Together Pharma's ROCE against it's prior returns. If you're interested in investigating Together Pharma's past further, check out this free graph covering Together Pharma's past earnings, revenue and cash flow.

The Trend Of ROCE

We're delighted to see that Together Pharma is reaping rewards from its investments and is now generating some pre-tax profits. About five years ago the company was generating losses but things have turned around because it's now earning 25% on its capital. And unsurprisingly, like most companies trying to break into the black, Together Pharma is utilizing 813% more capital than it was five years ago. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 36%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.

Our Take On Together Pharma's ROCE

Overall, Together Pharma gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. However the stock is down a substantial 85% in the last five years so there could be other areas of the business hurting its prospects. In any case, we believe the economic trends of this company are positive and looking into the stock further could prove rewarding.

On a final note, we found 3 warning signs for Together Pharma (2 are significant) you should be aware of.

Together Pharma is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

If you're looking to trade Together Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Together Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TGTR

Together Pharma

Through its subsidiaries, engages in growing, production, storage, and distribution of medical cannabis products in Israel.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives