Israel Corp (TASE:ILCO) Valuation in Focus After Removal From TA-35 Index

Reviewed by Simply Wall St

Israel Corporation Ltd (TASE:ILCO) has been dropped from the TA-35 Index. This change is prompting many investors to pay closer attention. Index changes often shake up portfolios and can lead to shifts in trading volumes.

See our latest analysis for Israel.

After surging over the past five years with a total shareholder return of 104.5 percent, Israel’s momentum has clearly shifted recently. The share price is down sharply in the last week following news of its removal from the TA-35 Index. Despite some longer-term gains, short-term share price returns have turned negative, reflecting investor concerns and adjusting risk perceptions as this development plays out.

If market shakeups like this have you curious about new opportunities, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

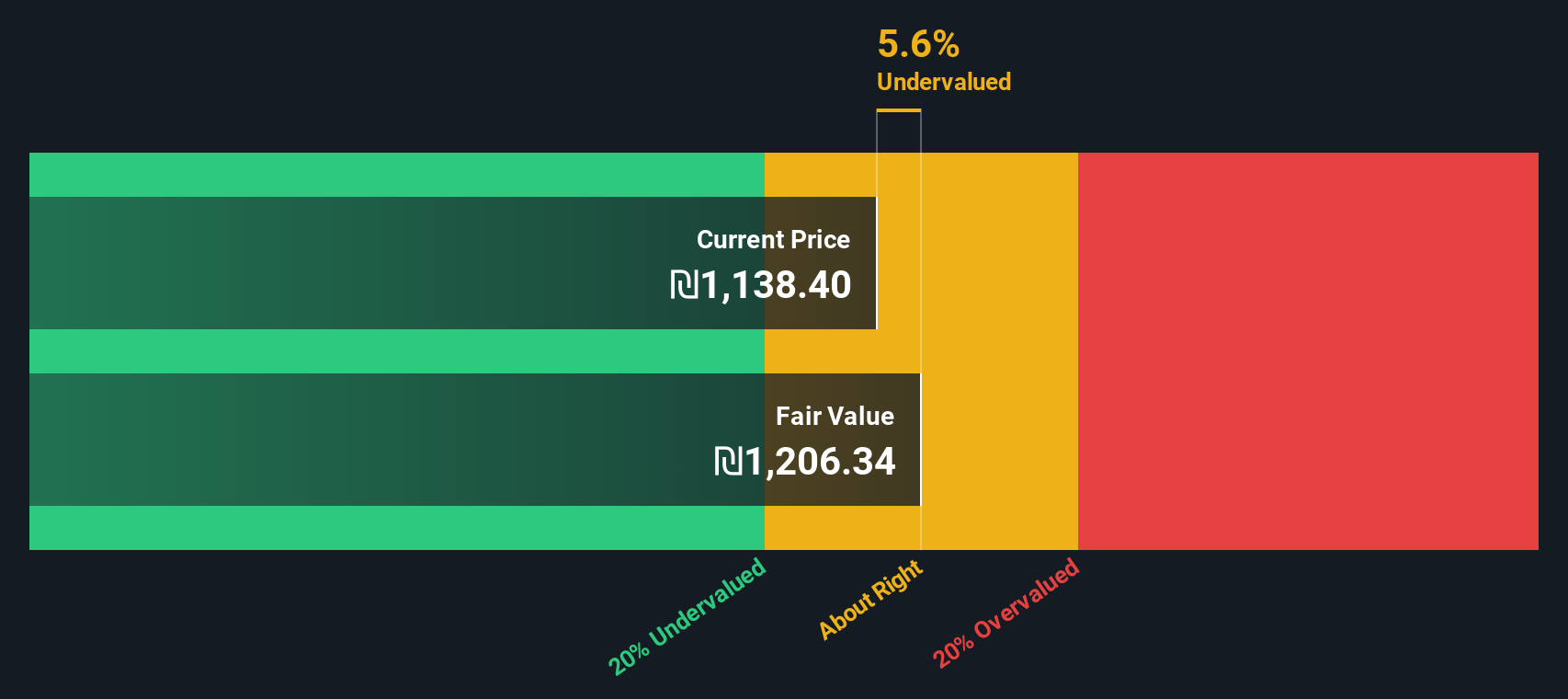

The real question now is whether Israel’s recent declines reflect an undervaluation that savvy investors can seize on, or if the current price already factors in all future growth expectations. Could this be a genuine buying opportunity?

Price-to-Earnings of 13.7x: Is it justified?

ILCO is trading at a price-to-earnings (P/E) ratio of 13.7x, considerably below both its industry peers and the broader market. With a last close price of ₪927.8, the stock stands out as undervalued by this metric, especially in comparison to the Asian Chemicals industry average.

The P/E ratio measures how much investors are willing to pay per unit of earnings. For a company in the chemicals sector, this metric offers insight into how the market values its current profitability relative to competitors.

Given that ILCO’s P/E is 13.7x, while the Asian Chemicals industry average is 22.6x and the peer average is a striking 43.6x, the market appears to be discounting ILCO’s future earnings potential. This gap is significant and could present an opportunity if ILCO’s earnings recover or outperform expectations.

ILCO's comparatively low multiple may indicate that investors are cautious about its short-term outlook or recent growth setbacks. If performance stabilizes, there could be room for a re-rating up toward sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.7x (UNDERVALUED)

However, caution is warranted because recent earnings declines and uncertain revenue trends could undermine the case for a quick rebound.

Find out about the key risks to this Israel narrative.

Another View: Our DCF Model Perspective

A different angle comes from our SWS DCF model, which estimates ILCO's fair value at ₪1,339.3, about 31 percent above its current price. This suggests the market may be undervaluing the stock, but does the DCF capture the real risks ahead, or is the discount justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Israel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Israel Narrative

If you'd like to dig into the numbers and form your own perspective instead of relying solely on this analysis, you can put together your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Israel.

Looking for More Actionable Investment Ideas?

Seize your competitive edge by going beyond a single stock and tapping into fresh opportunities picked by the Simply Wall St Screener. If you want to stay a step ahead, don't miss a chance to uncover companies that could shape your portfolio’s next chapter.

- Unlock income potential by tapping into these 14 dividend stocks with yields > 3% that consistently deliver yields above 3 percent. These may be ideal for strengthening your steady returns.

- Catalyze your growth strategy by targeting these 26 AI penny stocks at the forefront of artificial intelligence innovation and future-defining technologies.

- Take advantage of overlooked gems with these 862 undervalued stocks based on cash flows based on robust cash flows and genuine value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ILCO

Israel

Operates in the specialty minerals and chemical businesses in Europe, Asia, South America, North America, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives