Zur Shamir (TASE:ZUR) Margin Decline Reinforces Profitability Concerns Despite Discounted Valuation

Reviewed by Simply Wall St

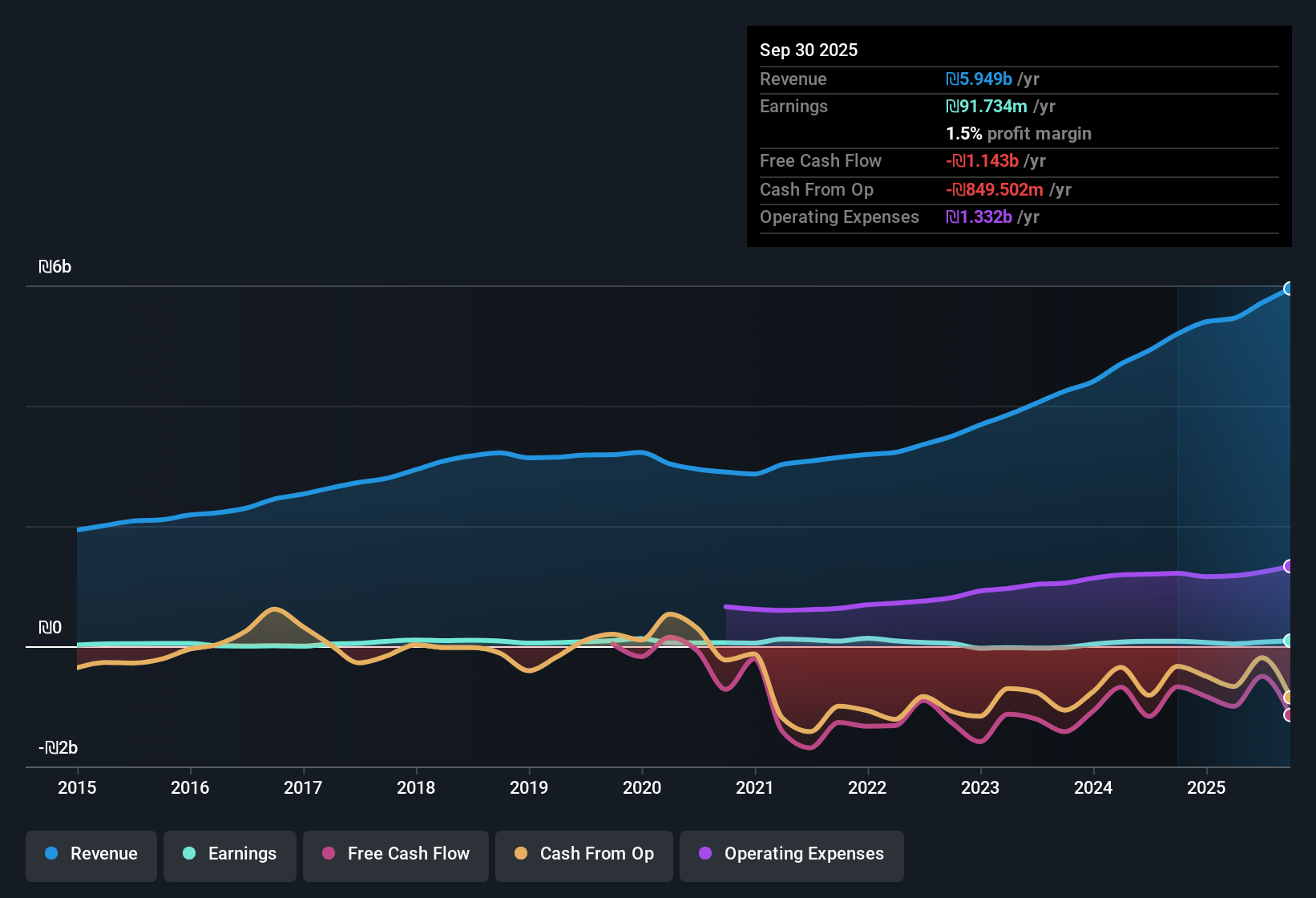

Zur Shamir Holdings (TASE:ZUR) just released its Q3 2025 results, reporting total revenue of ₪1.6 billion and basic EPS of ₪0.34. Looking back, the company has seen revenue move from ₪1.3 billion in Q2 2024 to the latest figure. EPS moved from a negative result of -₪0.08 to the current positive level. Margins were under pressure this period, which may influence how investors interpret profitability and outlook going forward.

See our full analysis for Zur Shamir Holdings.Next up, we will see how these numbers match up with the broader narratives investors have been weighing on Simply Wall St, challenging some assumptions while reinforcing others.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Narrow Further

- Net profit margins shrank from 1.7% to 1.2% year over year, despite total revenue escalating to ₪5.7 billion over the trailing twelve months.

- Pressure on profitability is highlighted by the prevailing market narrative that recognizes Zur Shamir’s defensive diversification, while warning that sector swings, especially in Israeli real estate or insurance regulation, can intensify these already thin margins.

- Critics cite the 13.1% annual drop in profits over five years as a sign underlying earnings remain at risk, especially given the margin slide.

- It is notable that, while insurance stability often supports diversified holding companies, Zur’s margin weakness raises questions about its sector-buffered resilience during this cycle.

Share Price versus DCF Fair Value

- The current share price of ₪11.60 trades at a 7.3% discount to the DCF fair value estimate of ₪12.51. The company’s P/E ratio of 11x remains competitive against its peer average (13x) and aligns with the Asian insurance industry (11x).

- Prevailing opinion holds that this apparent valuation gap could attract value-minded investors. However, the ongoing trend of weaker profitability and uncertain dividend coverage presents real headwinds.

- The attractive valuation is directly related to the discounted price versus intrinsic value, but the narrative notes that multiple sector downturns or tighter coverage ratios could quickly erode that upside.

- Investors are advised not to rely solely on the discounted price, given that challenges in interest and dividend sustainability may arise sooner than expected.

Dividend Coverage Remains Fragile

- The dividend yield is reported at 3.58%, but payouts are not supported by free cash flows, while interest payments continue to lack full earnings coverage.

- Consensus narrative notes that this dual pressure, the need to sustain dividends without strong cash flow support and weak earnings coverage for debt, could place significant stress on Zur’s financial flexibility.

- Both points are supported by explicit data showing a shrinking margin (1.2%) and interest that is not fully covered, weighing on the outlook for any near-term improvement in payout reliability.

- This fragile base for dividends further distinguishes Zur from typical defensive holdings and keeps dividend-oriented investors cautious despite the headline yield.

Results like these keep investors wondering whether Zur's diversification will be enough if cash flow strain persists. Get the big picture from the consensus narrative for all the numbers and context. 📊 Read the full Zur Shamir Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Zur Shamir Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Zur Shamir’s falling profit margins, weak dividend coverage, and stretched interest payments reveal mounting financial health concerns beneath its defensive surface.

If you want to bypass companies facing similar strains, check out solid balance sheet and fundamentals stocks screener (1938 results) to focus on those with stronger balance sheets and greater resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zur Shamir Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ZUR

Zur Shamir Holdings

Through its subsidiaries, operates in the insurance, consumer credit, and real estate markets in Israel.

Fair value with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.