Discovering Çimsa Çimento Sanayi ve Ticaret And 2 Other Hidden Small Caps With Solid Foundations

Reviewed by Simply Wall St

As global markets navigate rising U.S. Treasury yields and tepid economic growth, small-cap stocks have been particularly impacted, with indices like the S&P 600 reflecting this volatility. Amid these broader market dynamics, investors may find opportunities in lesser-known companies that possess strong fundamentals and potential for long-term growth. In such an environment, discovering stocks with solid foundations and resilience can be key to capitalizing on undervalued opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Çimsa Çimento Sanayi ve Ticaret (IBSE:CIMSA)

Simply Wall St Value Rating: ★★★★★★

Overview: Çimsa Çimento Sanayi ve Ticaret A.S. is involved in the production and sale of cement and building materials in Turkey, with a market capitalization of TRY32.74 billion.

Operations: Çimsa generates revenue primarily from its cement segment, which accounts for TRY14.78 billion, and the ready-mixed concrete segment contributing TRY4.20 billion.

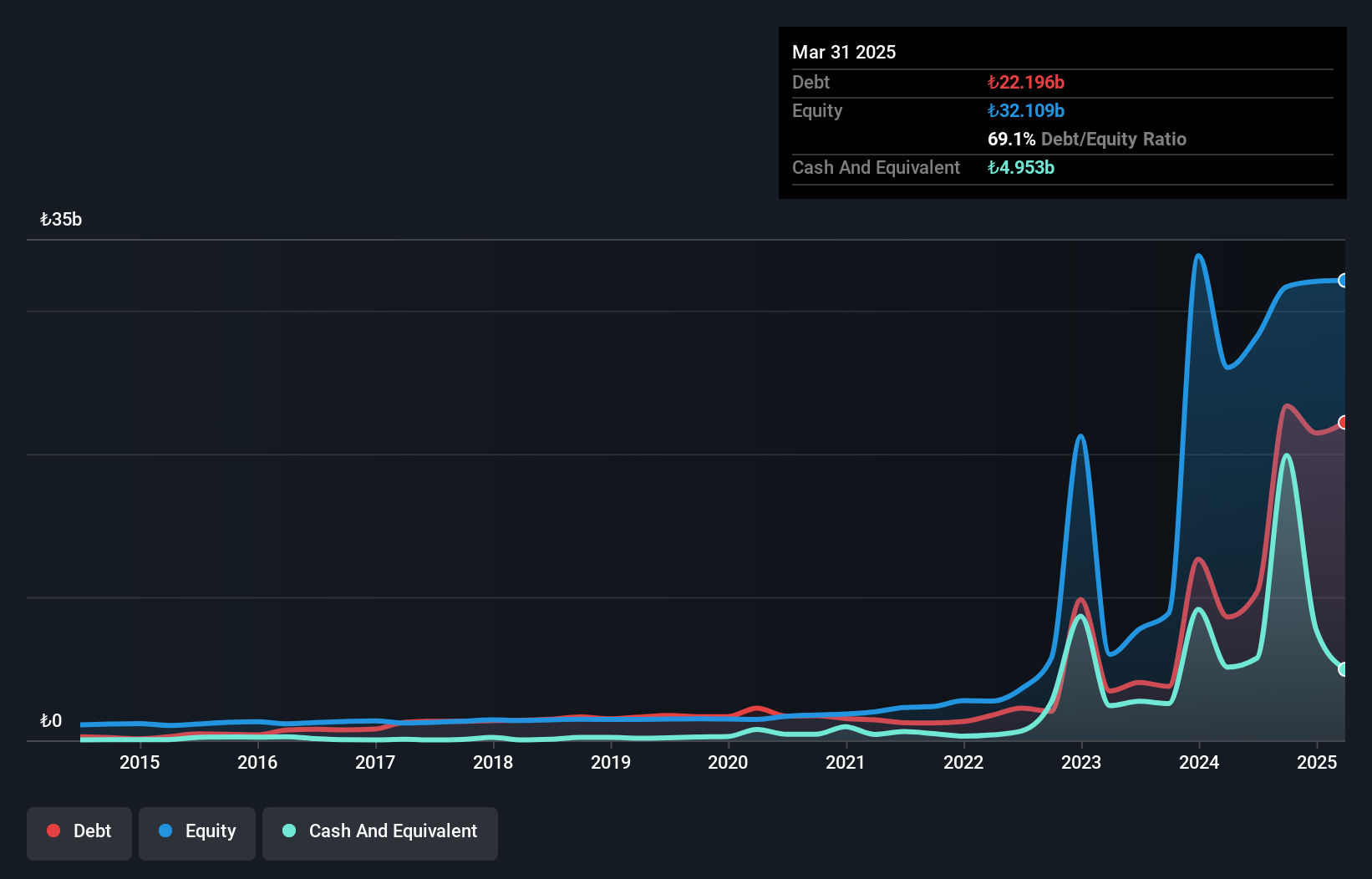

Çimsa Çimento, a notable player in the cement industry, has shown robust financial health with a net debt to equity ratio of 10.9%, deemed satisfactory. Despite sales decreasing to TRY 5,928 million from TRY 6,328 million year-over-year for Q3 2024, net income surged dramatically to TRY 1,163 million from TRY 0.46 million. The company's earnings have consistently grown at an impressive rate of 52.7% annually over the past five years. With a price-to-earnings ratio of 8.8x below the TR market average and strong EBIT coverage of interest payments at 33.7x, Çimsa presents as an intriguing investment opportunity with substantial growth potential forecasted at around 27% per year.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is engaged in the production, sale, and distribution of beer and malt both within Turkey and internationally, with a market capitalization of TRY41.28 billion.

Operations: Türk Tuborg generates revenue primarily from the sale of alcoholic beverages, amounting to TRY19.19 billion. The company's net profit margin is a critical metric to consider when evaluating its profitability and financial performance over time.

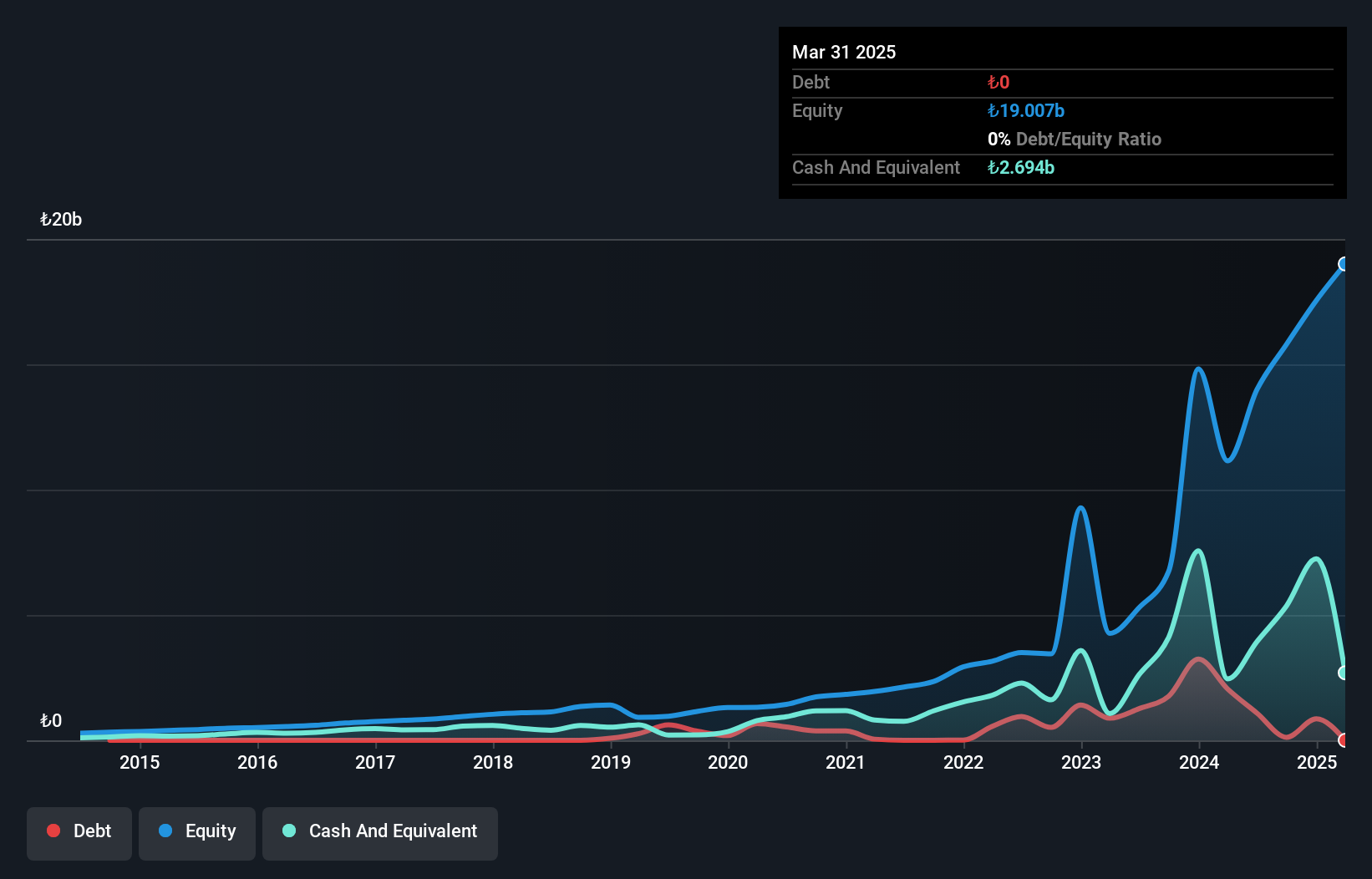

Türk Tuborg, a notable player in the beverage industry, has shown impressive earnings growth of 21.5% over the past year, outpacing the industry's 14.7%. The company's debt to equity ratio has significantly improved from 64% to just 7.8% over five years, indicating effective debt management. Despite its highly volatile share price recently, Türk Tuborg reported robust second-quarter sales of TRY 7.73 billion and net income of TRY 1.92 billion, up from TRY 6.24 billion and TRY 1.19 billion respectively in the previous year. With basic earnings per share rising to TRY 5.96 from TRY 3.68 last year, this company seems poised for continued financial strength amidst industry fluctuations.

Menora Mivtachim Holdings (TASE:MMHD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Menora Mivtachim Holdings Ltd is an Israeli company engaged in the insurance and finance sectors, with a market capitalization of approximately ₪7.05 billion.

Operations: Menora Mivtachim Holdings generates revenue primarily from its life insurance and long-term savings segment, which includes life insurance (₪5.32 billion) and pension products (₪738.01 million). The company also has significant income from general insurance, notably automobile property insurance (₪1.75 billion).

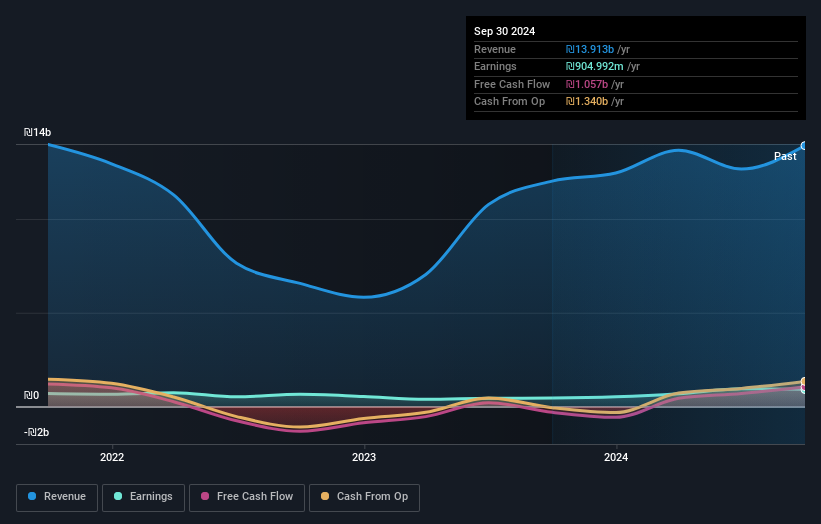

Menora Mivtachim Holdings, a notable player in the financial sector, has shown a robust financial performance despite recent challenges. The company reported net income of ILS 296.95 million for the second quarter of 2024, significantly up from ILS 21.16 million a year ago, reflecting its strong earnings growth trajectory over the past five years at an annual rate of 11%. Although revenue dipped from ILS 3.71 billion to ILS 2.71 billion compared to last year’s second quarter, Menora's basic earnings per share surged to ILS 4.79 from ILS 0.34, indicating improved profitability and operational efficiency amidst industry pressures.

- Click here to discover the nuances of Menora Mivtachim Holdings with our detailed analytical health report.

Learn about Menora Mivtachim Holdings' historical performance.

Summing It All Up

- Reveal the 4739 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MMHD

Menora Mivtachim Holdings

Operates in insurance and finance sectors in Israel.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives