- China

- /

- Communications

- /

- SHSE:600198

Undiscovered Gems To Watch This January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainties. Despite these challenges, resilient labor market data and mixed economic indicators suggest that opportunities may still exist for discerning investors who can identify promising companies poised for growth. In this environment, a good stock might be characterized by its ability to withstand market volatility and demonstrate potential for long-term value creation.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

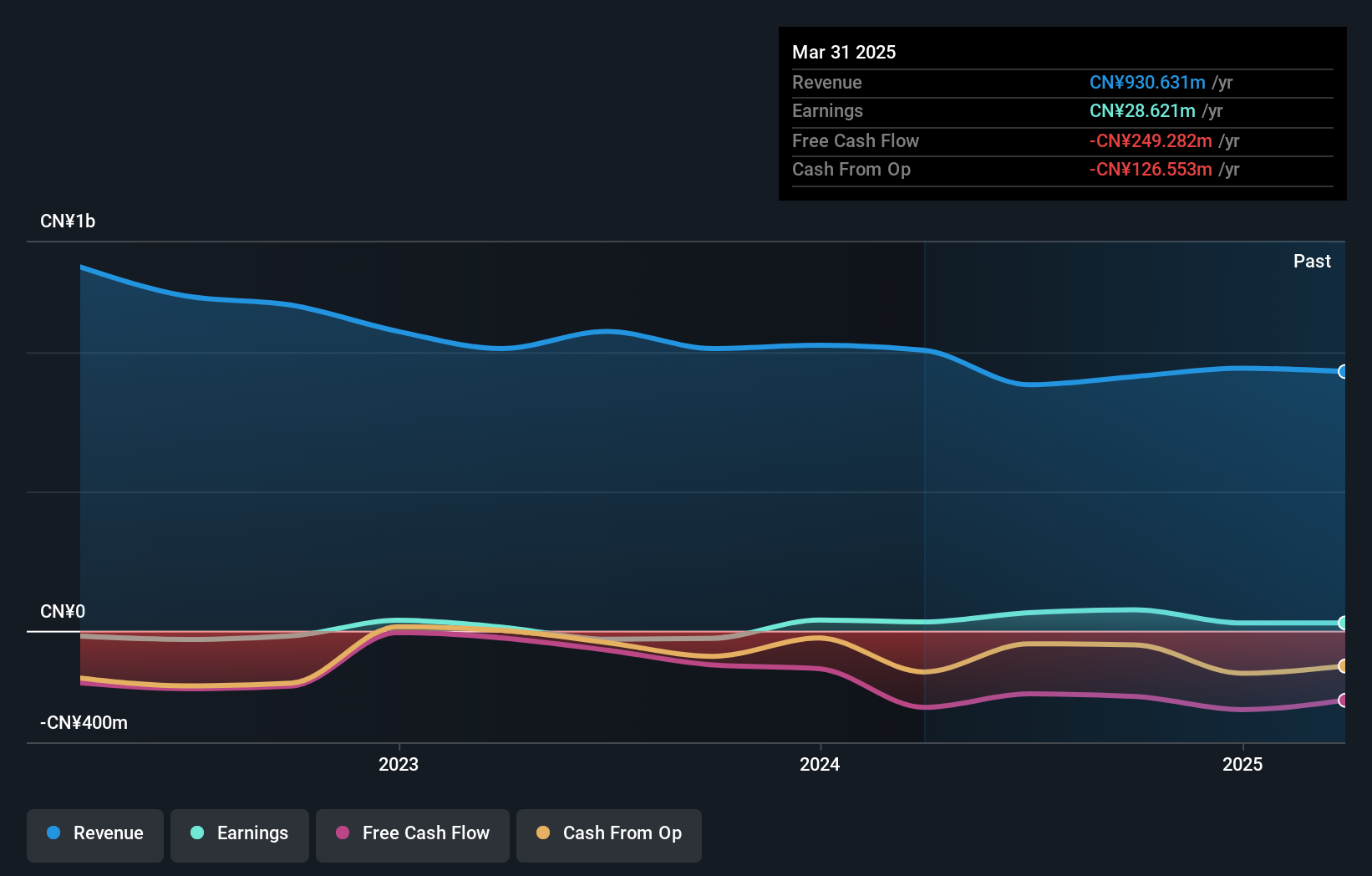

Datang Telecom Technology (SHSE:600198)

Simply Wall St Value Rating: ★★★★★☆

Overview: Datang Telecom Technology Co., Ltd. operates in the integrated circuit design and special communications business in China, with a market cap of CN¥10.94 billion.

Operations: Datang Telecom generates revenue primarily from its integrated circuit design and special communications segments. The company has a market capitalization of CN¥10.94 billion, reflecting its position in the industry.

Datang Telecom Technology, operating within the communications sector, showcases a notable turnaround with its debt to equity ratio plummeting from 4434.3% to 43.5% over five years, indicating a significant reduction in leverage. Despite reporting a net loss of CNY 90.55 million for the nine months ending September 2024, this figure reflects an improvement from the previous year's CNY 126.68 million loss. The company is now profitable and covers interest payments comfortably with earnings exceeding interest expenses, though it grapples with high non-cash earnings and volatile share prices recently observed over three months.

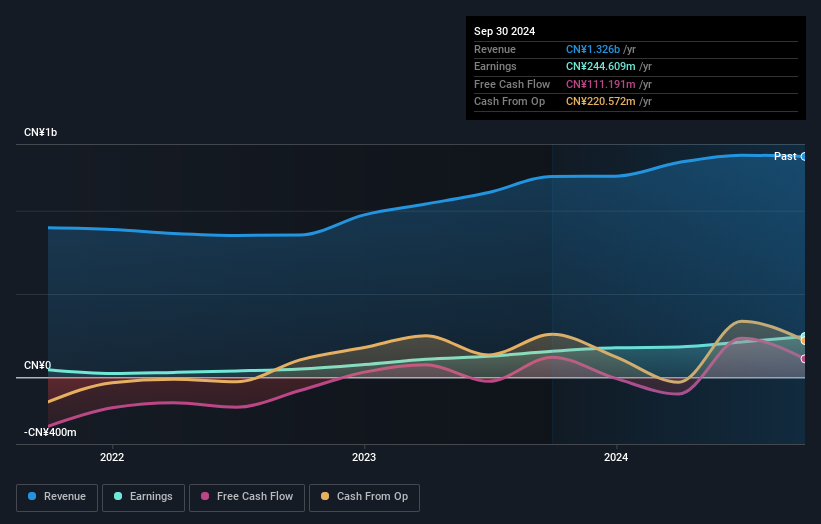

Shenzhen Liande Automation Equipmentltd (SZSE:300545)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Liande Automation Equipment Co., Ltd. operates in the automation equipment industry and has a market capitalization of CN¥5.63 billion.

Operations: Shenzhen Liande Automation Equipment Co., Ltd. generates revenue primarily from its automation equipment offerings. The company has a market capitalization of CN¥5.63 billion, indicating its significant presence in the industry.

Shenzhen Liande Automation Equipment, a small company in the machinery sector, has shown impressive earnings growth of 56.6% over the past year, outpacing its industry peers. The firm's debt management appears robust with a debt-to-equity ratio reduction from 52.5% to 25.6% over five years and interest payments well covered by EBIT at 37.5 times coverage. Recent earnings revealed sales of CNY 1 billion and net income of CNY 195 million for the first nine months of 2024, reflecting strong performance compared to last year's figures. Additionally, recent changes in company bylaws suggest strategic adjustments that could influence future operations positively.

- Dive into the specifics of Shenzhen Liande Automation Equipmentltd here with our thorough health report.

Learn about Shenzhen Liande Automation Equipmentltd's historical performance.

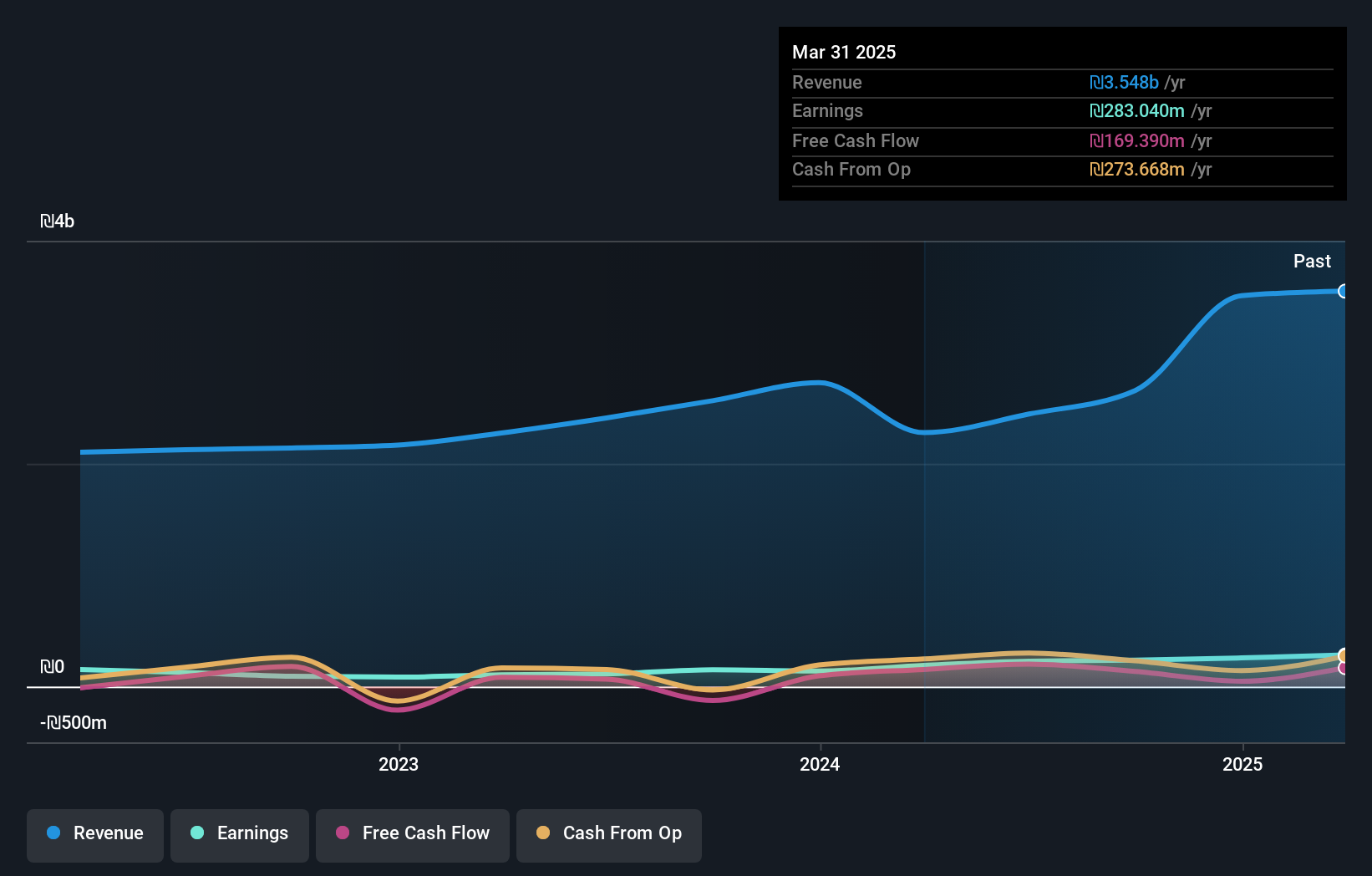

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to individuals and corporate clients in Israel, with a market capitalization of ₪2.15 billion.

Operations: The company's primary revenue stream comes from General Insurance, particularly Automobile Property Insurance, which generated ₪1.80 billion. Health and Life Insurance contribute significantly with revenues of ₪276.86 million and ₪363.24 million, respectively. The net profit margin shows a notable trend at 15%.

I.D.I. Insurance, a smaller player in the market, has shown some intriguing financial dynamics recently. Trading at 25% below its estimated fair value suggests potential undervaluation. Over the past five years, the company has successfully reduced its debt to equity ratio from 87.8% to 50.7%, indicating improved financial health and more cash than total debt further strengthens this position. Despite a challenging environment with earnings declining by 4.6% annually over five years, recent results show promise with third-quarter revenue rising to ILS 918 million from ILS 708 million last year and net income increasing to ILS 60 million from ILS 51 million previously.

- Click to explore a detailed breakdown of our findings in I.D.I. Insurance's health report.

Examine I.D.I. Insurance's past performance report to understand how it has performed in the past.

Where To Now?

- Navigate through the entire inventory of 4618 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600198

Datang Telecom Technology

Operates in the integrated circuit (IC) design and special communications business in China.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives