- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A083450

Discovering Hidden Opportunities With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape with U.S. stock indexes nearing record highs and small-cap stocks trailing behind, investors are keenly observing the potential impact of inflation data and interest rate expectations on market dynamics. In this environment, identifying promising opportunities among lesser-known stocks can be particularly rewarding; these undiscovered gems often possess strong fundamentals or unique growth prospects that may not yet be reflected in their valuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

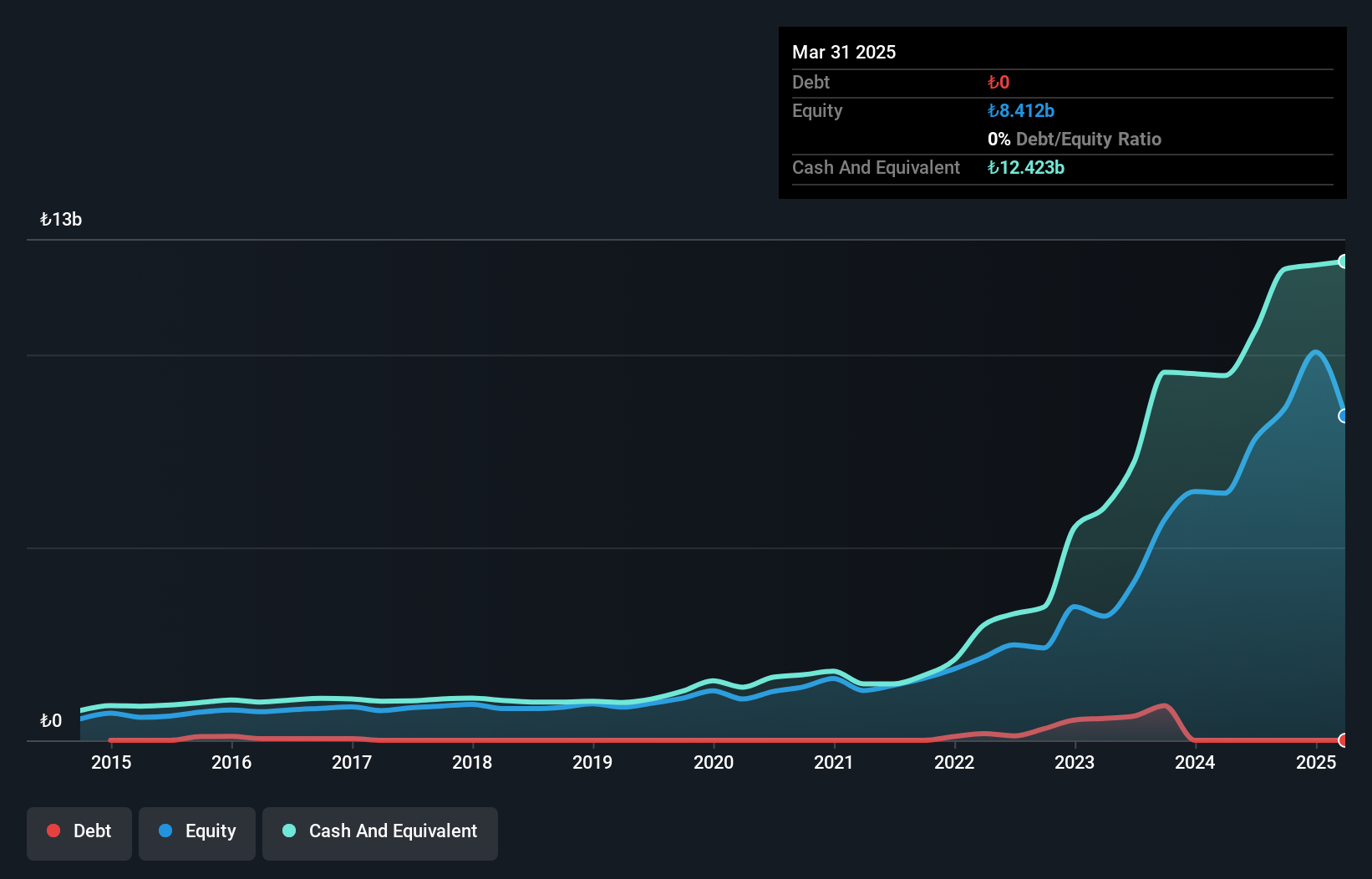

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey offering individual and group insurance, reinsurance services, and personal accident coverage with a market capitalization of TRY44.03 billion.

Operations: Anadolu Hayat generates revenue primarily through its individual and group insurance services, with a focus on life, retirement, and personal accident coverage. The company's financial performance is significantly influenced by its cost structure related to these services. Notably, the net profit margin has shown variability over recent periods.

Anadolu Hayat Emeklilik, a nimble player in the financial sector, showcases impressive earnings growth of 50.3% annually over the past five years. With net income jumping to TRY 4.31 billion from TRY 2.85 billion last year, it highlights robust performance despite not outpacing the broader insurance industry’s growth rate of 84%. The firm operates debt-free and maintains high-quality earnings, reflected in its attractive price-to-earnings ratio of 10.2x compared to the TR market average of 15.7x, suggesting potential value for investors seeking opportunities in this space.

Global Standard Technology (KOSDAQ:A083450)

Simply Wall St Value Rating: ★★★★★★

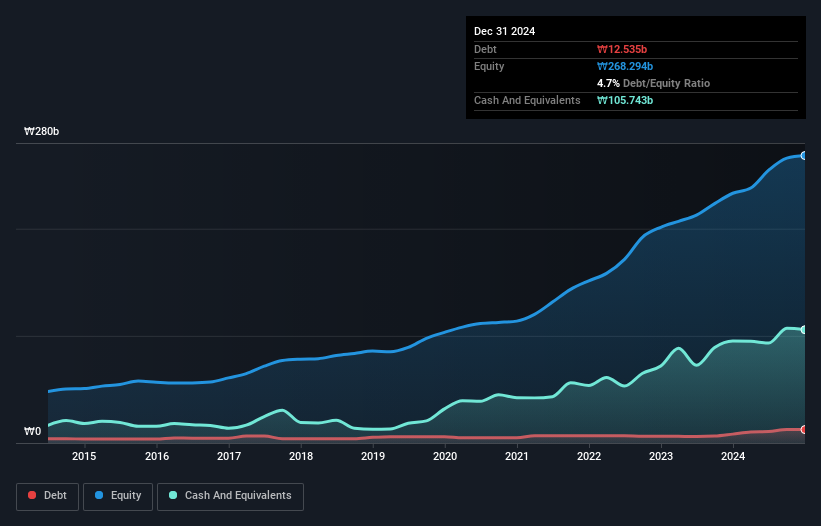

Overview: Global Standard Technology, Limited operates in the environmental and energy sectors both within South Korea and internationally, with a market capitalization of approximately ₩379.84 billion.

Operations: Global Standard Technology generates revenue primarily from its Semiconductor Manufacture Equipment segment, which amounts to ₩335.89 billion.

Global Standard Technology, a nimble player in the semiconductor space, has been making waves with its impressive earnings growth of 45.6% over the past year, outpacing the industry's 7.4%. The company seems to have a solid financial footing, with its debt-to-equity ratio improving from 6% to 4.7% over five years and holding more cash than total debt. Trading at approximately half of its estimated fair value suggests potential undervaluation. Recently, it completed a share buyback program repurchasing 300,000 shares for KRW 4,588 million aimed at boosting shareholder value and stabilizing stock prices.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

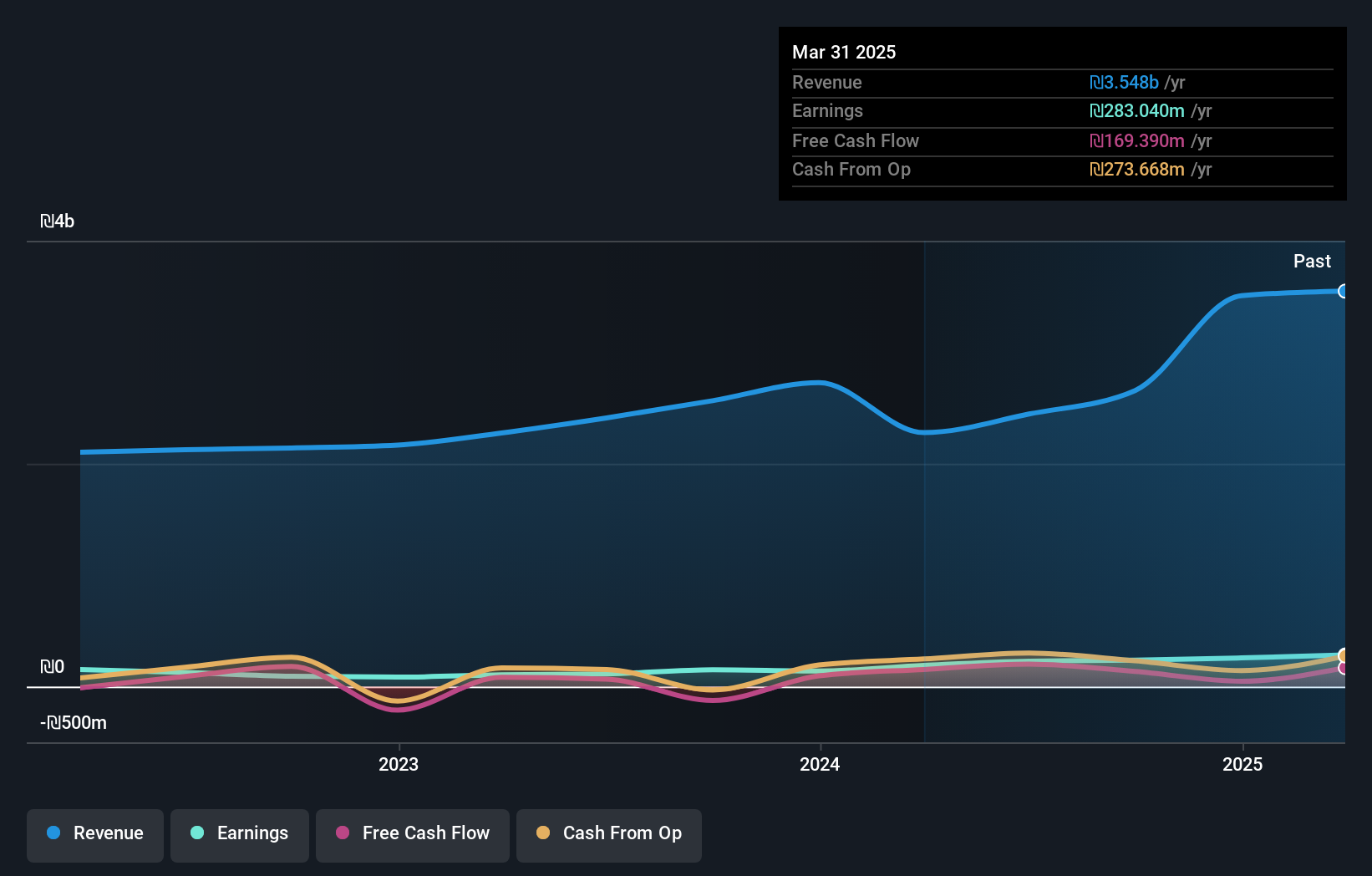

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market capitalization of approximately ₪2.40 billion.

Operations: I.D.I. Insurance generates revenue primarily from its General Insurance segment, with Automobile Property Insurance contributing ₪1.80 billion and Compulsory Vehicle Insurance adding ₪596 million. The Life Insurance and Long-Term Savings segment also plays a significant role, bringing in ₪363.24 million in revenue.

I.D.I. Insurance has shown a commendable reduction in its debt to equity ratio from 87.8% to 50.7% over five years, indicating improved financial leverage. Despite a 4.6% annual decline in earnings over the past five years, recent results reveal growth with third-quarter revenue at ILS 918 million and net income of ILS 59.6 million, up from ILS 51.33 million last year. The company's price-to-earnings ratio stands at an attractive 10.8x compared to the IL market's average of 14.9x, suggesting potential undervaluation for investors seeking value opportunities in the insurance sector.

- Take a closer look at I.D.I. Insurance's potential here in our health report.

Explore historical data to track I.D.I. Insurance's performance over time in our Past section.

Where To Now?

- Explore the 4720 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A083450

Global Standard Technology

Engages in the environmental and energy industry activities in South Korea and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives