Harel Insurance (TASE:HARL) Margins Hit 8.2%—Profit Growth Outpaces Cautious Market Narratives

Reviewed by Simply Wall St

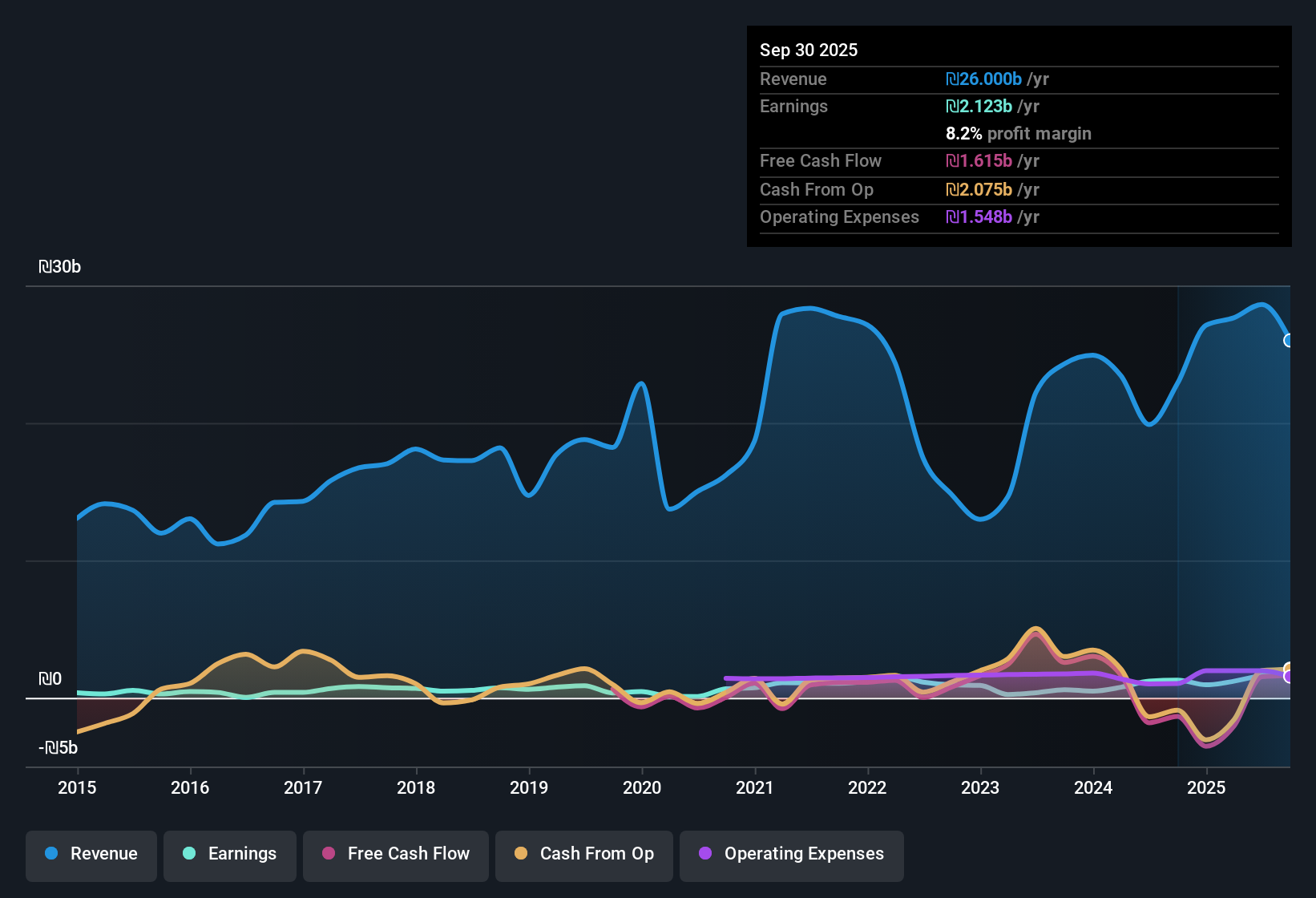

Harel Insurance Investments & Financial Services (TASE:HARL) just reported its Q3 2025 results, booking revenue of ₪5.3 billion and net income of ₪855 million, with basic EPS at ₪4.16. The company has seen revenue move from ₪4.3 billion to ₪7.9 billion across the past six quarters, while EPS ranged between ₪1.06 and ₪4.16 over the same period. Profit margins continue to draw attention as investors weigh the sustainability of recent EPS and revenue performance.

See our full analysis for Harel Insurance Investments & Financial Services.The next step is to see how these fresh headline numbers compare with the narratives commonly tracked by the market. Where do expectations meet reality and where does the story diverge?

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Reach 8.2% High Point

- Net profit margins for Harel Insurance Investments & Financial Services rose to 8.2% over the past year, up from 5.6% previously. This was supported by net income of ₪2.1 billion ($2.1 billion) on trailing twelve-month revenue of ₪26.0 billion ($26.0 billion).

- Harel’s strong margin improvement supports arguments that broad diversification across insurance and financial services can provide advantages in volatile markets.

- Compared to a five-year average growth rate of 9.1% per year, the latest 64.8% surge in annual earnings underscores how recent profit improvements align with claims of “high-quality execution” based on diversified business lines.

- What stands out is the speed at which margins rebounded versus both the sector and the company’s own history. This supports the narrative that resilient operations can withstand broader macro pressures.

Share Price Premium Over DCF Fair Value

- The current share price of ₪121.70 stands significantly above the estimated DCF fair value of ₪51.68, reflecting a 135% premium that surpasses recent profit gains.

- Bulls often point to strong underlying growth, but this premium indicates that investors are betting on either continued margin gains or future upside beyond what trailing results provide.

- The company’s price-to-earnings ratio of 11.8x is lower than the market average of 15.4x. However, the stock trades at more than double its DCF fair value, highlighting a disconnect between historical performance and what is already reflected in the price.

- The consensus narrative notes that, while returns are robust and margins high, the current valuation now requires those strengths to continue. Otherwise, the market could reassess quickly if expectations change.

Debt Coverage and Dividend Instability Persist

- Despite record annual profits, the company’s debt is not well covered by operating cash flow, and its dividend track record remains unstable according to the latest risk assessment.

- Critics highlight that, even with a banner year, fundamental risks identified in the data remain significant for cautious investors.

- Detailed analysis shows that high earnings alone do not fully address debt coverage concerns. This increases pressure on management to sustain strong margins in less favorable conditions.

- Dividend consistency has yet to improve, reflecting ongoing uncertainty about long-term income reliability for shareholders despite headline profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Harel Insurance Investments & Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust earnings, Harel’s ongoing issues with debt coverage and dividend reliability highlight vulnerabilities that could impact stability for cautious investors.

If you want companies with stronger finances and lower risk of payout instability, check out solid balance sheet and fundamentals stocks screener (1924 results) to find businesses built for resilience and consistent performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harel Insurance Investments & Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:HARL

Harel Insurance Investments & Financial Services

Offers insurance and financial services in Israel, Europe, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success