Should You Be Adding N.R. Spuntech Industries (TLV:SPNTC) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like N.R. Spuntech Industries (TLV:SPNTC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for N.R. Spuntech Industries

N.R. Spuntech Industries's Improving Profits

In the last three years N.R. Spuntech Industries's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, N.R. Spuntech Industries's EPS shot from ₪0.50 to ₪0.93, over the last year. Year on year growth of 87% is certainly a sight to behold.

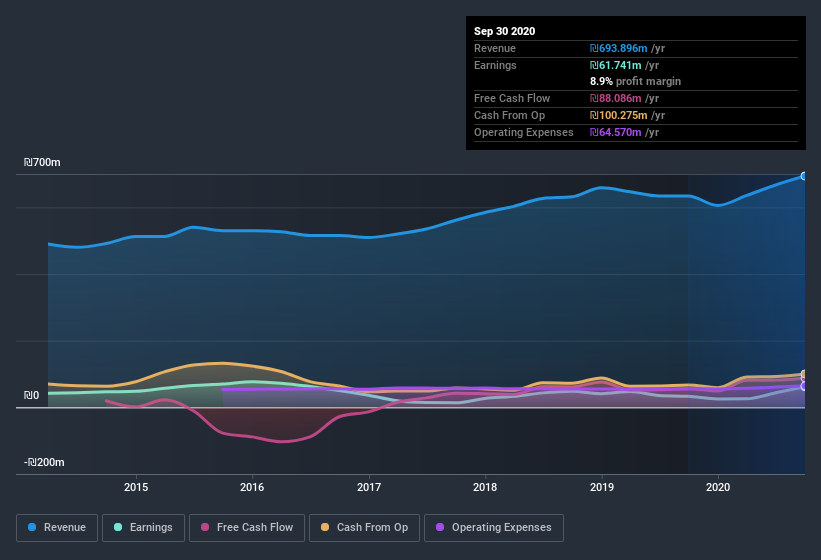

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. N.R. Spuntech Industries shareholders can take confidence from the fact that EBIT margins are up from 7.2% to 13%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

N.R. Spuntech Industries isn't a huge company, given its market capitalization of ₪621m. That makes it extra important to check on its balance sheet strength.

Are N.R. Spuntech Industries Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between ₪324m and ₪1.3b, like N.R. Spuntech Industries, the median CEO pay is around ₪2.0m.

The N.R. Spuntech Industries CEO received ₪1.5m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is N.R. Spuntech Industries Worth Keeping An Eye On?

N.R. Spuntech Industries's earnings per share have taken off like a rocket aimed right at the moon. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. So N.R. Spuntech Industries looks like it could be a good quality growth stock, at first glance. That's worth watching. It is worth noting though that we have found 3 warning signs for N.R. Spuntech Industries (1 is a bit unpleasant!) that you need to take into consideration.

Although N.R. Spuntech Industries certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade N.R. Spuntech Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if N.R. Spuntech Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:SPNTC

N.R. Spuntech Industries

Produces, markets, and sells non-woven fabrics in Israel, the United States, Canada, Europe, Central and Southern America, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives