- Israel

- /

- Medical Equipment

- /

- TASE:NISA

Introducing Nissan Medical Industries (TLV:NISA), A Stock That Climbed 89% In The Last Year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the Nissan Medical Industries Ltd. (TLV:NISA) share price is 89% higher than it was a year ago, much better than the market decline of around 7.8% (not including dividends) in the same period. So that should have shareholders smiling. The longer term returns have not been as good, with the stock price only 12% higher than it was three years ago.

See our latest analysis for Nissan Medical Industries

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

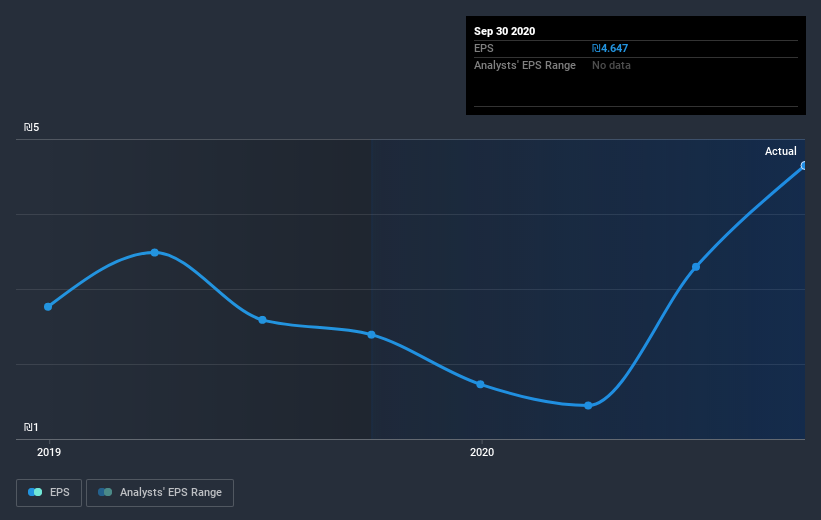

During the last year Nissan Medical Industries grew its earnings per share (EPS) by 95%. This EPS growth is reasonably close to the 89% increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. It makes intuitive sense that the share price and EPS would grow at similar rates.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Nissan Medical Industries' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Nissan Medical Industries shareholders have received a total shareholder return of 89% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Nissan Medical Industries , and understanding them should be part of your investment process.

We will like Nissan Medical Industries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you’re looking to trade Nissan Medical Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nissan Medical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:NISA

Nissan Medical Industries

Through its subsidiary, engages in the manufacturing and marketing of spunlace non-woven fabrics in the United States, Canada, Europe, and Israel.

Established dividend payer with proven track record.

Market Insights

Community Narratives