- Israel

- /

- Medical Equipment

- /

- TASE:BWAY

BrainsWay Ltd.'s (TLV:BWAY) P/S Is Still On The Mark Following 26% Share Price Bounce

BrainsWay Ltd. (TLV:BWAY) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 223% in the last year.

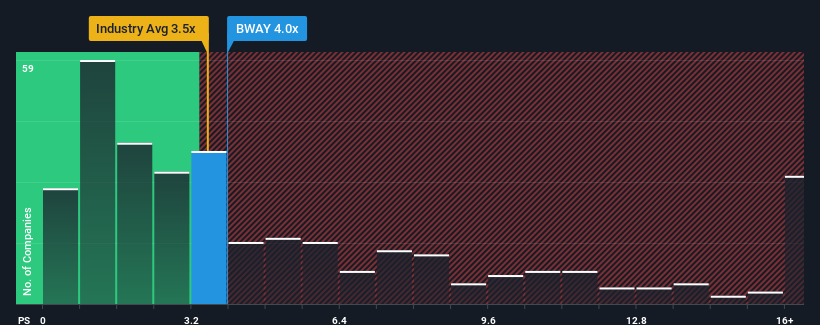

In spite of the firm bounce in price, it's still not a stretch to say that BrainsWay's price-to-sales (or "P/S") ratio of 4x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in Israel, where the median P/S ratio is around 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for BrainsWay

How Has BrainsWay Performed Recently?

While the industry has experienced revenue growth lately, BrainsWay's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think BrainsWay's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For BrainsWay?

There's an inherent assumption that a company should be matching the industry for P/S ratios like BrainsWay's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.8%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 35% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 21% over the next year. That's shaping up to be similar to the 23% growth forecast for the broader industry.

With this in mind, it makes sense that BrainsWay's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

BrainsWay's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A BrainsWay's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Medical Equipment industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 1 warning sign for BrainsWay you should know about.

If these risks are making you reconsider your opinion on BrainsWay, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BrainsWay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BWAY

BrainsWay

Develops and sells noninvasive neurostimulation treatments for mental health disorders in the United States, East Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion