- Israel

- /

- Medical Equipment

- /

- TASE:BIOV

Shareholders Will Probably Not Have Any Issues With Bio-View Ltd's (TLV:BIOV) CEO Compensation

Key Insights

- Bio-View's Annual General Meeting to take place on 10th of December

- Salary of ₪1.03m is part of CEO Alan Schwebel's total remuneration

- The overall pay is 40% below the industry average

- Bio-View's three-year loss to shareholders was 22% while its EPS grew by 0.5% over the past three years

The performance at Bio-View Ltd (TLV:BIOV) has been rather lacklustre of late and shareholders may be wondering what CEO Alan Schwebel is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 10th of December. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Bio-View

How Does Total Compensation For Alan Schwebel Compare With Other Companies In The Industry?

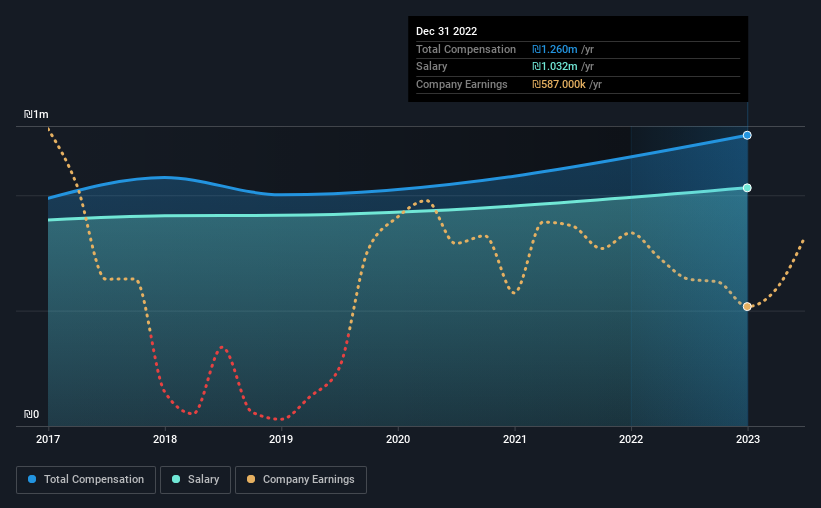

At the time of writing, our data shows that Bio-View Ltd has a market capitalization of ₪46m, and reported total annual CEO compensation of ₪1.3m for the year to December 2022. This was the same amount the CEO received in the prior year. In particular, the salary of ₪1.03m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Israel Medical Equipment industry with market capitalizations below ₪742m, we found that the median total CEO compensation was ₪2.1m. This suggests that Alan Schwebel is paid below the industry median. What's more, Alan Schwebel holds ₪229k worth of shares in the company in their own name.

| Component | 2022 | 2022 | Proportion (2022) |

| Salary | ₪1.0m | ₪1.0m | 82% |

| Other | ₪228k | ₪228k | 18% |

| Total Compensation | ₪1.3m | ₪1.3m | 100% |

Talking in terms of the industry, salary represented approximately 63% of total compensation out of all the companies we analyzed, while other remuneration made up 37% of the pie. It's interesting to note that Bio-View pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Bio-View Ltd's Growth

Earnings per share at Bio-View Ltd are much the same as they were three years ago, albeit with slightly higher. In the last year, its revenue is up 15%.

We would argue that the modest growth in revenue is a notable positive. And, while modest, the EPS growth is noticeable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Bio-View Ltd Been A Good Investment?

Given the total shareholder loss of 22% over three years, many shareholders in Bio-View Ltd are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. The disappointing performance may have something to do with the flat earnings growth. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Bio-View that investors should look into moving forward.

Switching gears from Bio-View, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bio-View might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BIOV

Bio-View

Develops, manufactures, and markets automated cell imaging and analysis solutions for use in cytology, cytogenetic, and pathology clinical and research laboratories in Israel and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion