- Saudi Arabia

- /

- Food

- /

- SASE:9556

Discovering 3 Undiscovered Gems in Middle East Stocks with Strong Potential

Reviewed by Simply Wall St

The Middle East stock markets have shown mixed performance recently, influenced by fluctuating oil prices and potential U.S. interest rate cuts, with Gulf markets particularly sensitive due to currency pegs to the dollar. Despite these challenges, the region's solid economic fundamentals present opportunities for investors seeking stocks with strong growth potential. Identifying a good stock in this environment involves looking for companies that can leverage these fundamentals while navigating market volatility effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Emirates Reem Investments Company P.J.S.C (DFM:ERC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emirates Reem Investments Company P.J.S.C operates in the bottling, distribution, and trading of mineral water, carbonated drinks, soft drinks, juices, and evaporated milk across the United Arab Emirates and broader Middle East and Africa regions with a market cap of AED927.63 million.

Operations: Emirates Reem Investments Company P.J.S.C generates revenue primarily from its operations segment, amounting to AED208.64 million.

Emirates Reem Investments Company P.J.S.C has shown impressive growth, with earnings increasing by 481% over the past year, outpacing the Beverage industry. The company's debt-to-equity ratio improved significantly from 40.1% to 0.5% in five years, indicating effective debt management. Recent financials reveal a strong performance for Q2 2025, with net income rising to AED 8.07 million from AED 1.71 million the previous year and revenue climbing to AED 57.79 million from AED 22.68 million a year ago. Despite these gains, free cash flow remains negative, suggesting challenges in liquidity management persist amidst expansion efforts.

- Delve into the full analysis health report here for a deeper understanding of Emirates Reem Investments Company P.J.S.C.

Understand Emirates Reem Investments Company P.J.S.C's track record by examining our Past report.

Nofoth Food Products (SASE:9556)

Simply Wall St Value Rating: ★★★★★★

Overview: Nofoth Food Products Company is engaged in the production and sale of bakery products within Saudi Arabia, with a market capitalization of SAR1.12 billion.

Operations: Nofoth generates revenue primarily from the sale of bakery products in Saudi Arabia. The company's market capitalization stands at SAR1.12 billion.

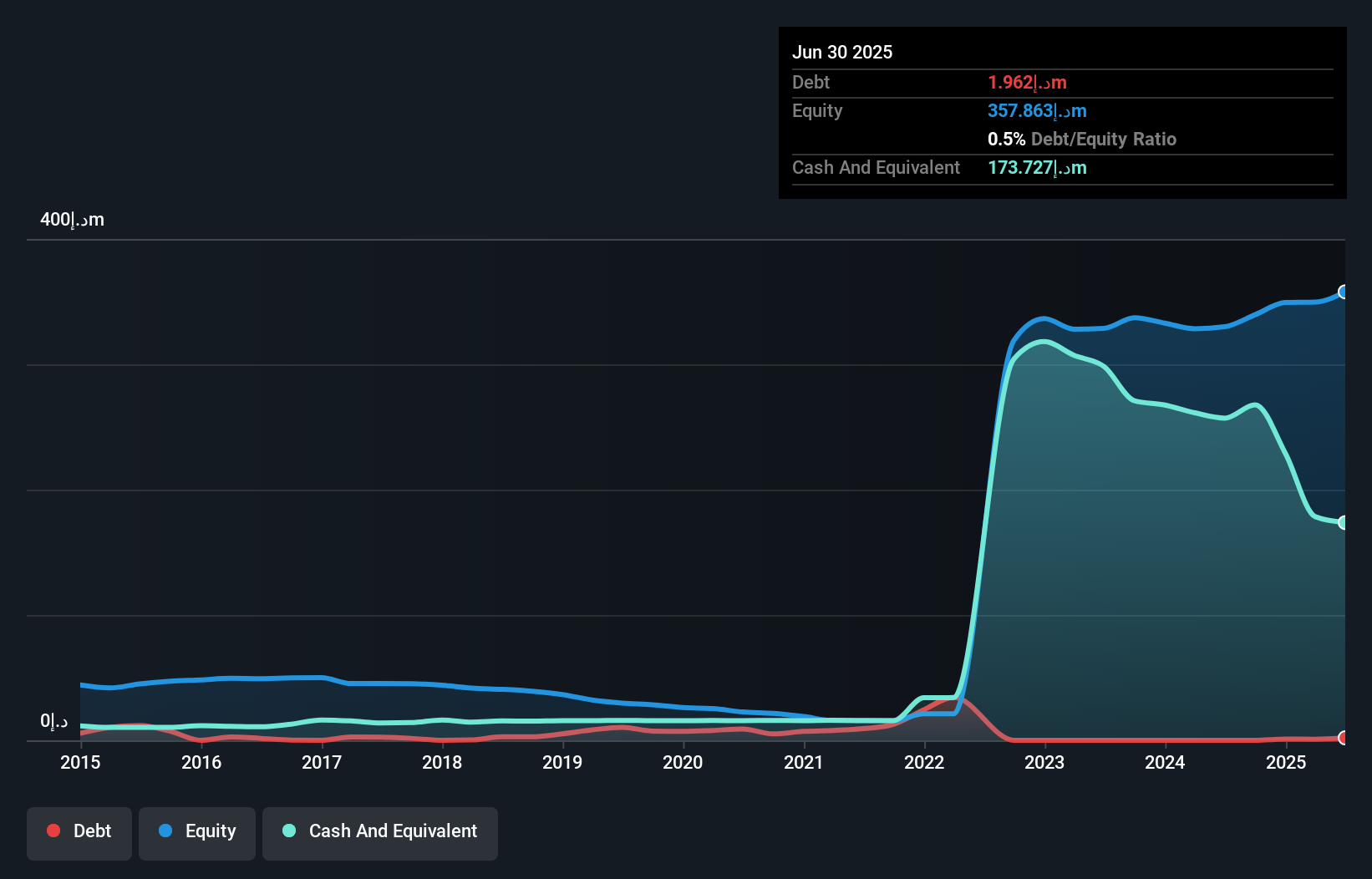

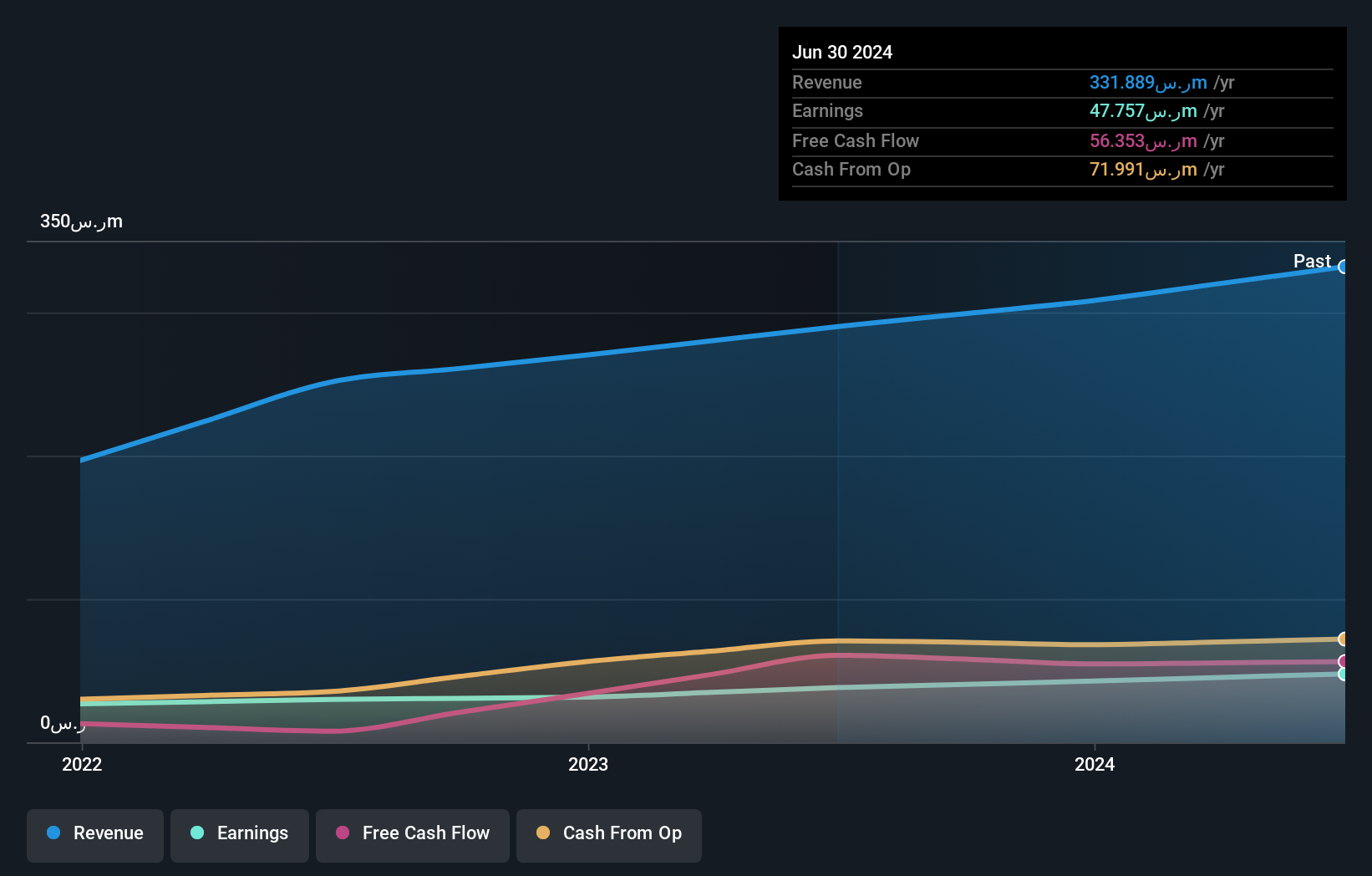

Nofoth Food Products showcases promising growth, with earnings rising 19.8% in the past year, outpacing the food industry's 4.1%. The company reported a net income of SAR 12.47 million for Q2 2025, up from SAR 10.25 million the previous year, reflecting its robust performance in a competitive market. Trading at approximately 31% below estimated fair value suggests potential for appreciation. Nofoth remains debt-free and has demonstrated strong free cash flow generation with SAR 66.84 million as of June 2024, indicating effective capital management despite increased capital expenditures over recent years reaching -SAR 44.62 million by mid-2025.

- Take a closer look at Nofoth Food Products' potential here in our health report.

Gain insights into Nofoth Food Products' past trends and performance with our Past report.

Gad-Dairies (Marketing 1992) (TASE:GAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gad-Dairies (Marketing 1992) Ltd. is involved in producing packaged food with a focus on dairy products, and it has a market capitalization of ₪1.02 billion.

Operations: Gad-Dairies generates revenue primarily from the Retail Sector and The Professional Field, with revenues of ₪403.73 million and ₪285.74 million, respectively.

Gad-Dairies, a small player in the dairy industry, recently completed an IPO raising ILS 280.43 million with shares priced at ILS 9.67 each. The company showcases high-quality earnings and reported a robust earnings growth of 53% over the past year, outpacing the food industry's average growth of 42%. Despite having a high net debt to equity ratio of 84.8%, its interest payments are well covered by EBIT at 27 times coverage, indicating strong operational efficiency. However, with highly illiquid shares and significant capital expenditures last year (ILS -16.75 million), investors should weigh these factors carefully.

Where To Now?

- Click here to access our complete index of 205 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nofoth Food Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9556

Flawless balance sheet and good value.

Market Insights

Community Narratives