- Saudi Arabia

- /

- Food

- /

- SASE:9556

Exploring 3 Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

As Gulf markets experience a retreat amid cautious investor sentiment and global economic uncertainties, the Middle East continues to present intriguing opportunities for those looking beyond the headlines. In this dynamic environment, identifying stocks with strong fundamentals and potential for growth can be key to uncovering hidden gems in the region's market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Nofoth Food Products (SASE:9556)

Simply Wall St Value Rating: ★★★★★★

Overview: Nofoth Food Products Company specializes in the production and sale of bakery products within Saudi Arabia, with a market capitalization of SAR1.30 billion.

Operations: Nofoth Food Products generates revenue primarily from the sale of bakery products in Saudi Arabia. The company has a market capitalization of SAR1.30 billion, reflecting its position within the local market.

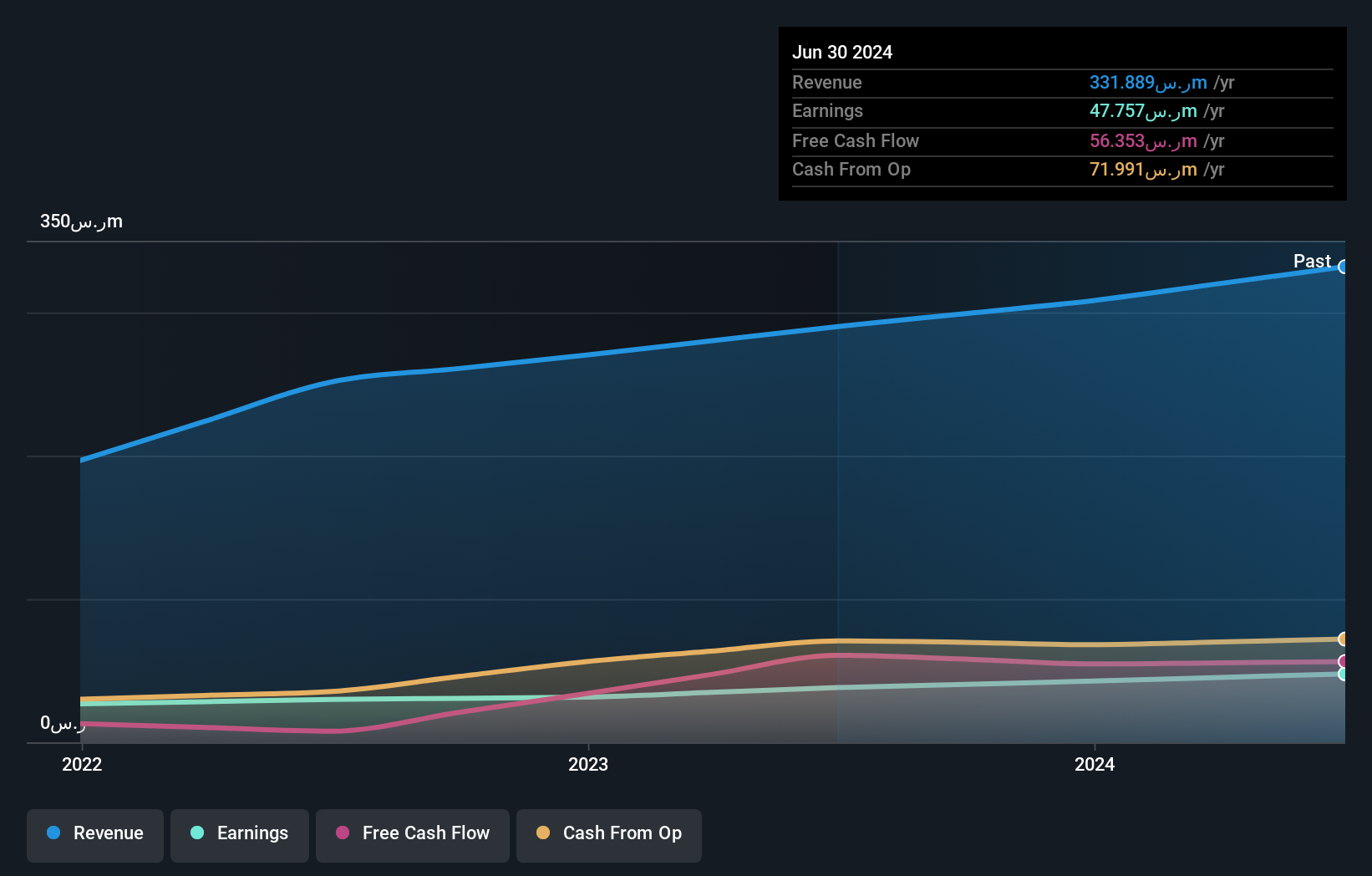

Nofoth Food Products, a relatively small player in the Middle East food industry, has shown impressive growth with earnings rising 13.3% over the past year, outpacing the industry's 8.8%. With no debt on its books for five years and high-quality non-cash earnings, it appears financially robust. The company reported Q1 2025 sales of SAR 114.3 million and net income of SAR 20.23 million, reflecting solid performance compared to last year’s figures. Recent updates include changes in company bylaws and a new external auditor appointment with fees totaling SAR 390,000, indicating strategic shifts to strengthen governance structures.

- Click here to discover the nuances of Nofoth Food Products with our detailed analytical health report.

Explore historical data to track Nofoth Food Products' performance over time in our Past section.

Ratio Energies - Limited Partnership (TASE:RATI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ratio Energies - Limited Partnership, along with its subsidiaries, is engaged in the exploration, development, and production of oil and natural gas both in Israel and internationally, with a market cap of ₪5.37 billion.

Operations: Ratio Energies generates revenue primarily from its oil and gas exploration and production segment, amounting to $316.77 million. The company's financial performance is highlighted by a focus on this core revenue stream.

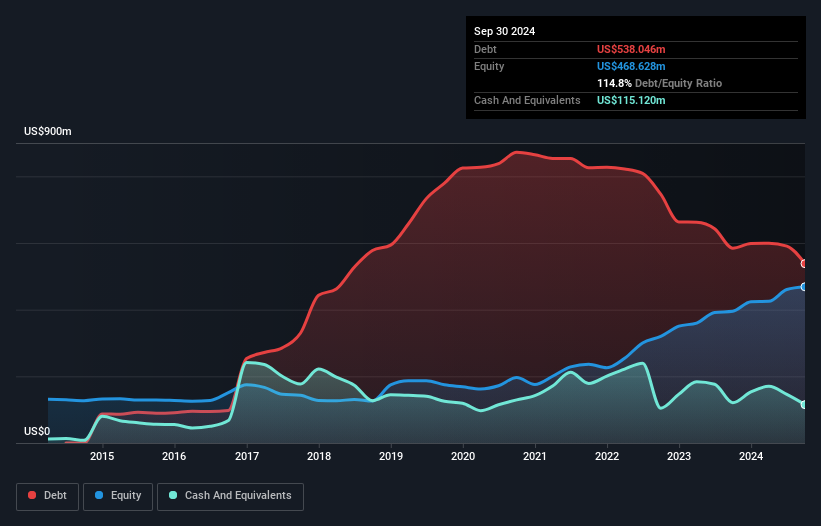

Ratio Energies, a player in the energy sector, has shown promising financial performance with earnings growing 14.9% over the past year, outpacing the Oil and Gas industry average of 1.6%. Despite a high net debt to equity ratio of 69.6%, their interest payments are well covered by EBIT at 4.9 times coverage, indicating manageable debt levels. Trading at 41.5% below its estimated fair value suggests potential undervaluation in the market. Recent results for Q1 2025 reveal revenue of US$78 million and net income of US$35 million, reflecting solid growth from last year's figures and highlighting its high-quality earnings profile.

- Take a closer look at Ratio Energies - Limited Partnership's potential here in our health report.

Learn about Ratio Energies - Limited Partnership's historical performance.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★★

Overview: Telsys Ltd. is engaged in the marketing and distribution of electronic components within Israel, with a market capitalization of ₪2.09 billion.

Operations: Telsys generates revenue primarily through its SOM Sector and Distribution segments, with revenues of ₪276.83 million and ₪128.70 million, respectively. The company's market capitalization stands at approximately ₪2.09 billion.

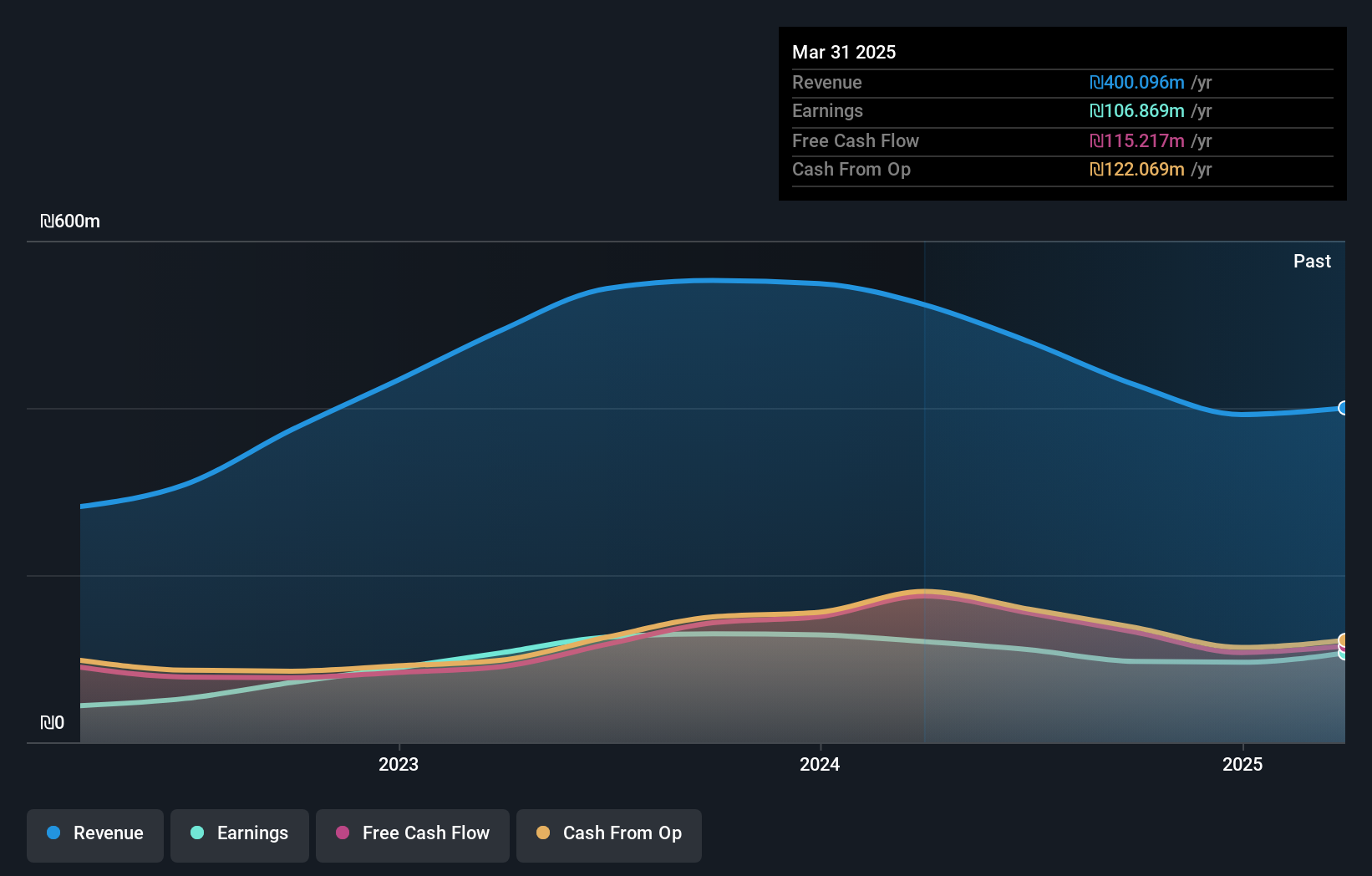

Telsys, a nimble player in the electronics sector, showcases a robust financial footing with more cash than its total debt. The firm's net income surged to ILS 32.23 million in Q1 2025 from ILS 21.04 million the previous year, and earnings per share rose to ILS 3.56 from ILS 2.33, reflecting solid profitability despite an industry lag with negative earnings growth of -11.3%. With high-quality past earnings and a reduced debt-to-equity ratio now at 8%, Telsys seems well-positioned for stability while maintaining positive free cash flow and strong interest coverage capabilities.

- Dive into the specifics of Telsys here with our thorough health report.

Review our historical performance report to gain insights into Telsys''s past performance.

Taking Advantage

- Dive into all 218 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nofoth Food Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9556

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives