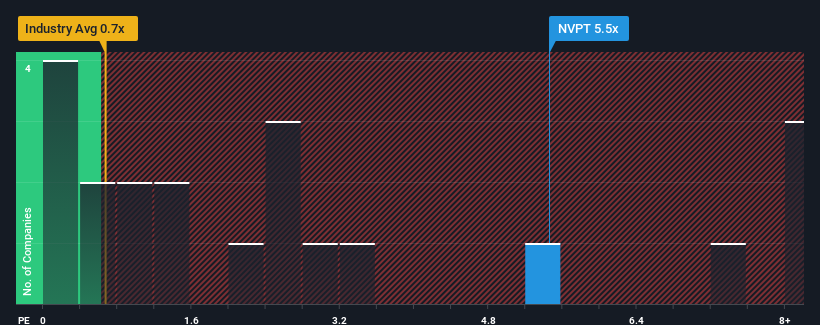

When close to half the companies in the Oil and Gas industry in Israel have price-to-sales ratios (or "P/S") below 1.5x, you may consider Navitas Petroleum, Limited Partnership (TLV:NVPT) as a stock to avoid entirely with its 5.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Navitas Petroleum Limited Partnership

What Does Navitas Petroleum Limited Partnership's Recent Performance Look Like?

Navitas Petroleum Limited Partnership has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Navitas Petroleum Limited Partnership, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Navitas Petroleum Limited Partnership's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Navitas Petroleum Limited Partnership's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 6.3% gain to the company's revenues. Pleasingly, revenue has also lifted 234% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to shrink 14% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's understandable that Navitas Petroleum Limited Partnership's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Bottom Line On Navitas Petroleum Limited Partnership's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Navitas Petroleum Limited Partnership revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

You always need to take note of risks, for example - Navitas Petroleum Limited Partnership has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Navitas Petroleum Limited Partnership, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Navitas Petroleum Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NVPT

Navitas Petroleum Limited Partnership

Explores for, develops, and produces oil and natural gas in North and South America.

Slight with mediocre balance sheet.

Market Insights

Community Narratives