- Israel

- /

- Energy Services

- /

- TASE:LAPD

Shareholders Should Be Pleased With Lapidoth Capital Ltd's (TLV:LAPD) Price

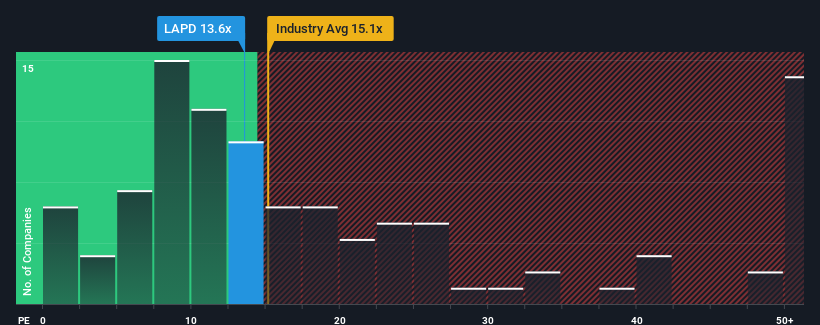

With a median price-to-earnings (or "P/E") ratio of close to 12x in Israel, you could be forgiven for feeling indifferent about Lapidoth Capital Ltd's (TLV:LAPD) P/E ratio of 13.6x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For example, consider that Lapidoth Capital's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Lapidoth Capital

Is There Some Growth For Lapidoth Capital?

In order to justify its P/E ratio, Lapidoth Capital would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 125% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 29% shows it's about the same on an annualised basis.

In light of this, it's understandable that Lapidoth Capital's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Lapidoth Capital maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Lapidoth Capital with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:LAPD

Lapidoth Capital

Provides drilling and related services in Israel, Romania, the United States, Poland, rest of Europe, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives