Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at Lapidoth Capital (TLV:LAPD) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Lapidoth Capital, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = ₪435m ÷ (₪7.9b - ₪3.8b) (Based on the trailing twelve months to June 2023).

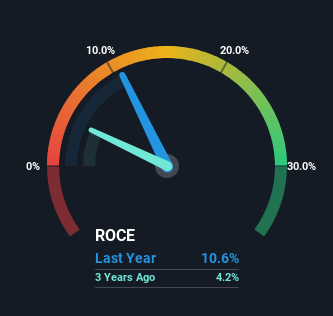

So, Lapidoth Capital has an ROCE of 11%. In absolute terms, that's a satisfactory return, but compared to the Energy Services industry average of 7.0% it's much better.

See our latest analysis for Lapidoth Capital

Historical performance is a great place to start when researching a stock so above you can see the gauge for Lapidoth Capital's ROCE against it's prior returns. If you're interested in investigating Lapidoth Capital's past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

The trend of ROCE doesn't look fantastic because it's fallen from 13% five years ago, while the business's capital employed increased by 472%. Usually this isn't ideal, but given Lapidoth Capital conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. It's unlikely that all of the funds raised have been put to work yet, so as a consequence Lapidoth Capital might not have received a full period of earnings contribution from it. It's also worth noting the company's latest EBIT figure is within 10% of the previous year, so it's fair to assign the ROCE drop largely to the capital raise.

On a side note, Lapidoth Capital's current liabilities have increased over the last five years to 49% of total assets, effectively distorting the ROCE to some degree. Without this increase, it's likely that ROCE would be even lower than 11%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

In Conclusion...

Bringing it all together, while we're somewhat encouraged by Lapidoth Capital's reinvestment in its own business, we're aware that returns are shrinking. Yet to long term shareholders the stock has gifted them an incredible 303% return in the last five years, so the market appears to be rosy about its future. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

Like most companies, Lapidoth Capital does come with some risks, and we've found 1 warning sign that you should be aware of.

While Lapidoth Capital may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:LAPD

Lapidoth Capital

Provides drilling and related services in Israel, Romania, the United States, Poland, rest of Europe, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives