- Israel

- /

- Oil and Gas

- /

- TASE:ISRA

Isramco Negev 2 Limited Partnership (TLV:ISRA) Has Some Difficulty Using Its Capital Effectively

What financial metrics can indicate to us that a company is maturing or even in decline? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. So after we looked into Isramco Negev 2 Limited Partnership (TLV:ISRA), the trends above didn't look too great.

We've discovered 3 warning signs about Isramco Negev 2 Limited Partnership. View them for free.Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Isramco Negev 2 Limited Partnership is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = US$195m ÷ (US$1.3b - US$200m) (Based on the trailing twelve months to December 2024).

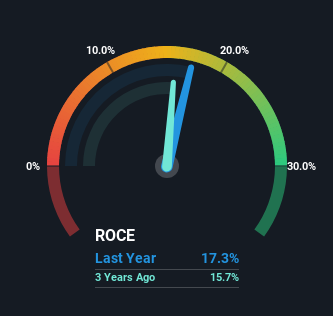

So, Isramco Negev 2 Limited Partnership has an ROCE of 17%. In absolute terms, that's a satisfactory return, but compared to the Oil and Gas industry average of 9.2% it's much better.

Check out our latest analysis for Isramco Negev 2 Limited Partnership

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Isramco Negev 2 Limited Partnership's past further, check out this free graph covering Isramco Negev 2 Limited Partnership's past earnings, revenue and cash flow.

The Trend Of ROCE

We are a bit worried about the trend of returns on capital at Isramco Negev 2 Limited Partnership. Unfortunately the returns on capital have diminished from the 35% that they were earning five years ago. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Isramco Negev 2 Limited Partnership to turn into a multi-bagger.

In Conclusion...

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Since the stock has skyrocketed 420% over the last five years, it looks like investors have high expectations of the stock. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

If you'd like to know more about Isramco Negev 2 Limited Partnership, we've spotted 3 warning signs, and 1 of them shouldn't be ignored.

While Isramco Negev 2 Limited Partnership isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ISRA

Isramco Negev 2 Limited Partnership

Engages in the exploration, development, and production of oil, natural gas, and condensate in Israel, Jordan, and Egypt.

Proven track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026