As the Middle East grapples with the economic challenges posed by a global trade war and fluctuating oil prices, regional markets have experienced significant volatility, with most Gulf indices reflecting a downward trend. Amidst this backdrop of uncertainty, identifying promising stocks requires a keen eye for companies that demonstrate resilience through strong fundamentals and adaptability to shifting market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★★

Overview: Lydia Yesil Enerji Kaynaklari A.S. is involved in the production and sale of electricity and heat energy in Turkey, with a market capitalization of TRY23.79 billion.

Operations: Lydia Yesil Enerji Kaynaklari generates revenue primarily from the production and sale of electricity and heat energy. The company reported revenue from food processing amounting to TRY54.65 million.

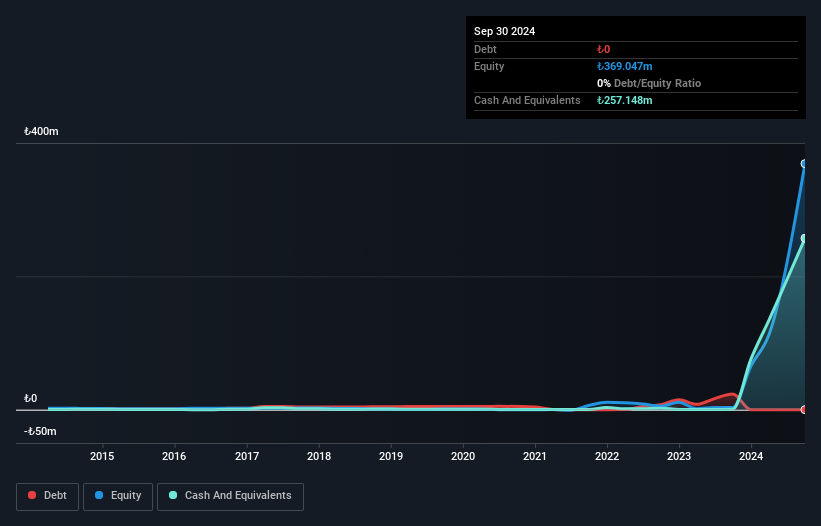

Lydia Yesil Enerji Kaynaklari, a small energy player in the Middle East, has demonstrated remarkable financial performance with earnings growth of 1333.4% over the past year, outpacing the broader food industry. This impressive surge is accompanied by high-quality earnings and a debt-free status, contrasting its previous debt-to-equity ratio of 423.8% five years ago. Despite this growth, revenue remains modest at TRY55 million. Recently added to the FTSE All-World Index, Lydia's net income skyrocketed to TRY960 million from TRY67 million last year, reflecting robust profitability even as sales dipped slightly to TRY54.65 million from TRY71.41 million previously.

Africa Israel Residences (TASE:AFRE)

Simply Wall St Value Rating: ★★★★☆☆

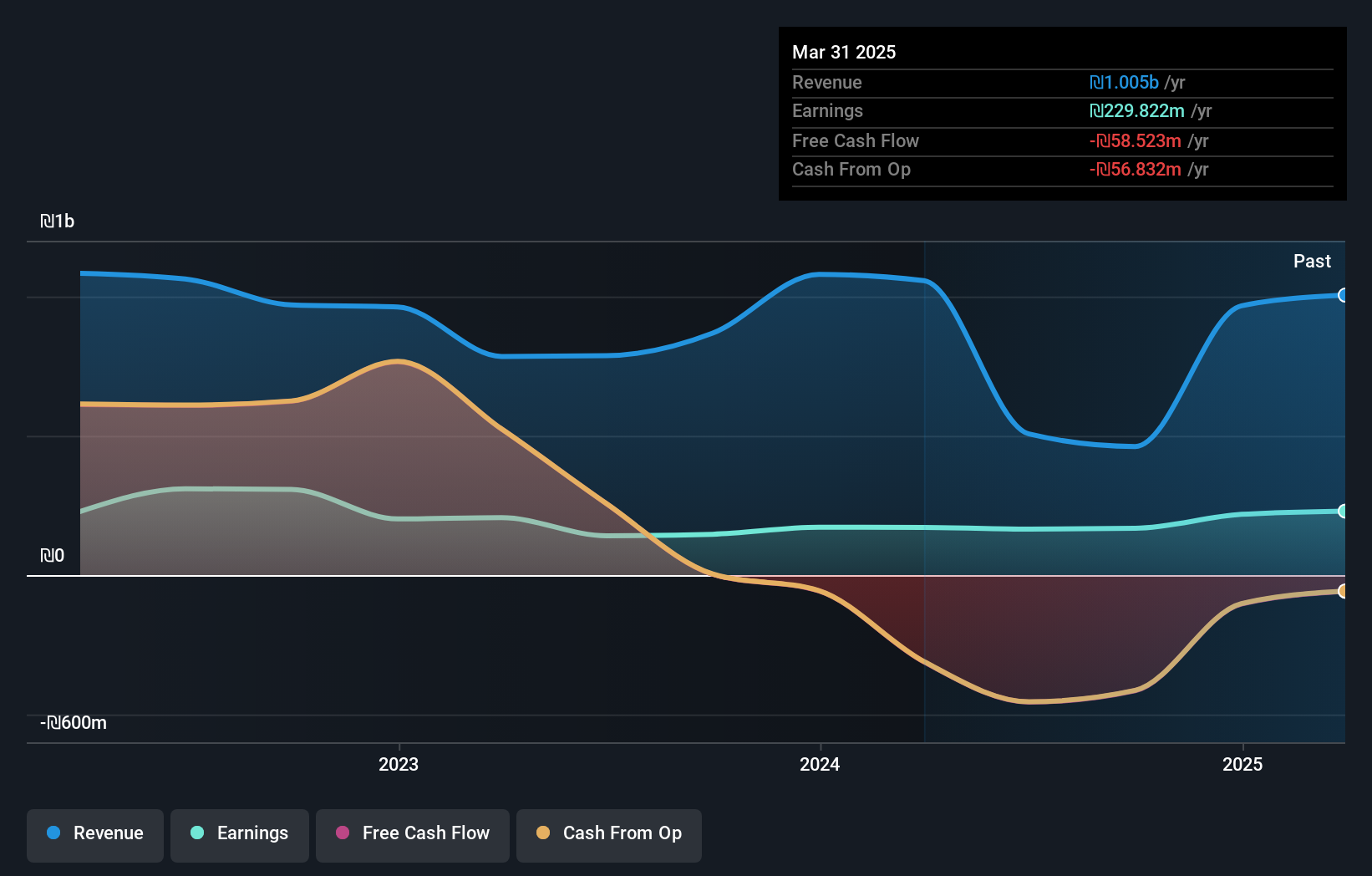

Overview: Africa Israel Residences Ltd focuses on developing and selling residential units under the Savyonim brand in Israel, with a market capitalization of ₪3.02 billion.

Operations: The company generates revenue primarily from the promotion of projects, amounting to ₪1.10 billion, and initiation of rental housing at ₪22.07 million.

Africa Israel Residences, a smaller player in the real estate sector, has seen its net income rise to ₪217.9M from ₪171.46M despite a drop in sales from ₪1.08B to ₪966.48M over the past year. The company reported basic earnings per share of ₪17.23, up from ₪13.56, reflecting improved profitability even though earnings growth of 27% lagged behind the industry's 36%. While its debt-to-equity ratio has decreased significantly from 174% to 81%, it remains high at 65%. A notable one-off gain of ₪80.3M influenced recent financial results, highlighting both opportunities and challenges ahead for AFRE.

- Navigate through the intricacies of Africa Israel Residences with our comprehensive health report here.

Gain insights into Africa Israel Residences' past trends and performance with our Past report.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

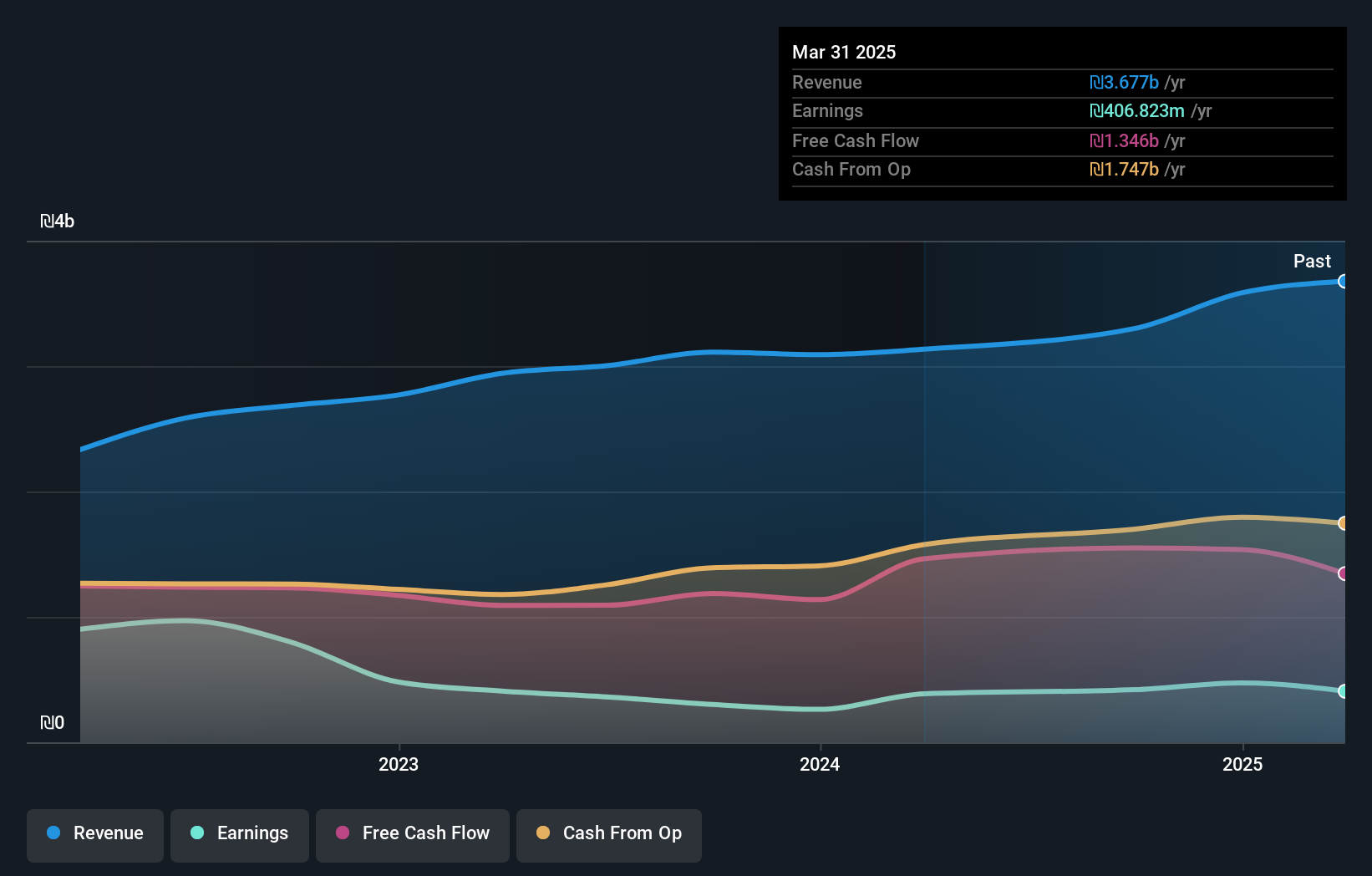

Overview: Equital Ltd. operates in the real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market cap of ₪5.06 billion.

Operations: Equital generates revenue primarily from its activities in real estate, oil and gas, and residential construction. The company has shown a net profit margin trend of 15% over recent periods.

Equital, a promising player in the Middle East, has seen its earnings soar by 80.5% over the past year, outpacing the industry average of 9.6%. Despite a high net debt to equity ratio of 47%, its interest payments are well covered with EBIT at 4.2 times coverage. The company trades at a significant discount, about 79% below estimated fair value, indicating potential for growth. Recent results show revenue climbed to ILS 3.58 billion from ILS 3.09 billion last year, while net income jumped to ILS 473.95 million from ILS 262.51 million, reflecting robust financial health and profitability prospects ahead.

- Click here to discover the nuances of Equital with our detailed analytical health report.

Review our historical performance report to gain insights into Equital's's past performance.

Seize The Opportunity

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 243 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LYDYE

Lydia Yesil Enerji Kaynaklari

Engages in the production and sale of electricity and heat energy in Turkey.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives