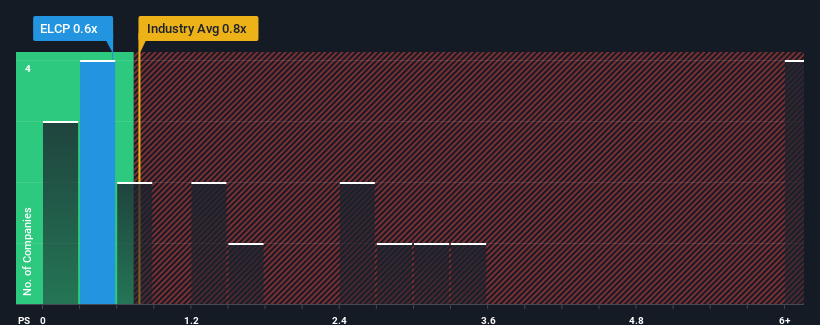

ELECTRA POWER (2019) LTD's (TLV:ELCP) price-to-sales (or "P/S") ratio of 0.6x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in Israel have P/S ratios greater than 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for ELECTRA POWER (2019)

What Does ELECTRA POWER (2019)'s P/S Mean For Shareholders?

For example, consider that ELECTRA POWER (2019)'s financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ELECTRA POWER (2019)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as ELECTRA POWER (2019)'s is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

In contrast to the company, the rest of the industry is expected to decline by 2.7% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that ELECTRA POWER (2019) is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Upon analysing the past data, we see it is unexpected that ELECTRA POWER (2019) is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

We don't want to rain on the parade too much, but we did also find 2 warning signs for ELECTRA POWER (2019) that you need to be mindful of.

If you're unsure about the strength of ELECTRA POWER (2019)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SPGS

Supergas Power (2019)

Supergas Power (2019) Ltd markets, sells, and distributes liquefied petroleum gas, natural gas, electricity, and thermal energy in Israel.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026