Dubai Refreshment (P.J.S.C.) And 2 Other Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

As Gulf markets experience gains fueled by rising oil prices and anticipation of potential U.S. Federal Reserve rate cuts, the Middle East's investment landscape is drawing increased attention from global investors. In this dynamic environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Value Rating: ★★★★★★

Overview: Dubai Refreshment (P.J.S.C.) focuses on bottling and selling Pepsi Cola International products both in the United Arab Emirates and internationally, with a market capitalization of AED2.03 billion.

Operations: The company generates revenue primarily from soft drinks and related beverage products, totaling AED869.04 million. It has a market capitalization of AED2.03 billion.

Dubai Refreshment, a small player in the Middle East market, has shown impressive earnings growth of 21.7% over the past year, outpacing the Consumer Retailing industry which saw a 6% downturn. The company is debt-free and reported sales of AED 238.75 million for Q3 2025, up from AED 220.22 million last year. Net income also rose to AED 47.48 million from AED 35.57 million in the same period last year, with basic earnings per share increasing to AED 0.53 from AED 0.4 previously, indicating strong operational performance and financial health despite its illiquid shares.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market cap of ₪1.37 billion.

Operations: Cohen Development Gas & Oil generates revenue through the exploration, production, and marketing of natural gas, condensate, and oil in Israel, Cyprus, and Morocco. The company has a market capitalization of approximately ₪1.37 billion.

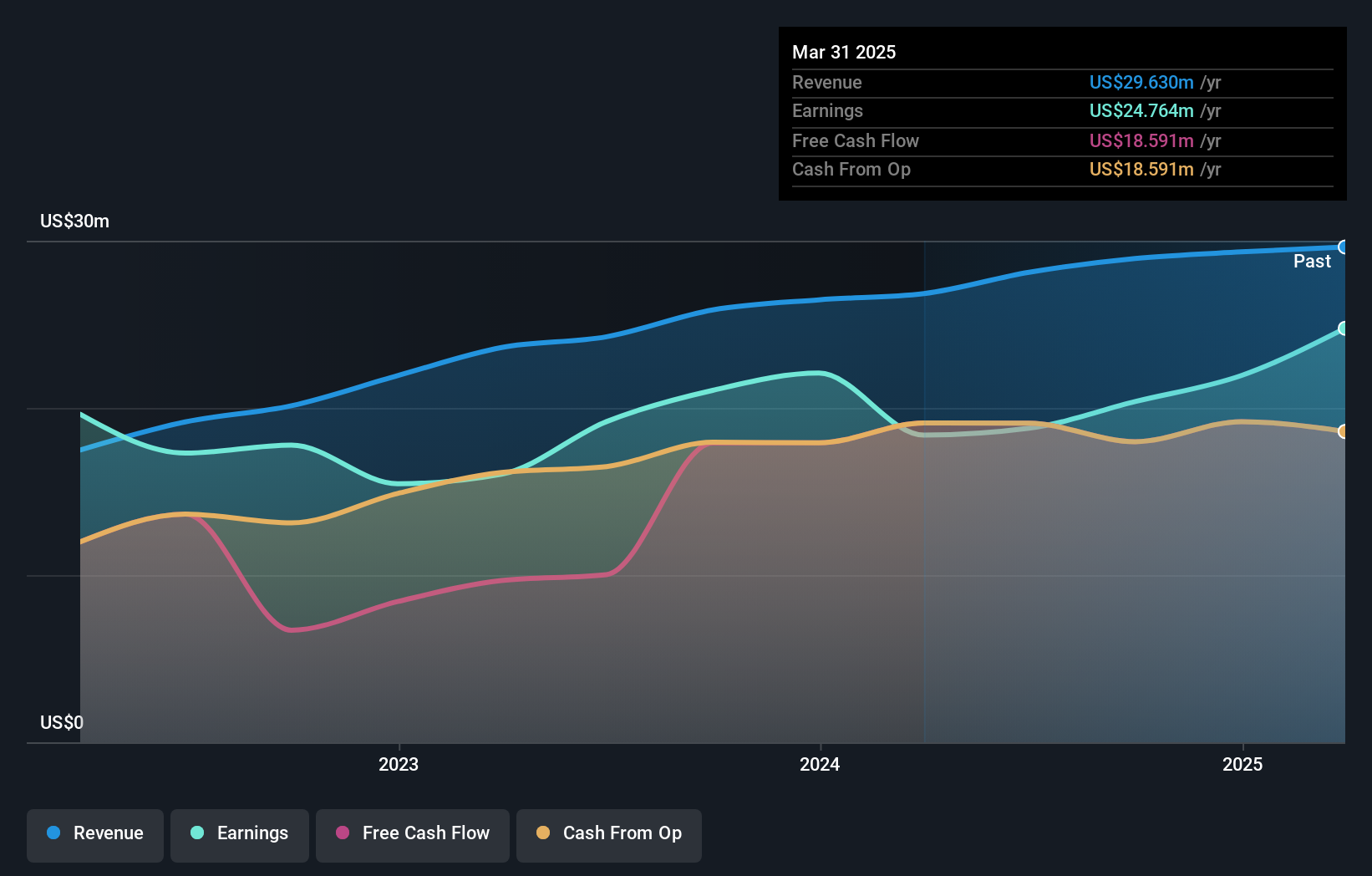

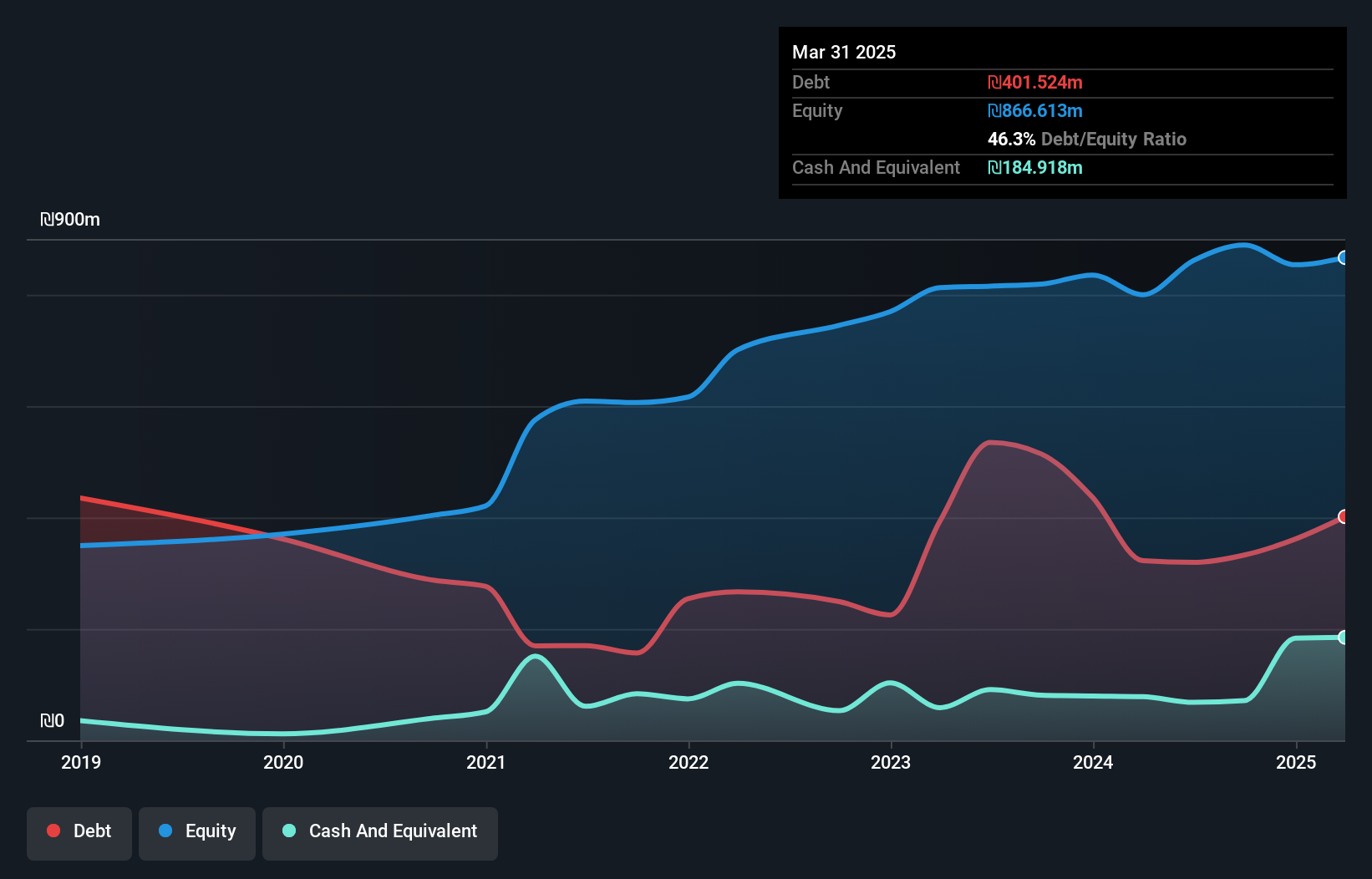

Cohen Development Gas & Oil, a small-cap player in the Middle East energy sector, has shown robust financial health with no debt over the past five years. The company reported a net income of US$7.42 million for Q3 2025, slightly down from US$7.96 million last year; however, for the nine months ending September 2025, net income rose to US$24.83 million from US$16.1 million previously. With a price-to-earnings ratio of 13.7x below the IL market average and earnings growth of 50.5% outpacing industry trends, Cohen appears well-positioned within its market segment despite minor fluctuations in quarterly performance figures.

- Click to explore a detailed breakdown of our findings in Cohen Development Gas & Oil's health report.

Understand Cohen Development Gas & Oil's track record by examining our Past report.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.37 billion.

Operations: Diplomat Holdings generates revenue primarily through sales and distribution in the fast-moving consumer goods sector. It reported a gross profit margin of 22.5% in the latest period, reflecting its efficiency in managing production costs relative to sales.

Diplomat Holdings, a nimble player in the Middle East market, showcases a net debt to equity ratio of 30.9%, deemed satisfactory and reduced from 79.4% over five years. The company's earnings growth of 21.2% outpaces the industry average of 7.1%, indicating robust performance despite large one-off gains affecting recent results by ₪34.9M. Its price-to-earnings ratio at 11x is favorable compared to the IL market's 15x, suggesting potential undervaluation. Diplomat's free cash flow remains positive, and it comfortably covers interest payments, reflecting sound financial health amidst its dynamic growth trajectory in consumer retailing.

- Click here to discover the nuances of Diplomat Holdings with our detailed analytical health report.

Gain insights into Diplomat Holdings' past trends and performance with our Past report.

Key Takeaways

- Get an in-depth perspective on all 184 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DRC

Dubai Refreshment (P.J.S.C.)

Engages in bottling and selling Pepsi Cola International products in the United Arab Emirates and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026