- Israel

- /

- Capital Markets

- /

- TASE:TASE

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For The Tel-Aviv Stock Exchange Ltd.'s (TLV:TASE) CEO For Now

Key Insights

- Tel-Aviv Stock Exchange will host its Annual General Meeting on 11th of September

- CEO Ittai Ben-Zeev's total compensation includes salary of ₪4.64m

- The total compensation is 622% higher than the average for the industry

- Tel-Aviv Stock Exchange's total shareholder return over the past three years was 122% while its EPS grew by 36% over the past three years

Performance at The Tel-Aviv Stock Exchange Ltd. (TLV:TASE) has been reasonably good and CEO Ittai Ben-Zeev has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 11th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Tel-Aviv Stock Exchange

How Does Total Compensation For Ittai Ben-Zeev Compare With Other Companies In The Industry?

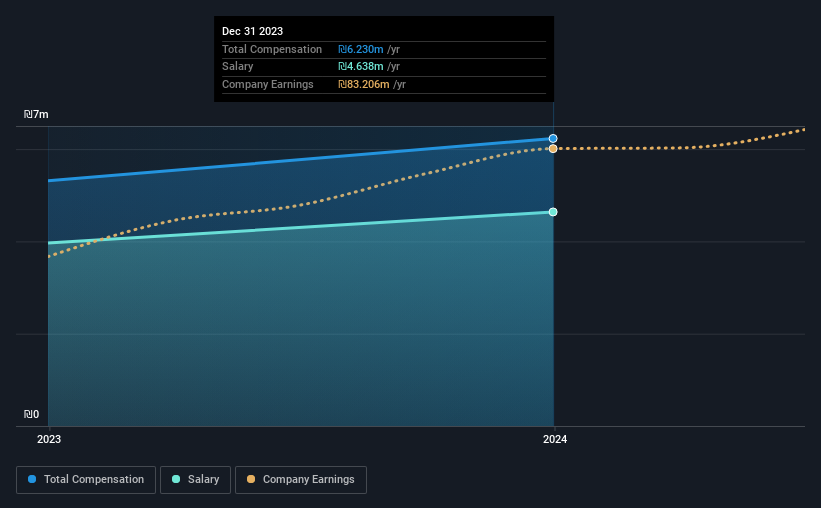

According to our data, The Tel-Aviv Stock Exchange Ltd. has a market capitalization of ₪3.0b, and paid its CEO total annual compensation worth ₪6.2m over the year to December 2023. Notably, that's an increase of 17% over the year before. In particular, the salary of ₪4.64m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Israel Capital Markets industry with market capitalizations ranging from ₪1.5b to ₪5.9b, the reported median CEO total compensation was ₪862k. Hence, we can conclude that Ittai Ben-Zeev is remunerated higher than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₪4.6m | ₪4.0m | 74% |

| Other | ₪1.6m | ₪1.3m | 26% |

| Total Compensation | ₪6.2m | ₪5.3m | 100% |

Speaking on an industry level, nearly 87% of total compensation represents salary, while the remainder of 13% is other remuneration. It's interesting to note that Tel-Aviv Stock Exchange allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at The Tel-Aviv Stock Exchange Ltd.'s Growth Numbers

The Tel-Aviv Stock Exchange Ltd. has seen its earnings per share (EPS) increase by 36% a year over the past three years. Its revenue is up 12% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has The Tel-Aviv Stock Exchange Ltd. Been A Good Investment?

Most shareholders would probably be pleased with The Tel-Aviv Stock Exchange Ltd. for providing a total return of 122% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Tel-Aviv Stock Exchange (free visualization of insider trades).

Important note: Tel-Aviv Stock Exchange is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.