- Israel

- /

- Food and Staples Retail

- /

- TASE:RMLI

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

As Gulf bourses rise on the back of favorable U.S. data and ongoing trade talks, investor confidence in the Middle East market is being bolstered by positive movements in key indices such as Abu Dhabi's and Dubai's. This environment presents a fertile ground for identifying promising stocks, particularly those that are well-positioned to capitalize on regional economic trends and sectoral strengths.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

I.E.S Holdings (TASE:IES)

Simply Wall St Value Rating: ★★★★★★

Overview: I.E.S Holdings Ltd primarily engages in the real estate investment business in Israel with a market capitalization of ₪1.60 billion.

Operations: The company generates revenue from its investment in real estate, amounting to ₪57.17 million.

IES Holdings, a small player in the market, showcases intriguing financial dynamics. With earnings growth of 119.5% over the past year, it outpaced the Real Estate industry average of 32.4%. The price-to-earnings ratio stands at a favorable 10.5x compared to the IL market's 16.1x, suggesting potential undervaluation. Despite a one-off gain of ₪140.7M influencing recent results, IES maintains solid profitability with more cash than total debt and an improved debt-to-equity ratio from 0.4% to 0.1% over five years. Recent quarterly earnings revealed sales growth but slightly lower net income at ₪15M compared to ₪16M last year.

- Dive into the specifics of I.E.S Holdings here with our thorough health report.

Explore historical data to track I.E.S Holdings' performance over time in our Past section.

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market capitalization of approximately ₪4.46 billion.

Operations: Rami Levi generates revenue primarily from its retail chains, amounting to approximately ₪6.64 billion, and Good Pharm Wholesale, contributing around ₪455.07 million.

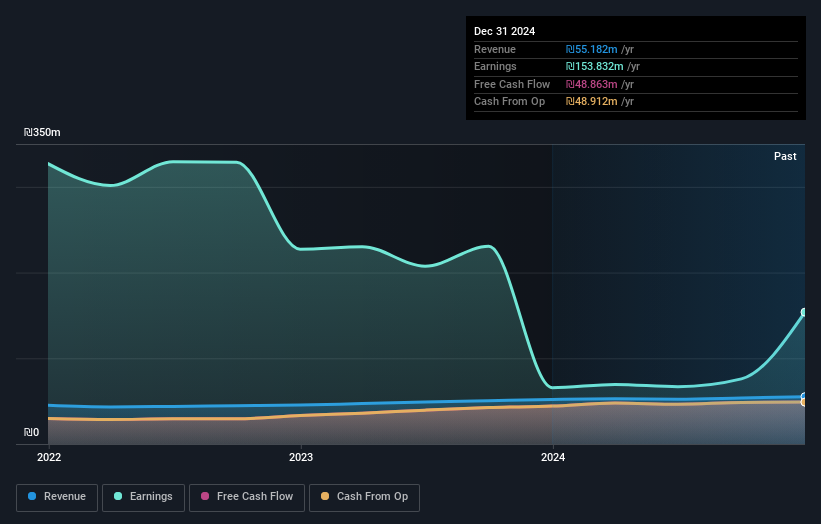

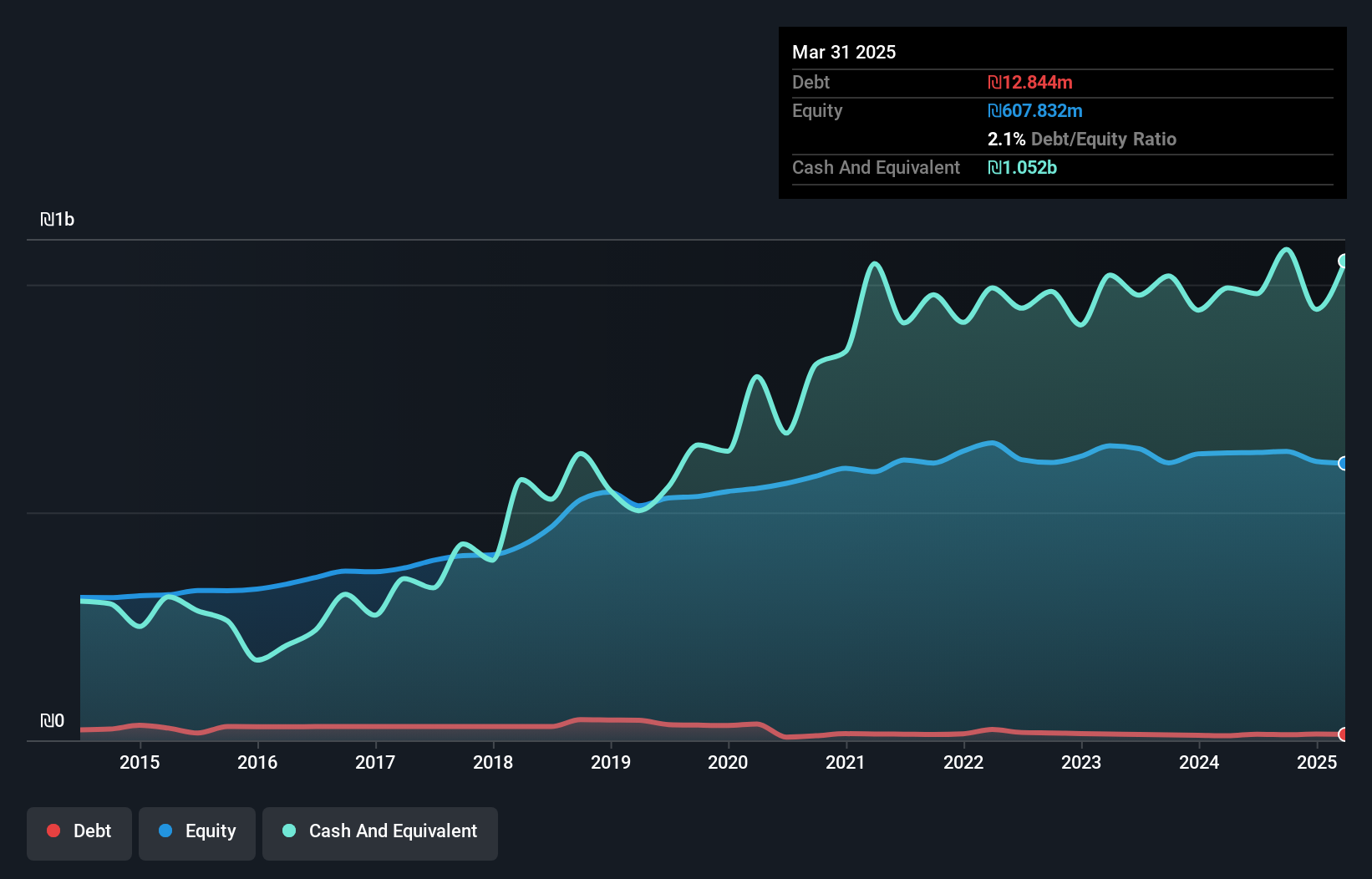

Rami Levi stands out with its shares trading at 59.3% below fair value, presenting an intriguing opportunity. Despite a slight earnings dip of -0.6% last year, the company maintains high-quality earnings and is profitable, ensuring cash runway isn't a worry. Interest payments are well-covered with EBIT at 6.9x coverage, and they have more cash than debt—a comforting sign for investors. Over five years, their debt-to-equity ratio improved from 6.5 to 2.1, indicating prudent financial management amidst industry challenges where net income recently fell to ILS 50.96 million from ILS 58.25 million year-on-year.

Tel-Aviv Stock Exchange (TASE:TASE)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Tel-Aviv Stock Exchange Ltd. operates as a stock exchange in Israel with a market capitalization of ₪5.70 billion.

Operations: Revenue from unclassified services amounts to ₪460.60 million.

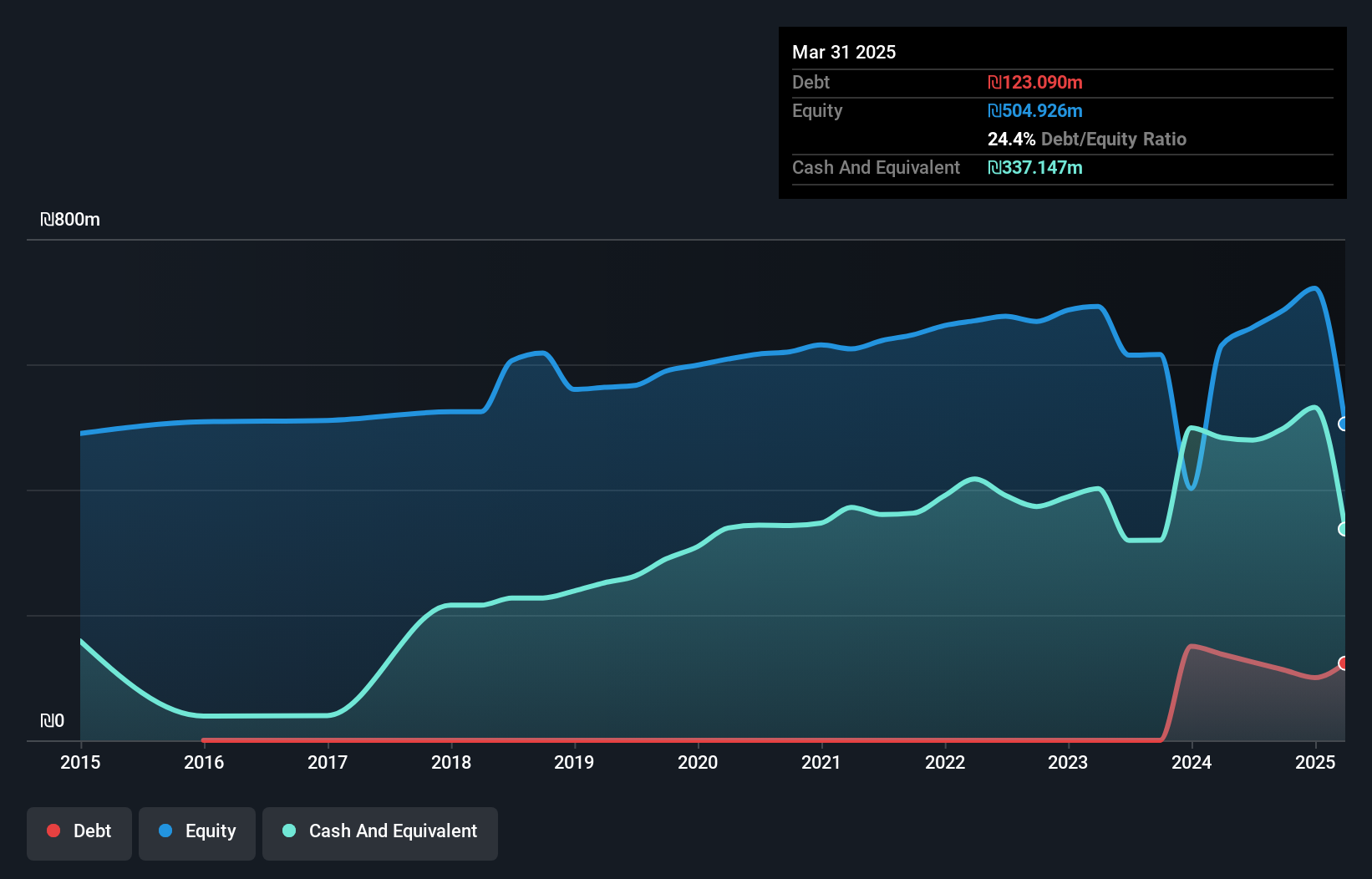

The Tel-Aviv Stock Exchange (TASE) is making waves with its robust earnings growth of 33.6% over the past year, surpassing the Capital Markets industry's 28.5%. Despite a volatile share price recently, TASE boasts high-quality earnings and a healthy debt-to-equity ratio that rose to 24.4% over five years, reflecting strategic financial management. The recent acquisition of a 2.7% stake by Clal Insurance for ILS 150 million highlights investor confidence in TASE's potential. With net income climbing to ILS 35.79 million in Q1 from ILS 25.71 million last year, TASE's future prospects seem promising as it explores strategic partnerships to enhance global exposure through its indices.

- Get an in-depth perspective on Tel-Aviv Stock Exchange's performance by reading our health report here.

Evaluate Tel-Aviv Stock Exchange's historical performance by accessing our past performance report.

Next Steps

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 218 more companies for you to explore.Click here to unveil our expertly curated list of 221 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RMLI

Rami Levi Chain Stores Hashikma Marketing 2006

Operates a chain of discount format retail stores in Israel.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives