- Israel

- /

- Capital Markets

- /

- TASE:TASE

Assessing Tel Aviv Stock Exchange (TASE:TASE) Valuation After Recent Shift in Momentum

Reviewed by Kshitija Bhandaru

Tel-Aviv Stock Exchange (TASE:TASE) shares have experienced mild shifts in recent days, prompting investors to re-examine the company’s recent performance and metrics. Returns over the past month remain slightly negative, even as longer-term figures continue to show strength.

See our latest analysis for Tel-Aviv Stock Exchange.

After a year marked by healthy long-term gains, the Tel-Aviv Stock Exchange’s momentum has moderated recently, suggesting that investors may be recalibrating expectations after a stretch of sustained progress. The 1-year total shareholder return stands at 1.23%, indicating modest but positive long-term performance, while recent share price returns show momentum has paused for now.

If you’re weighing your next move, now is a great moment to discover fast growing stocks with high insider ownership.

With steady returns over a multi-year period, but recent plateaus in price and only a slight discount to analyst targets, the key question is whether Tel-Aviv Stock Exchange is undervalued now or if the market has already factored in all its future growth.

Price-to-Earnings of 53.4x: Is it justified?

The Tel-Aviv Stock Exchange currently trades at a price-to-earnings (P/E) ratio of 53.4x, a figure that stands out when compared with industry averages and peer companies. At the last close price of ₪76.39, this signals investors are paying a substantial premium for each shekel of earnings generated by the company.

The price-to-earnings ratio compares a company’s current share price to its earnings per share. It serves as a measure of how much investors are willing to pay for anticipated earnings growth. For capital markets firms, a higher P/E can indicate confidence in above-market growth or sustained profitability, but it can also flag over-optimism if not matched by results.

Tel-Aviv Stock Exchange’s P/E is not only well above its peer group average (19.7x), but it also exceeds the Asian Capital Markets industry average of 21.9x. This higher valuation suggests the market is pricing in much faster profit growth than is typical for the sector. However, it also raises questions about how sustainable such optimism may be.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 53.4x (OVERVALUED)

However, slower revenue growth and a recent dip below analyst targets could challenge current optimism around the Tel-Aviv Stock Exchange’s high valuation.

Find out about the key risks to this Tel-Aviv Stock Exchange narrative.

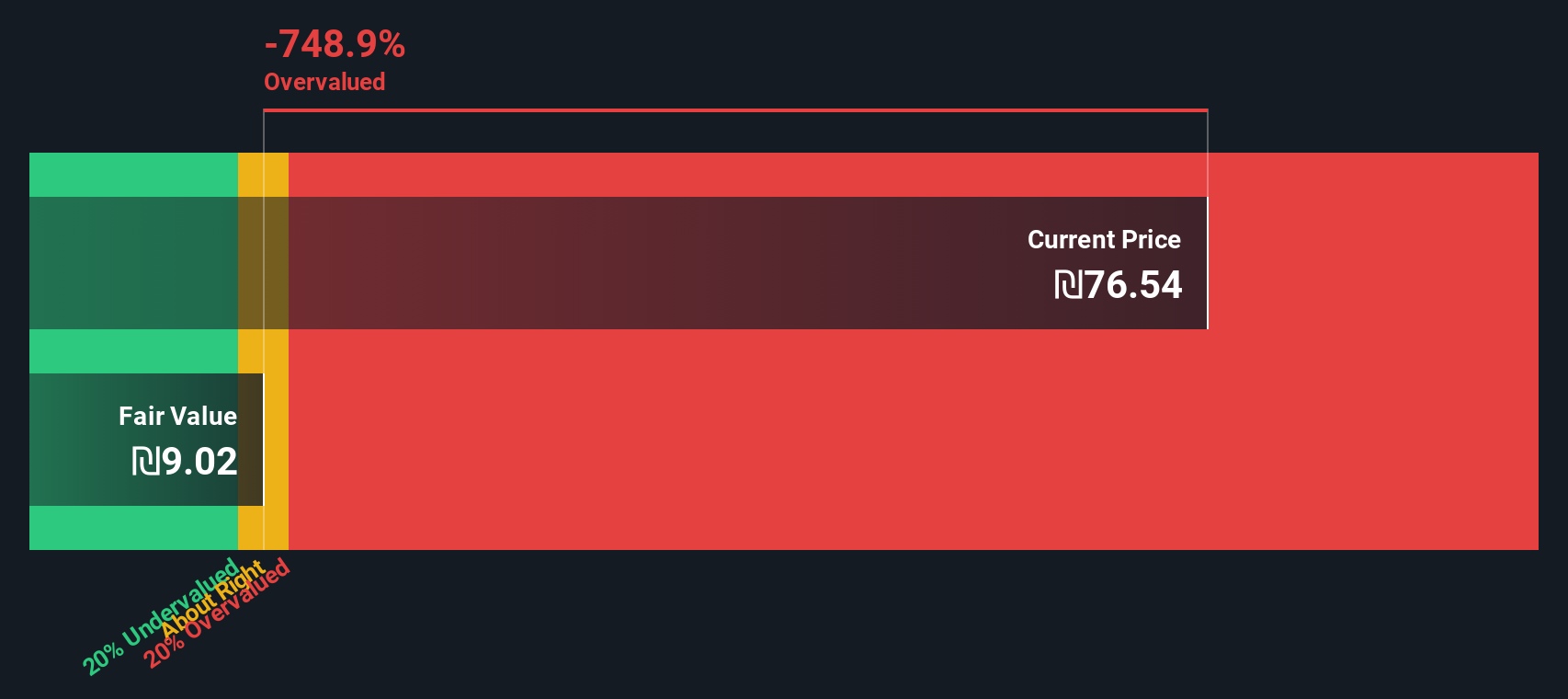

Another View: DCF Points to Overvaluation

Looking at Tel-Aviv Stock Exchange from another angle, the Simply Wall St DCF model shows the shares trade well above their estimated fair value of ₪8.93. This means that, according to cash flow projections, the stock is currently considered overvalued. The question remains whether fundamentals can catch up to justify the premium.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tel-Aviv Stock Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tel-Aviv Stock Exchange Narrative

If you’d rather reach your own conclusions or want a fresh perspective, it’s easy to examine the figures firsthand and shape your own view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tel-Aviv Stock Exchange.

Ready for More Smart Investment Opportunities?

Sharpen your edge by actively seeking out stocks positioned for the next wave of growth. Skip the guesswork and go straight where others are finding opportunity.

- Capture the upside of fast-growing sectors by following these 24 AI penny stocks, uncovering companies breaking new ground in artificial intelligence.

- Supercharge your passive income with these 19 dividend stocks with yields > 3%, which deliver reliable yields and the potential to strengthen your portfolio for years to come.

- Ride the momentum of a rapidly evolving market with these 78 cryptocurrency and blockchain stocks, at the forefront of blockchain advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives