- Israel

- /

- Capital Markets

- /

- TASE:MRIN

Undiscovered Gems in the Middle East for July 2025

Reviewed by Simply Wall St

The Middle East market has been experiencing mixed movements, with Abu Dhabi's index gaining due to a surge in oil prices while Dubai's index saw a decline from profit-taking activities. Despite these fluctuations, the region remains steady overall, buoyed by positive corporate earnings and stable oil prices which are crucial for the Gulf’s financial markets. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth amidst shifting economic indicators and geopolitical developments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 2.82% | 0.61% | ★★★★★★ |

| Amir Marketing and Investments in Agriculture | 17.44% | 5.21% | 5.41% | ★★★★★★ |

| Formula Systems (1985) | 33.74% | 8.44% | 11.96% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

| Dogan Burda Dergi Yayincilik Ve Pazarlama | 64.82% | 46.23% | -12.39% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Israel Brands Ltd. designs, develops, markets, and sells various clothing products in Israel with a market cap of ₪2.46 billion.

Operations: Delta Israel Brands generates revenue primarily from the sale of clothing products in Israel. The company's financial performance is highlighted by a notable net profit margin trend, which has shown varying levels over recent periods.

Delta Israel Brands, a nimble player in the market, has been showcasing its resilience with high-quality earnings and an annual growth rate of 8.7% over the past five years. The company is debt-free now, a stark contrast to its previous debt-to-equity ratio of 12.8%. Despite not outpacing industry peers recently, it offers good value with a price-to-earnings ratio of 15.9x compared to the IL market's 16.4x. Recent earnings showed sales at ILS 315 million but net income dipped slightly to ILS 29 million from last year's ILS 33 million, reflecting ongoing challenges in maintaining profitability amidst market fluctuations.

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

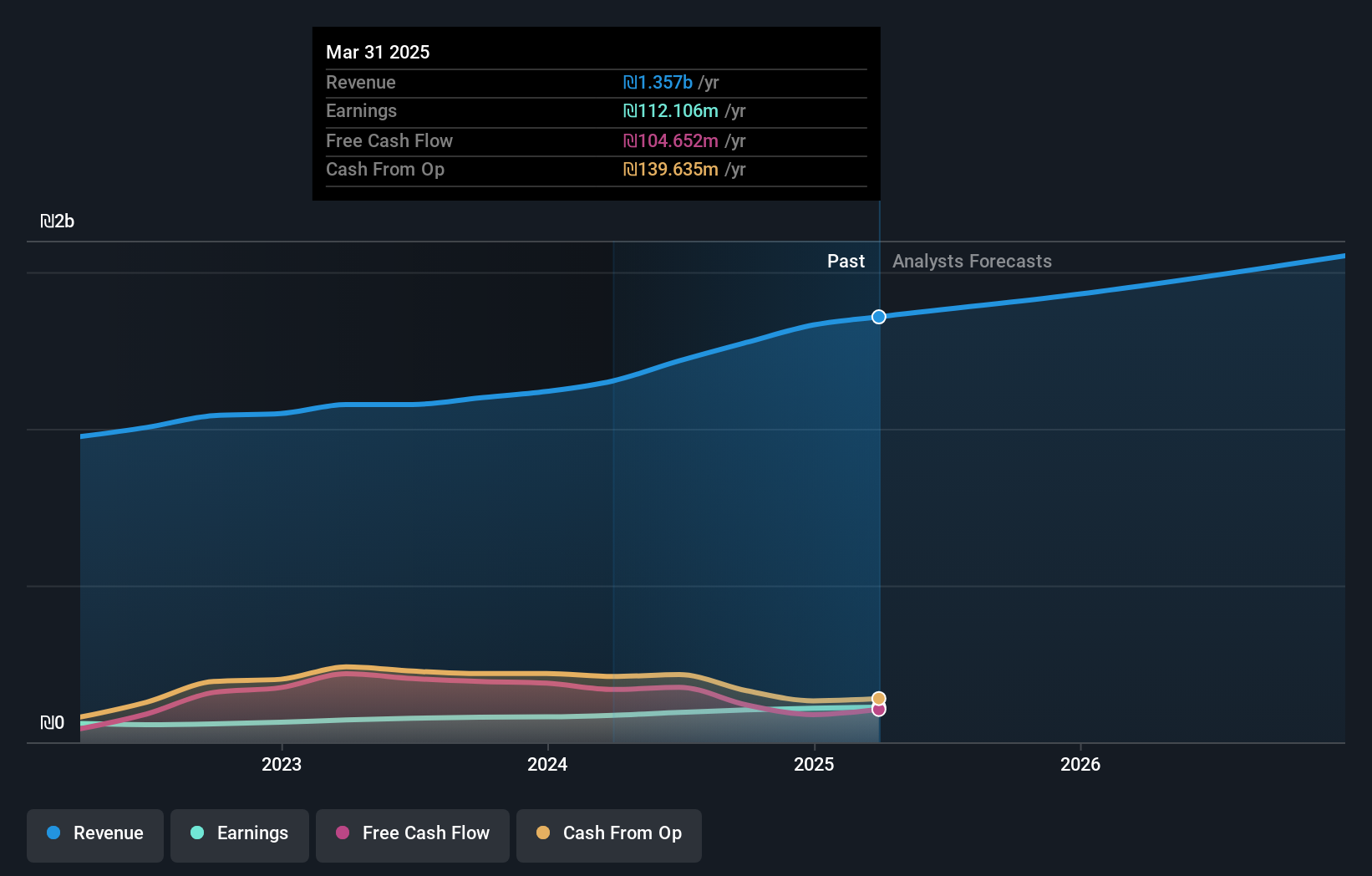

Overview: Max Stock Ltd. operates a chain of discount stores across Israel with a market capitalization of ₪2.46 billion.

Operations: Max Stock Ltd. generates revenue primarily from its retail trade segment, amounting to ₪1.36 billion. The company exhibits a gross profit margin trend that is noteworthy for analysis.

Max Stock, a notable player in the Middle East retail scene, showcases impressive financial health with high-quality earnings and a debt-to-equity ratio that has significantly dropped to 19.5% from 356.4% over five years. The company's price-to-earnings ratio of 22x is favorable compared to the industry average of 26.3x, suggesting potential value for investors. In recent developments, an undisclosed buyer acquired a 5.50% stake for ILS 120 million at ILS 15.4 per share, leaving Apax Partners LLP with a remaining stake of 22.7%. Earnings have been robust with net income rising to ILS 29.28 million in Q1 from ILS 25.93 million last year, reflecting strong performance amidst industry challenges.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★☆

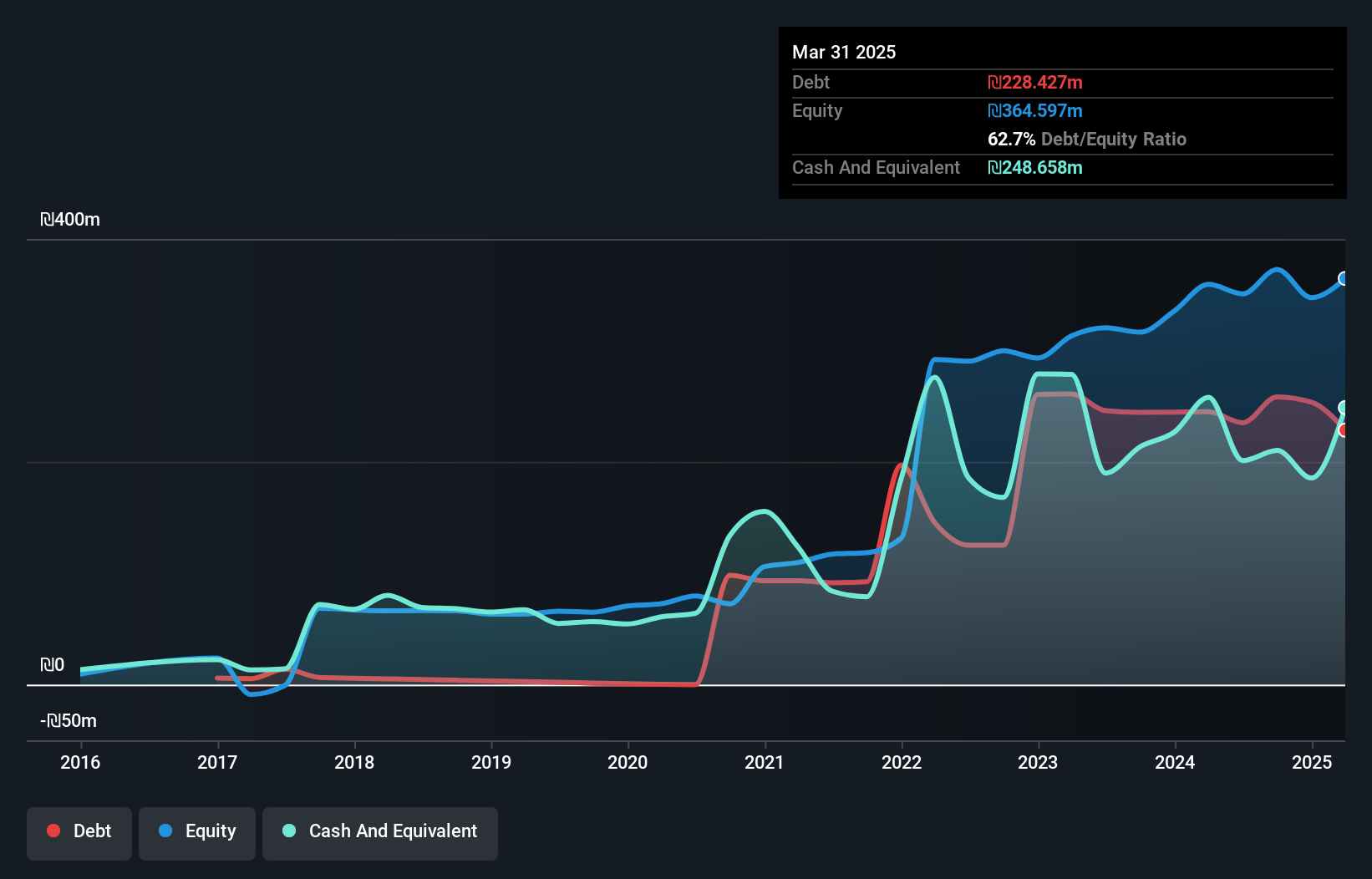

Overview: Y.D. More Investments Ltd is a privately owned investment manager with a market cap of ₪2.57 billion, focusing on various financial services including mutual fund and portfolio management.

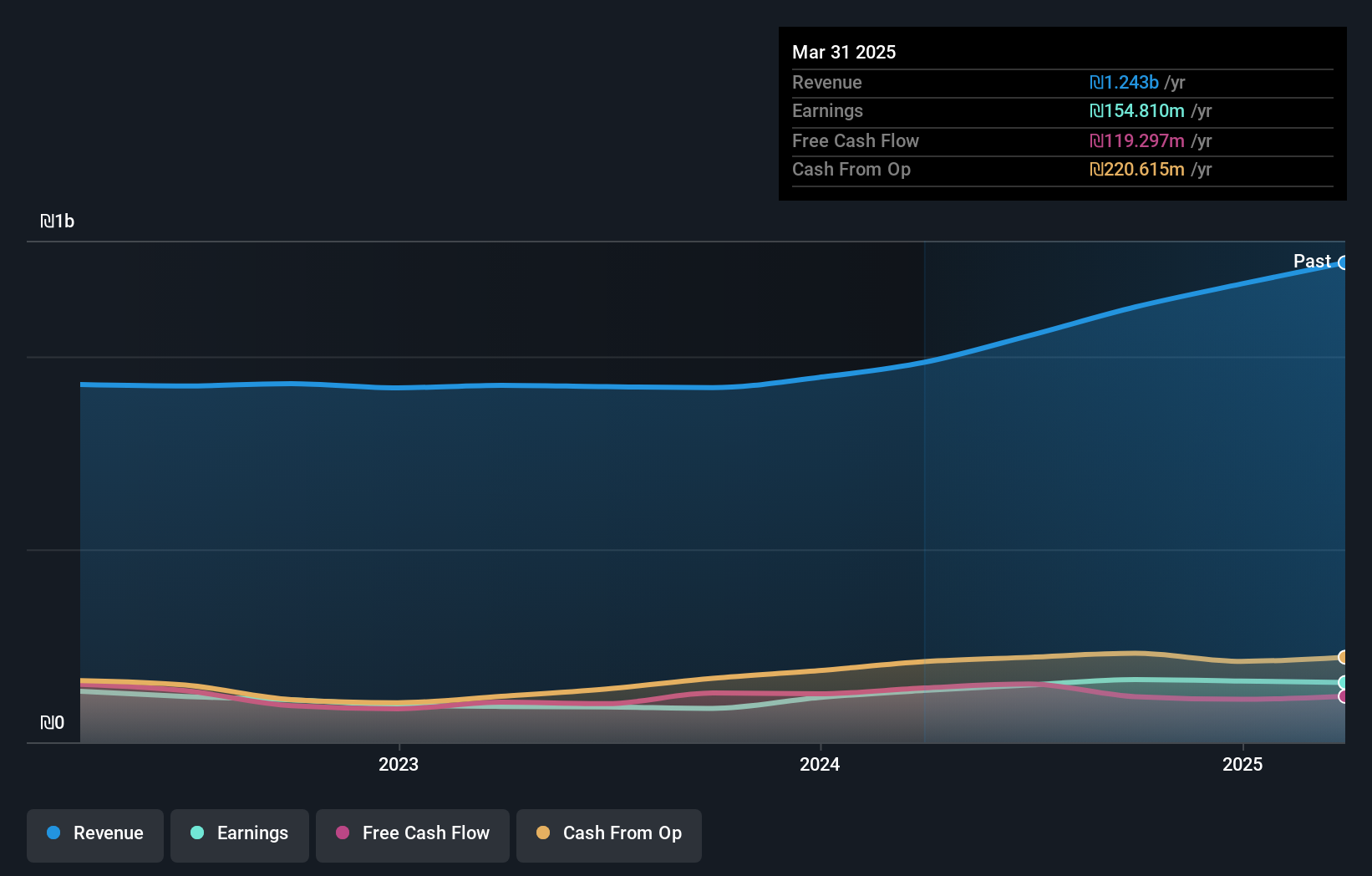

Operations: Y.D. More Investments generates revenue primarily from the management of provident and pension funds, contributing ₪540.82 million, followed by mutual fund management at ₪231.26 million. Investment portfolio management adds another ₪34.40 million to its revenue streams.

Y.D. More Investments, a nimble player in the Middle Eastern market, has shown promising growth with its recent earnings report. The company's revenue jumped to ILS 230 million from ILS 188 million year-over-year, while net income rose to ILS 31.62 million from ILS 17.11 million. This performance translated into basic earnings per share of ILS 0.44 compared to last year's ILS 0.24, reflecting robust operational efficiency and strategic positioning in the industry landscape. With a focus on quality earnings and strong interest coverage at an impressive EBIT multiple of 60x, Y.D.'s financial health seems solid amidst evolving market dynamics.

Key Takeaways

- Unlock our comprehensive list of 224 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MRIN

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives