- Israel

- /

- Household Products

- /

- TASE:SANO1

Middle East Undiscovered Gems Featuring 3 Promising Stocks

Reviewed by Simply Wall St

As Gulf markets experience gains driven by strong corporate earnings, concerns about tariffs and U.S. monetary policy continue to cast a shadow over investor sentiment. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience and growth potential amid economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market capitalization of ₪1.09 billion.

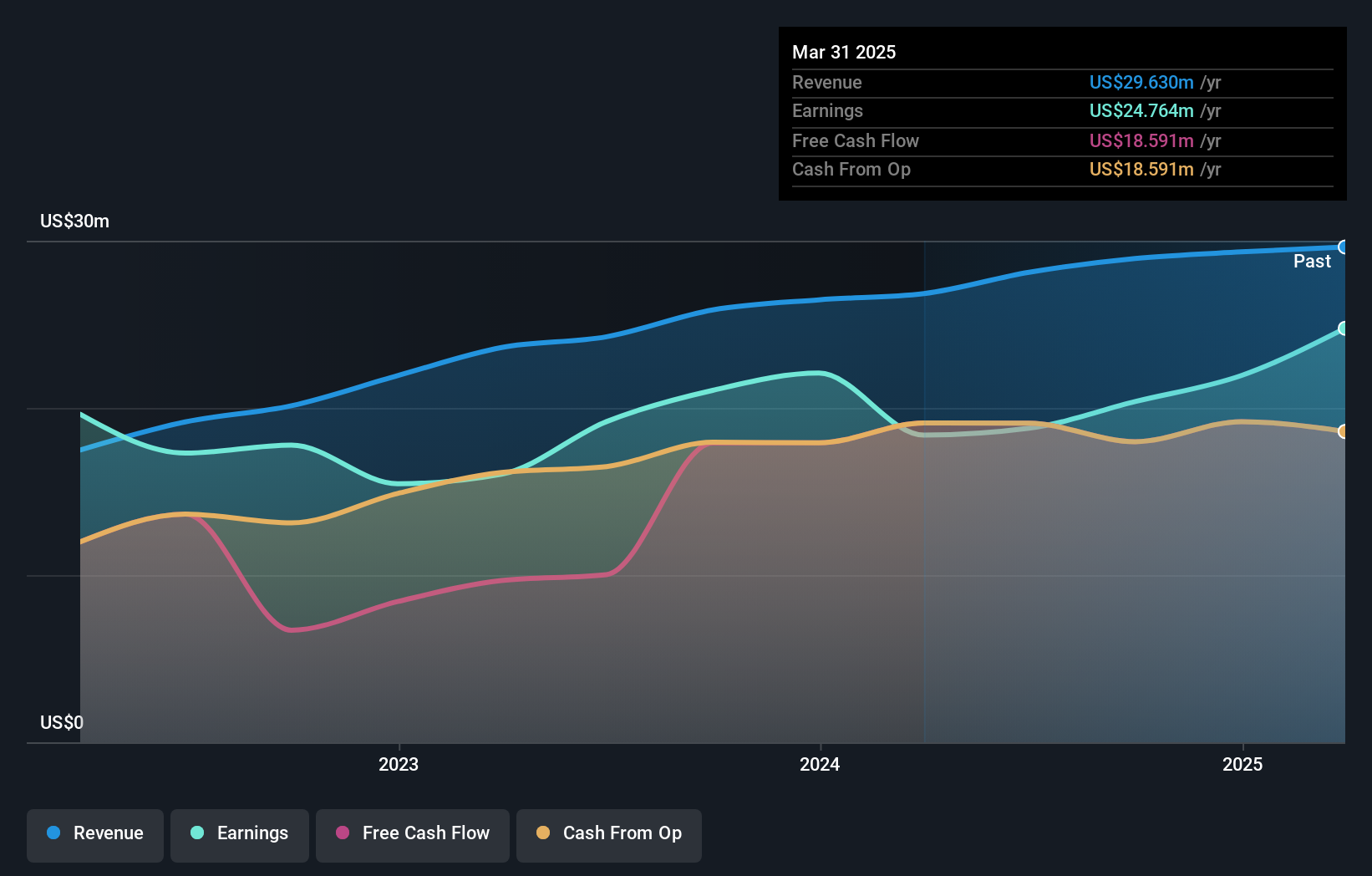

Operations: Revenue from the production and management of oil and gas exploration totals $28.94 million.

Cohen Development Gas & Oil, a smaller player in the Middle East energy sector, stands out with its debt-free status for the past five years and high-quality earnings. Despite trading at 6.3% below its estimated fair value, it faces challenges with a negative earnings growth of 3.2%, contrasting sharply with the industry average of 9.6%. The company generated levered free cash flow of US$17.98 million as of April 2025, indicating strong operational efficiency despite capital expenditure pressures that reached US$6.47 million in recent quarters. This blend of financial stability and operational hurdles paints a nuanced picture for potential investors.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Y.D. More Investments Ltd is a privately owned investment manager with a market cap of ₪1.14 billion.

Operations: Y.D. More Investments generates revenue primarily through investment management services. The company has a market capitalization of ₪1.14 billion, reflecting its standing in the financial sector.

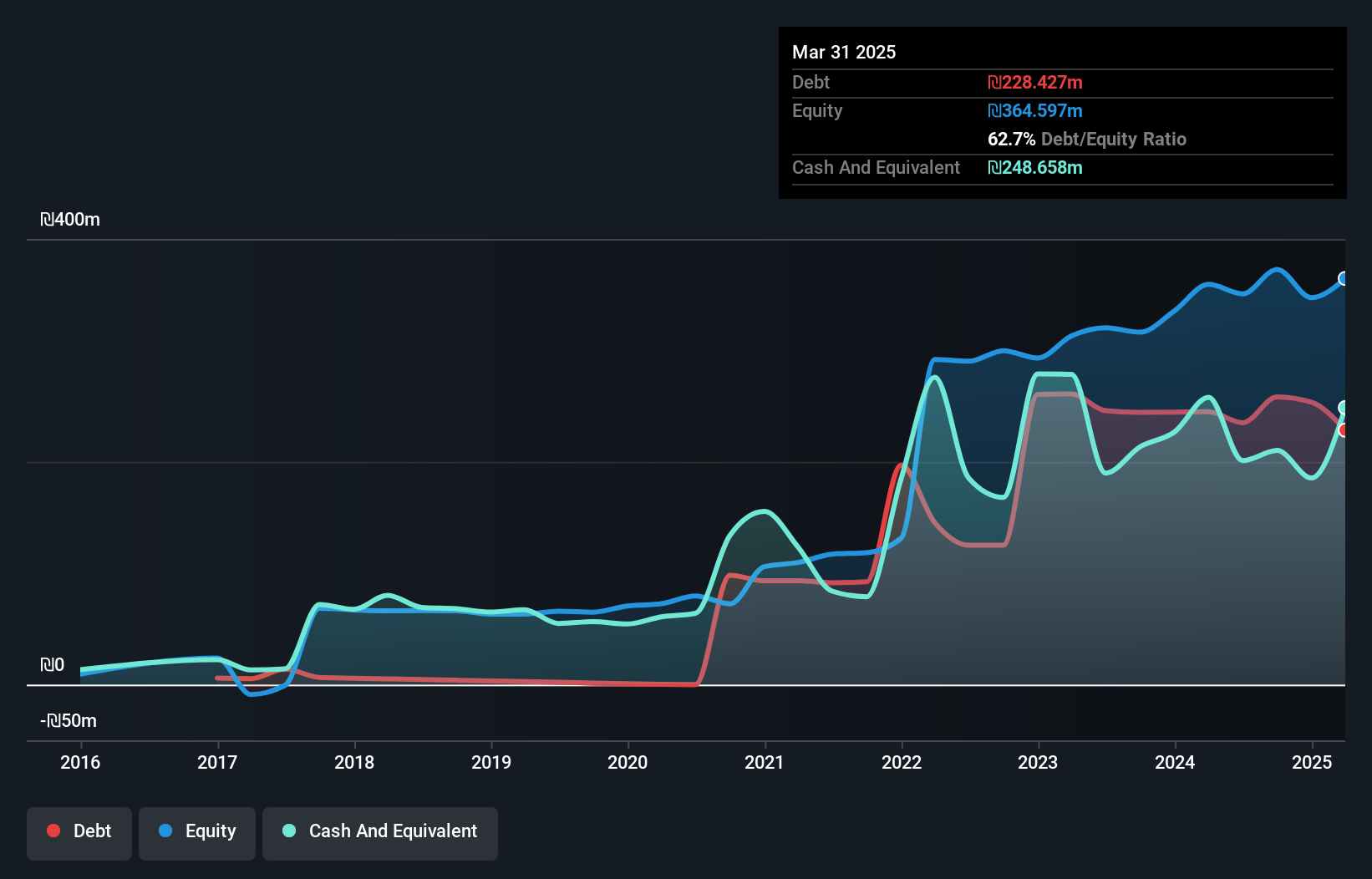

Y.D. More Investments, a nimble player in the Middle East's financial landscape, has shown robust earnings growth of 29.5% annually over the past five years. Despite this impressive trajectory, its recent annual earnings growth of 17.8% lagged behind the Capital Markets industry's 19%. The company’s debt to equity ratio climbed from a modest 1.2% to a hefty 73% over five years, yet its interest payments are comfortably covered by EBIT at 12.8 times coverage, indicating sound financial management. Recent events include a cash dividend payout and an acquisition of a significant stake by an undisclosed buyer for ILS 33.2 million, reflecting investor confidence in its prospects.

Sano Bruno's Enterprises (TASE:SANO1)

Simply Wall St Value Rating: ★★★★★★

Overview: Sano Bruno's Enterprises Ltd is involved in the global manufacture and sale of a diverse range of products including laundry, home care, cleaning and hygiene items, kitchen accessories, air fresheners, insecticides, and paper products with a market capitalization of ₪3.51 billion.

Operations: Sano Bruno's Enterprises generates revenue through the sale of various consumer products, with a focus on laundry, home care, and hygiene items. The company experiences fluctuations in its cost structure due to raw material prices and operational expenses. Its net profit margin has shown variability over recent periods, reflecting changes in profitability.

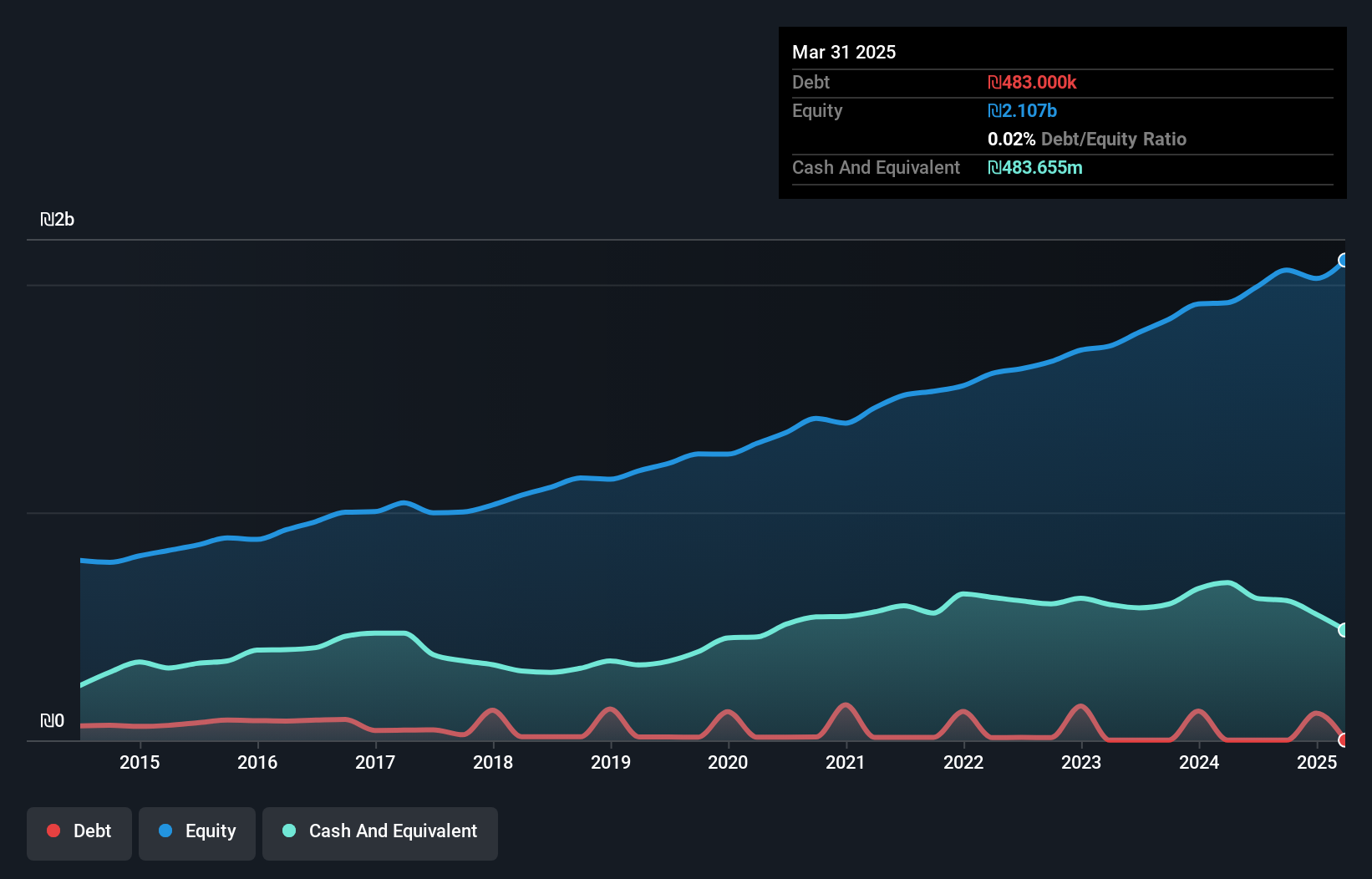

Sano Bruno's Enterprises, a dynamic player in the household products sector, has shown impressive financial health and growth. Its debt-to-equity ratio plummeted from 10% to a mere 0.02% over five years, highlighting strong fiscal management. The firm reported earnings growth of 10.9%, outpacing the industry average of 6.2%. With interest payments comfortably covered by EBIT at 33.9 times and a price-to-earnings ratio of 13.3x below the IL market average of 13.8x, Sano Bruno's seems well-positioned for continued success in its niche market space, offering quality earnings and robust cash flow performance.

- Click here to discover the nuances of Sano Bruno's Enterprises with our detailed analytical health report.

Evaluate Sano Bruno's Enterprises' historical performance by accessing our past performance report.

Make It Happen

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 245 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SANO1

Sano Bruno's Enterprises

Engages in the manufacture and sale of laundry products, home care products, cleaning and hygiene products, kitchen accessories, air fresheners, insecticides, and paper products worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives