- Israel

- /

- Consumer Finance

- /

- TASE:ISCD

The Bull Case For Isracard (TASE:ISCD) Could Change Following Revenue Gain but Profit Decline in Q3 Results

Reviewed by Sasha Jovanovic

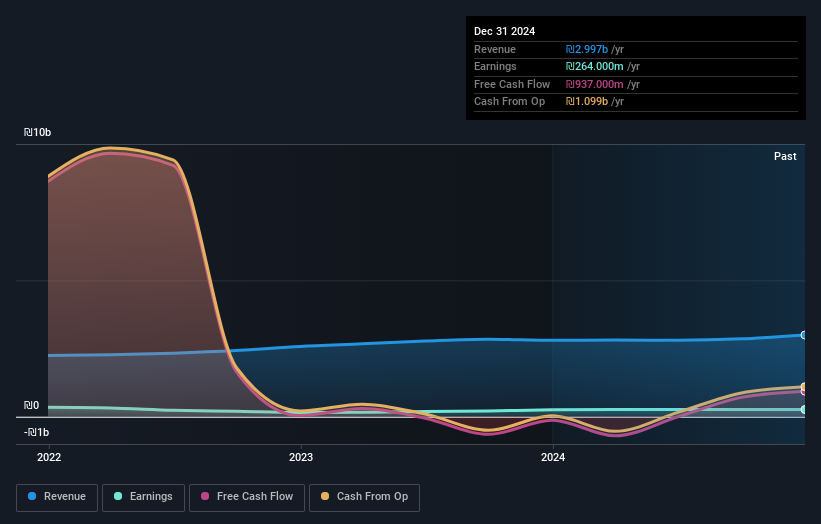

- Isracard Ltd. reported results for the third quarter and nine months ended September 30, 2025, with revenue rising to ILS 933 million for the quarter but net income falling to ILS 37 million, less than half compared to the same period last year.

- The company posted a net loss of ILS 106 million for the nine-month period, reversing a net profit from the prior year despite revenue growth.

- We'll examine how the sharp drop in profitability shapes Isracard's investment narrative and outlook for operational performance.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Isracard's Investment Narrative?

Being an Isracard shareholder today means believing in the potential for stability, and perhaps renewal, in a company that has moved from consistent revenue growth to confronting deep profitability challenges. The recent news of rising revenue but sliding net income, culminating in a net loss for the nine months to September, has immediate implications: the investment case is no longer about simple income recovery, but rather whether Isracard can reverse operational headwinds and restore sustainable earnings. Short-term catalysts now hinge on how effectively management can address cost pressures and leverage Delek Group’s recent stake, as well as on tangible progress toward dividend commitments made after the M&A activity. Risks have shifted: with dividend sustainability in question, earnings volatility and sector underperformance are front and center. The latest results make these issues even harder to ignore, and it’s clear that any meaningful turnaround will demand action on all operational fronts.

Yet with profitability in doubt, dividend coverage is now a key concern investors can’t afford to ignore.

Exploring Other Perspectives

Explore another fair value estimate on Isracard - why the stock might be worth 25% less than the current price!

Build Your Own Isracard Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Isracard research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Isracard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Isracard's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISCD

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success