- Israel

- /

- Consumer Finance

- /

- TASE:ISCD

Isracard (TASE:ISCD) Valuation in Focus After Profits Slide Despite Rising Revenue

Reviewed by Simply Wall St

Isracard (TASE:ISCD) just released its earnings results for the third quarter and nine months ended September 2025, showing higher revenue but a marked drop in net income and earnings per share compared to last year.

See our latest analysis for Isracard.

Despite Isracard's improved revenue, the stock's momentum has faded this year, with a year-to-date share price return of -16.57%. However, its long-term performance stands out thanks to a robust 30.08% total shareholder return over the past year and an impressive 77.54% over three years. This suggests that recent profit declines have not erased investors’ gains.

If you want to see which other resilient growth stories the market is uncovering, now is an ideal time to broaden your radar and discover fast growing stocks with high insider ownership

With profits slipping even as revenue rises, the key question now is whether Isracard’s recent struggles make the stock undervalued, or if the market has already factored in any potential recovery. Could this be a buying opportunity, or is future growth already priced in?

Price-to-Sales Ratio of 1.4x: Is it justified?

Isracard’s shares currently trade at a price-to-sales (P/S) ratio of 1.4x, putting the company well below both local and regional industry peers. This stands out given the recent dip in share price and ongoing profit declines.

The price-to-sales ratio divides a company’s market capitalization by its total revenue, offering a quick way to gauge how much investors are paying per shekel of sales. For companies with fluctuating profits or those currently unprofitable like Isracard, the P/S ratio is a particularly relevant tool as it focuses solely on top-line performance rather than earnings volatility.

Despite short-term headwinds, Isracard is valued cheaply on this metric by the market. The current 1.4x multiple is a fraction of the peer average in Israel (4.1x) and the wider Asian Consumer Finance industry (3.1x), hinting at either cautious sentiment or expectation of continued challenges.

It is possible the market is waiting for a turnaround in profit trends before pricing Isracard more in line with sector norms. If business momentum returns, the multiple could move toward industry averages which may reward patient shareholders.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1.4x (UNDERVALUED)

However, persistent net losses and uncertain profit recovery could dampen sentiment and prevent Isracard’s valuation from catching up to industry peers.

Find out about the key risks to this Isracard narrative.

Another View: Discounted Cash Flow Challenges the Multiple

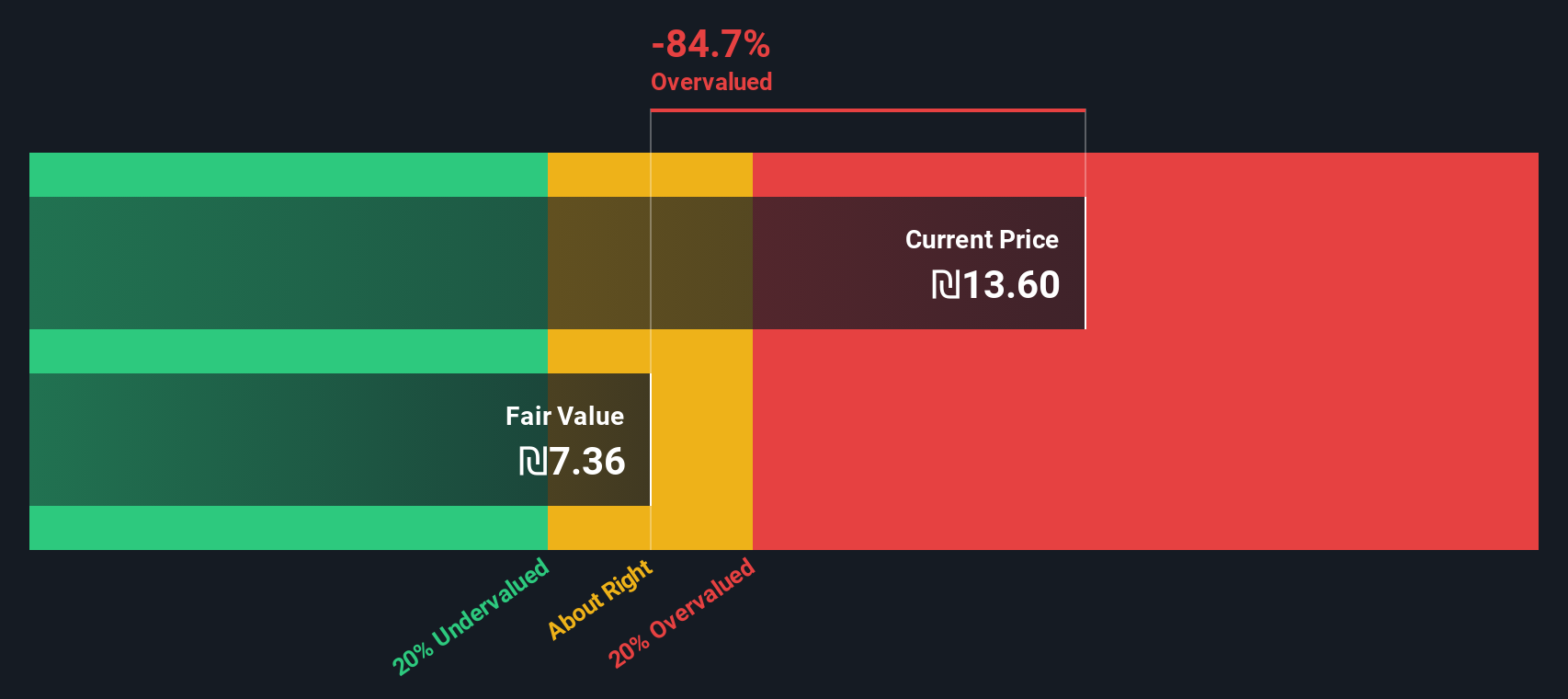

While Isracard looks undervalued using price-to-sales, our SWS DCF model suggests the current share price of ₪13.54 sits above its calculated fair value of ₪7.36. This method, which projects cash flows into the future, raises the possibility that the stock could be overvalued by the market. Could the risk of further downside be greater than some investors think?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Isracard for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Isracard Narrative

If you see things differently or want to dig into the numbers on your own terms, you can assemble a personal narrative in just a few minutes. Do it your way

A great starting point for your Isracard research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the next big opportunity is out there waiting. Make the most of Simply Wall Street and let powerful data sharpen your investment strategy now.

- Unlock regular income potential as you scan through these 15 dividend stocks with yields > 3%. These options offer above-average payouts, driven by strong performance and reliable balance sheets.

- Target the next wave of disruptive technology by jumping into these 26 quantum computing stocks. This group features companies advancing the frontiers of computing power and innovation.

- Secure value by acting on these 917 undervalued stocks based on cash flows. These choices are based on real underlying cash flows, highlighting stocks the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISCD

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives