As global markets navigate a volatile landscape marked by fluctuating corporate earnings and geopolitical tensions, small-cap stocks have faced unique challenges and opportunities. With the Federal Reserve maintaining steady interest rates amid persistent inflation, investors are increasingly looking towards under-the-radar small-cap companies that might offer resilience and growth potential in this dynamic environment. In this context, identifying undiscovered gems requires a keen eye for innovation, strong fundamentals, and the ability to adapt to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Value Rating: ★★★★★★

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that specializes in the manufacture and sale of computer numerical control machine tools, serving markets both in Mainland China and internationally, with a market capitalization of HK$4.66 billion.

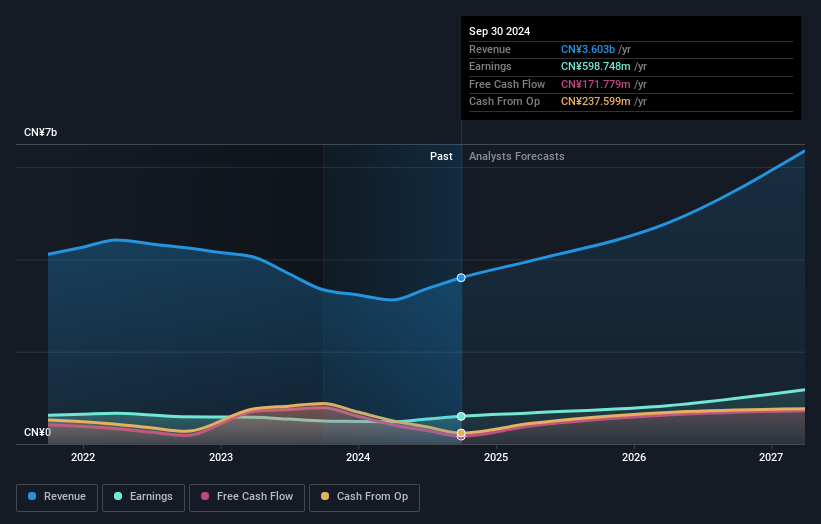

Operations: The company's primary revenue stream is the manufacture and sale of CNC high precision machine tools, generating CN¥3.60 billion. The net profit margin has shown notable trends over recent periods, reflecting the company's operational efficiency in its core business segment.

Precision Tsugami (China) stands out with its robust financial health, trading at 72.7% below estimated fair value and boasting a debt-free status for the past five years. The company has demonstrated impressive earnings growth of 19.8% over the last year, surpassing the Machinery industry average of 8.5%. Recent half-year results show sales climbing to CNY 1.98 billion from CNY 1.49 billion a year prior, while net income increased to CNY 340 million from CNY 221 million. With earnings per share rising to CNY 0.9 from CNY 0.58, Precision Tsugami seems poised for continued growth in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Precision Tsugami (China).

Learn about Precision Tsugami (China)'s historical performance.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

Overview: Atreyu Capital Markets Ltd, through its subsidiaries, offers investment management services in Israel with a market capitalization of ₪1.09 billion.

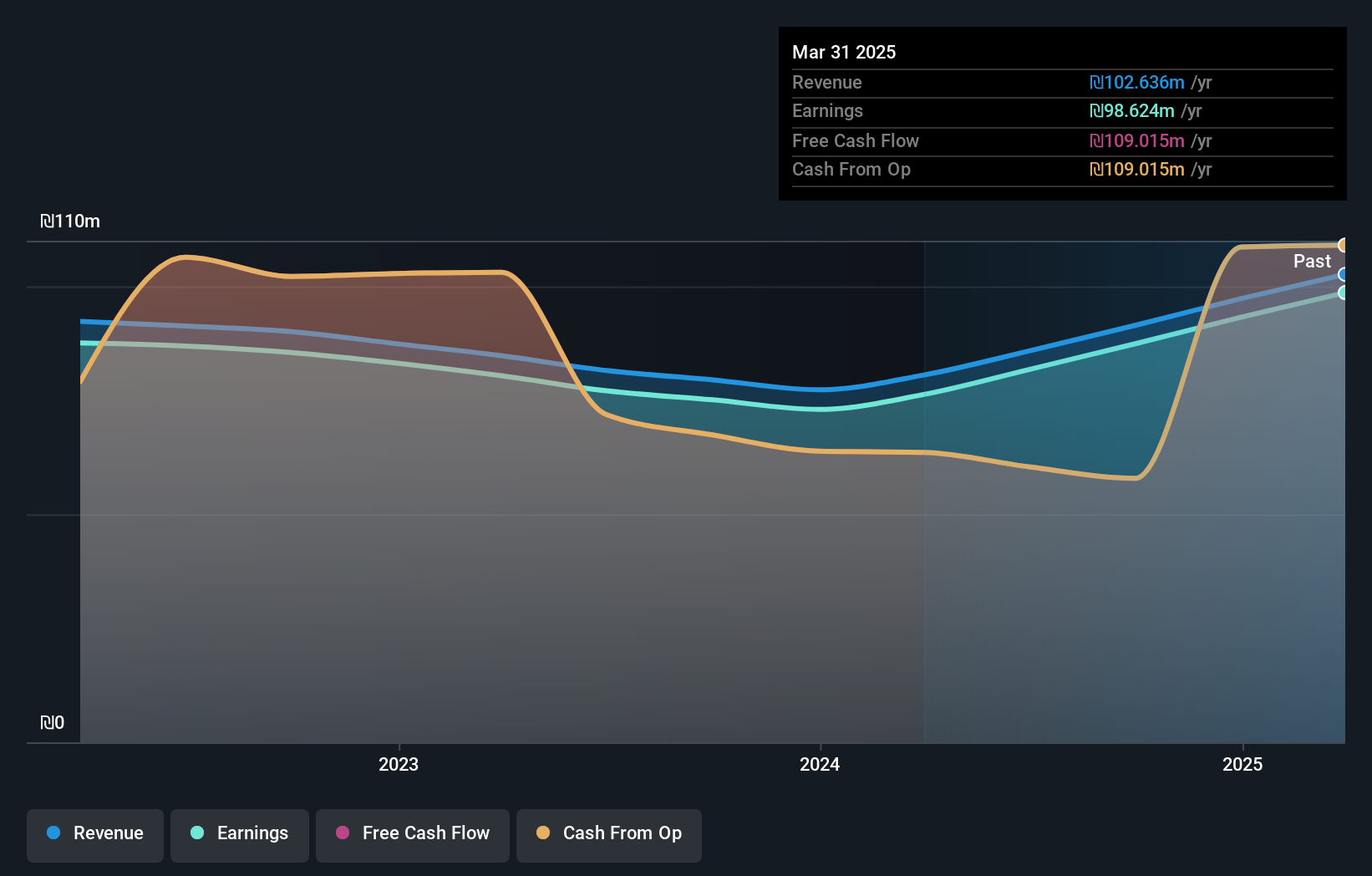

Operations: Atreyu Capital Markets generates revenue primarily from investment management services, amounting to ₪91.44 million.

Atreyu Capital Markets, a promising player in the financial sector, showcases robust earnings growth of 16.4% over the past year, outpacing the industry average of 12.8%. With net income rising to ILS 24.42 million for Q3 2024 from ILS 18.77 million a year ago and basic earnings per share jumping to ILS 1.66 from ILS 1.27, Atreyu demonstrates significant profitability without any debt burden—a consistent feature over five years—indicating sound financial health and stability. Trading at a discount of about 23% below its estimated fair value, it presents an intriguing valuation opportunity in today's market landscape.

- Click to explore a detailed breakdown of our findings in Atreyu Capital Markets' health report.

Explore historical data to track Atreyu Capital Markets' performance over time in our Past section.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fox-Wizel Ltd. engages in the design, purchasing, marketing, and distribution of a wide range of products including clothing, fashion accessories, underwear, footwear, sports accessories, home fashion items, and baby and children's products with a market cap of ₪3.96 billion.

Operations: The company's primary revenue streams include Sports, generating ₪2.23 billion, and Fashion and Home Fashion in Israel, contributing ₪2.00 billion.

Fox-Wizel, a notable player in the Specialty Retail industry, shows promise with its financial performance. Over the past year, earnings surged by 62.9%, outpacing the industry's -22.2% growth rate. The company's debt to equity ratio has improved significantly from 73% to 48.9% over five years, indicating effective debt management. Recent earnings reports reveal impressive growth; third-quarter sales reached ILS 1,631 million compared to ILS 1,399 million last year, while net income jumped to ILS 51 million from ILS 16 million previously. Trading at a substantial discount of nearly 88% below estimated fair value suggests potential for future appreciation in value.

- Delve into the full analysis health report here for a deeper understanding of Fox-Wizel.

Understand Fox-Wizel's track record by examining our Past report.

Seize The Opportunity

- Investigate our full lineup of 4678 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives