- Sweden

- /

- Electrical

- /

- NGM:PLEJD

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced a mix of moderate gains and setbacks, with major U.S. stock indexes finishing the holiday-shortened week on a higher note despite declining consumer confidence and manufacturing activity. Amidst this backdrop, small-cap stocks present intriguing opportunities for investors seeking potential growth, especially as economic indicators suggest varied challenges and prospects across different sectors. Identifying promising stocks often involves looking beyond immediate market trends to uncover companies with strong fundamentals or unique market positions that may thrive even in uncertain conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

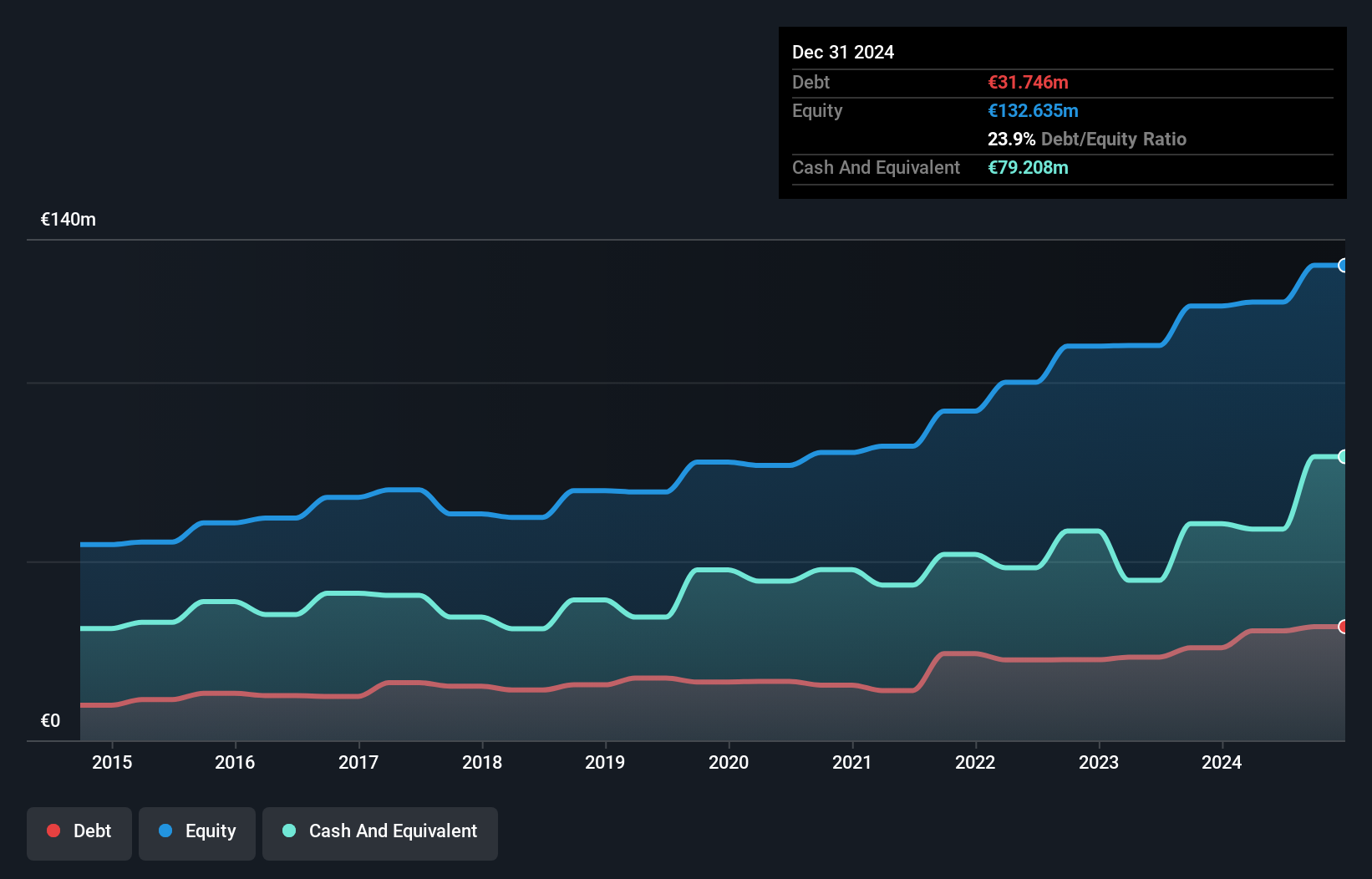

Gérard Perrier Industrie (ENXTPA:PERR)

Simply Wall St Value Rating: ★★★★★★

Overview: Gérard Perrier Industrie S.A. specializes in the design, manufacture, installation, and maintenance of electrical, electronic, automation, and instrumentation equipment both in France and internationally, with a market capitalization of €337.85 million.

Operations: The company's primary revenue streams include the Branch Manufacturing and Specializations segment at €96.75 million and the Branch Installation Maintenance segment at €95.89 million. The Energy Branch contributes €90.37 million, while the Aeronautical Branch adds €40.25 million to total revenues, with intra-group eliminations accounting for -€18.85 million in adjustments.

Gérard Perrier Industrie, a modestly sized player in the electrical industry, has shown resilience with earnings growth of 8.6% over the past year, outpacing an industry decline of 1.4%. This suggests robust operational performance and high-quality earnings. The company's financial health is underscored by a reduced debt-to-equity ratio from 25.1% to 25% over five years and positive free cash flow, indicating strong liquidity management. With interest coverage not posing any issues and more cash than total debt, Gérard Perrier seems well-positioned for sustainable growth amidst its peers in the sector.

- Take a closer look at Gérard Perrier Industrie's potential here in our health report.

Evaluate Gérard Perrier Industrie's historical performance by accessing our past performance report.

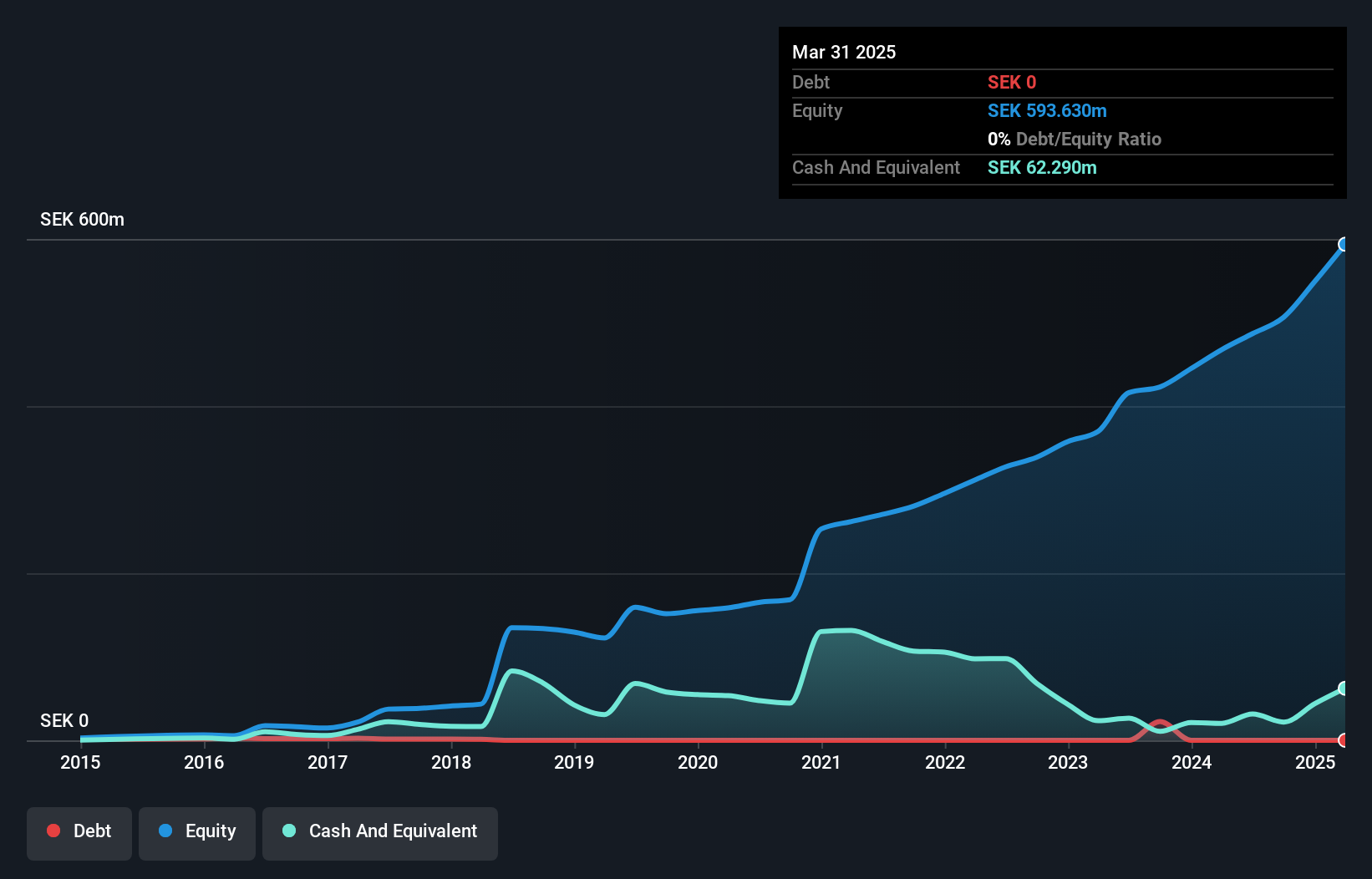

Plejd (NGM:PLEJD)

Simply Wall St Value Rating: ★★★★★★

Overview: Plejd AB (publ) is a technology company that specializes in developing products and services for smart lighting control across several countries, including Sweden, Norway, Finland, the Netherlands, and Germany, with a market capitalization of SEK4.23 billion.

Operations: Plejd generates revenue primarily from its electronic security devices segment, contributing SEK726.23 million.

With a robust performance in the past year, Plejd has seen its earnings grow by 104%, outpacing the Electrical industry, which faced a -20% downturn. The company is debt-free and boasts high-quality earnings, though recent months have shown significant insider selling and share price volatility. In Q3 2024, sales reached SEK 177.93 million from SEK 139.08 million the previous year, with net income climbing to SEK 20.32 million from SEK 4.38 million. Earnings per share rose to SEK 1.82 from SEK 0.39 a year ago, indicating solid financial health despite market fluctuations and insider activity concerns.

- Click here to discover the nuances of Plejd with our detailed analytical health report.

Review our historical performance report to gain insights into Plejd's's past performance.

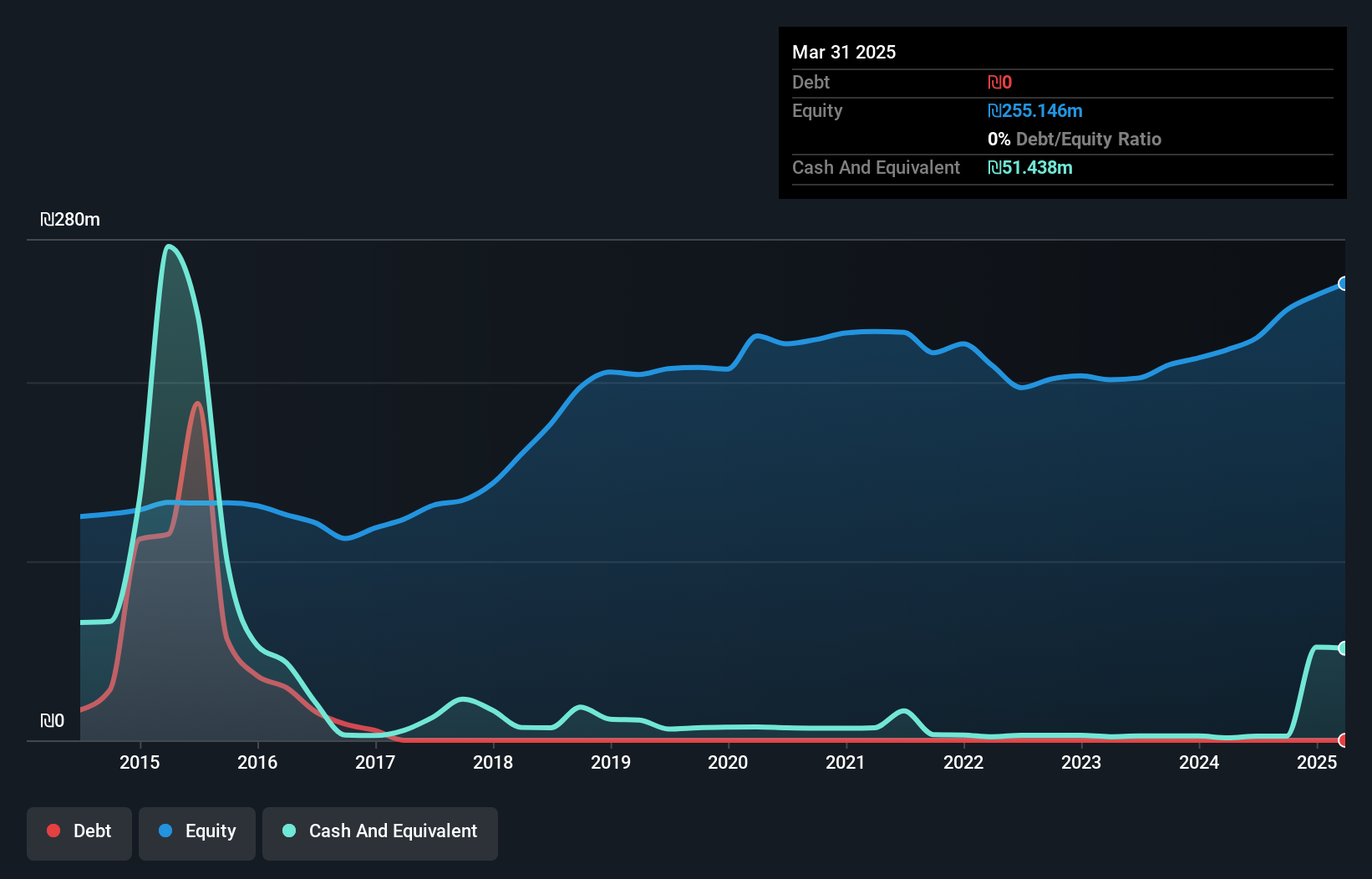

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

Overview: Atreyu Capital Markets Ltd provides investment management services both in Israel and internationally, with a market cap of ₪1.06 billion.

Operations: Atreyu Capital Markets generates revenue primarily from its investment management segment, totaling ₪91.44 million.

Atreyu Capital Markets, a nimble player in the financial sector, has shown impressive earnings growth of 16.4% over the past year, outpacing its industry peers at 9.1%. The company is debt-free and trades at nearly 30% below its estimated fair value, suggesting potential for appreciation. Recent results highlight strong performance with third-quarter revenue reaching ILS 25.41 million and net income climbing to ILS 24.42 million from last year's figures of ILS 19.78 million and ILS 18.77 million respectively. With high-quality earnings and positive free cash flow, Atreyu's financial health appears robust amidst ongoing profitability.

- Unlock comprehensive insights into our analysis of Atreyu Capital Markets stock in this health report.

Gain insights into Atreyu Capital Markets' past trends and performance with our Past report.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4641 more companies for you to explore.Click here to unveil our expertly curated list of 4644 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:PLEJD

Plejd

A technology company, develops products and services for smart lighting control in Sweden, Norway, Finland, the Netherlands, Germany, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026