- Israel

- /

- Hospitality

- /

- TASE:FTAL

How Much Did Fattal Holdings (1998)'s(TLV:FTAL) Shareholders Earn From Share Price Movements Over The Last Year?

While not a mind-blowing move, it is good to see that the Fattal Holdings (1998) Ltd (TLV:FTAL) share price has gained 24% in the last three months. But in truth the last year hasn't been good for the share price. After all, the share price is down 11% in the last year, significantly under-performing the market.

Check out our latest analysis for Fattal Holdings (1998)

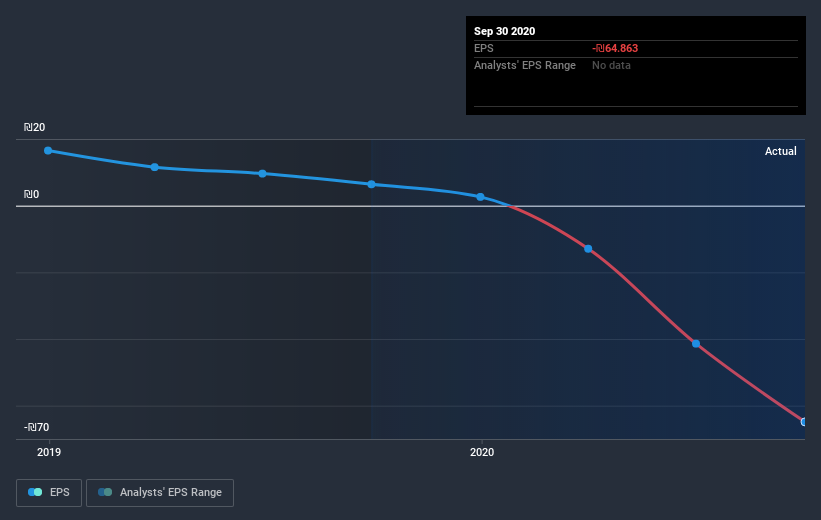

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Fattal Holdings (1998) saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Fattal Holdings (1998)'s earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Fattal Holdings (1998)'s total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Fattal Holdings (1998)'s TSR, at 7.9% is higher than its share price return of -11%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Fattal Holdings (1998) produced a TSR of 7.9% over the last year. It's always nice to make money but this return falls short of the market return which was about 9.2% for the year. But the (superior) three-year TSR of 8% per year is some consolation. Even the best companies don't see strong share price performance every year. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Fattal Holdings (1998) (2 are significant) that you should be aware of.

We will like Fattal Holdings (1998) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Fattal Holdings (1998), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:FTAL

Fattal Holdings (1998)

Owns and operates hotels in Israel and internationally.

Proven track record with very low risk.

Market Insights

Community Narratives